Invest in a better, sustainable future with Endowus.

ESG investing made simple — across Cash, CPF & SRS.

OUR WORLD, OUR FUTURE

Endowus is pioneering a new way for individuals to access sustainable investing from Singapore.

You can now gain unique access to ready made Endowus ESG portfolios built with the best ESG, sustainable and climate funds for both equities and fixed income from top ESG fund managers. Exclusively on the Endowus digital wealth platform at the lowest cost.

It is now possible to do good and do well in investing through Endowus.

It is possible to generate a triple bottom line of good returns and positive social and environmental impact.

Doing well and doing good is at the heart of sustainable investing. It is not just a passing fad, but a new investing trend that will future-proof your investment portfolios. Read more about ESG investing.

ESG investing has the potential to generate higher risk adjusted returns. Companies committed to sustainable business practices have had success at mitigating business risk while opening new growth opportunities - translating into long-term enhancement in shareholder value. Get more insights from our investment office.

Endowus has reviewed the whole ESG fund universe around the world to find the best-in-class equities and fixed income products and bring it to individual investors in Singapore. Most of them for the first time, making it easier for everybody to access ESG investing.

All funds are denominated or hedged to Singapore dollars, tax efficient and at the lowest cost.

Align your values to your investment and contribute to a more sustainable future.

Environmental issues and social inequality are likely to have a profound impact on the global population, world economy and the financial markets. By investing in ESG funds that strive to bring a positive impact to the world, you are investing in positive change for the world.

Endowus is the only digital advisor to negotiate access to the institutional share classes of the world's top ESG funds for our clients. We are also the first in the industry to rebate all trailer fees to our clients - significantly lowering the overall fees to access ESG products compared to other platforms.

Partnered with the best names in sustainable investing

.webp)

Calculate the environmental impact you are making with the Endowus ESG portfolio

In addition to elevating Social and Governance standards, by choosing funds that are investing in greener companies, you are reducing carbon dioxide emissions and improving energy efficiency. Quantify your contributions with our calculator.

The contents on this calculator are provided for information only. "Annual carbon emissions avoided" is calculated based on (i) the latest information provided by the fund managers of Endowus ESG Portfolio (40:60 Equity:Bond Mix) as at 20 January 2021, and (ii) the relevant conversion estimates are based on various sources, including but not limited to EPA or the Energy Market Authority.

Please view the full disclaimer here

ESG investing doesn’t need to sacrifice returns.

.webp)

