One of the world’s largest global investment firms

A multinational alternative asset management and financial services corporation

.webp)

assets held in your own name at

.webp)

assets held in your own name at

Grow all your wealth

0% sales charges

100% Cashback on trailer fees

Safety first