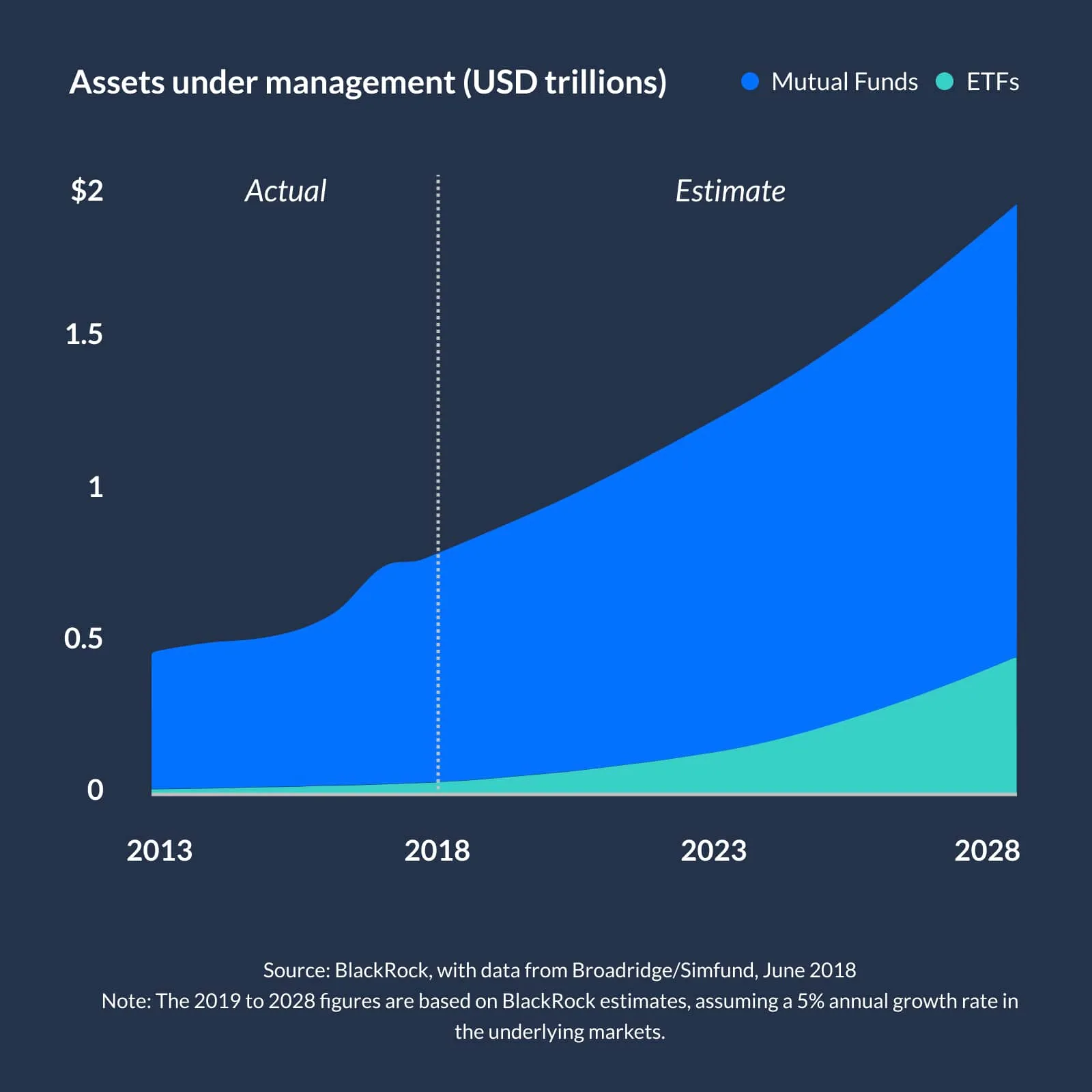

ESG investing growth is fuelled by global demand.

Global ESG sustainable investing by numbers.

.jpeg)

Sustainable investing made better with Endowus

Industry-first truly diversified ESG offering

Endowus ESG funds comprises both equities and fixed income products, across developed and emerging markets and across different ESG strategies. Investors can build multi-asset ESG portfolios suited to one’s own risk tolerance on Endowus Fund Smart.

Best-in-class fund offerings from the top ESG investors

Our equities and fixed income ESG fund managers are award-winning experts in managing ESG assets, with decades of experience and have developed proprietary industry-leading processes in ESG investing.

Investors can now access ready made Endowus ESG portfolios suited to one’s own risk tolerance.

Lowest achievable cost in the industry

ESG funds have historically been expensive and out of reach to individual investors. We remain committed to 100% trailer fee rebates and where possible securing access to institutional funds.

Frequently asked questions

ESG investing is a strategy and practice to incorporate environmental, social and governance factors in investment decisions and active ownership. Examples of ESG issues include climate change, gender and diversity, human rights. Read more here.

ESG investing, sustainable investing and impact investing are some of the many terms used to describe investment approaches that consider environmental, social and governance issues. These are often used interchangeably.

A key to understanding how ESG investing sits within the investing spectrum is that while some (e.g. ethical investing) make moral or ethical goals a primary purpose, and some (e.g. impact investing) make impact generation a primary purpose, ESG investing can and should also be pursued by the investor whose sole focus is financial performance.

ESG/SRI ETFs are typically passive index funds that track a certain market index. They usually employ a simplistic negative screening ESG process, which excludes companies with the lowest ESG ratings. These ESG ratings are usually provided by a third party data provider such as MSCI and Sustainalytics, and some challenges of relying an ESG fund on such ratings are that they are highly dependent on company disclosures, and that there is a high degree of dispersion amongst ratings by different data providers based on the rating methodology that each uses.

Most actively-managed ESG funds are offered to investors in a unit trust rather than ETF, and we believe there are certain benefits of an active approach to ESG investing. It is hard to quantify all the ESG aspects of an investment, therefore a more active approach to assessing companies would provide a more holistic perspective on companies’ ESG profile. Active managers can also be more involved in ESG engagement to push companies to improve on their ESG performance. The more holistic incorporation of ESG information and the ability to create change on the ESG side would hopefully lead to ESG alpha in the long term.

Invest in ESG Portfolios that are designed by our Investment Office (available for Cash, SRS):

ESG Portfolios are available via desktop or web app and will be available on the mobile app in the coming days.

1) Log in to your Endowus account here

2) Go to "Invest | Redeem | Transfer" and select “Invest”

3) "Add new goal" and select "General Investing"

4) Select Environmental, Social and Governance (ESG) as an investment type.

Customise your own ESG Portfolios (available for Cash, SRS, CPF)

1) Log in to your Endowus account here

2) Go to "Invest | Redeem | Transfer" and select “Invest”

3) "Add new goal" and select "Fund Smart"

4) Select Funding Source (Cash, SRS, CPF OA) and ESG funds.

Equity ESG funds

Mirova Global Sustainable Equity Fund (Available for Cash/SRS)

The Fund seeks to outperform the MSCI World Net Dividends Reinvested Index through investments in companies whose businesses include activities related to sustainable investment themes over the recommended minimum investment period of 5 years.

Links to Fund Rationale, Prospectus, PHS

Mirova is an affiliate of Natixis Investment Managers.

Schroder ISF Global Sustainable Growth Equity Fund (Available for Cash/SRS/CPF under different ISINs)

The Fund aims to provide capital growth by investing in equity and equity related securities of companies worldwide which demonstrate positive sustainability characteristics, such as managing the business for the long-term, recognising its responsibilities to its customers, employees and suppliers, and respecting the environment.

Links to Fund Rationale, Prospectus, PHS

Schroder ISF Global Climate Change Fund (Available for Cash/SRS)

The Fund aims to provide capital growth by investing in equity and equity-related securities of companies worldwide which the investment manager believes will benefit from efforts to accommodate or limit the impact of global climate change.

Links to Fund Rationale, Prospectus, PHS

Fixed Income ESG Funds

JPM Global Bond Opportunities Sustainable Fund (Available for Cash/SRS)

The Fund aims to achieve a return in excess of the benchmark by investing opportunistically in debt securities positively positioned towards debt securities issued by companies and countries that demonstrate effective governance and superior management of environmental and social issues (sustainable characteristics).

Links to Fund Rationale, Prospectus, PHS

PIMCO GIS Climate Bond Fund (Available for Cash/SRS)

The Fund aims to maximise total returns while fostering the transition to a net-zero carbon economy by investing in a diversified portfolio of bonds, including green bonds, issued by companies demonstrating climate change leadership across the value chain.

Links to Fund Rationale, Prospectus, PHS

UOB United Sustainable Credit Income Fund (Available for Cash/SRS)

The Fund aims to provide capital growth by investing in a multi-sector portfolio of fixed income instruments issued by companies worldwide that contribute positively to the UN Sustainable Development Goals (“UN SDGs”).

Links to Fund Rationale, Prospectus, PHS

Endowus charges an Endowus Fee based on assets under advice (AUA), which includes investment advice, portfolio creation and rebalancing, brokerage, and transfers.

Endowus has no sales fees, and gives 100% Cashback on trailer fee to our clients.

General Investing - Access Fee per annum based on assets under advice (AUA):

SRS

0.40% On any amount

Cash

0.60% S$200,000 and below

0.50% S$200,001 to S$1,000,000

0.35% S$1,000,001 to S$5,000,000

0.25% S$5,000,001 and above

Access Fees are charged on a quarterly basis based on your daily average total assets under advice (AUA) for the period of the fee, depending on your portfolio type (SRS, Cash).

Note that Fund-Level Fees (Fund’s Total Expense Ratio) are charged by the fund manager out of the underlying fund Net Asset Value (NAV).

%20(1).gif)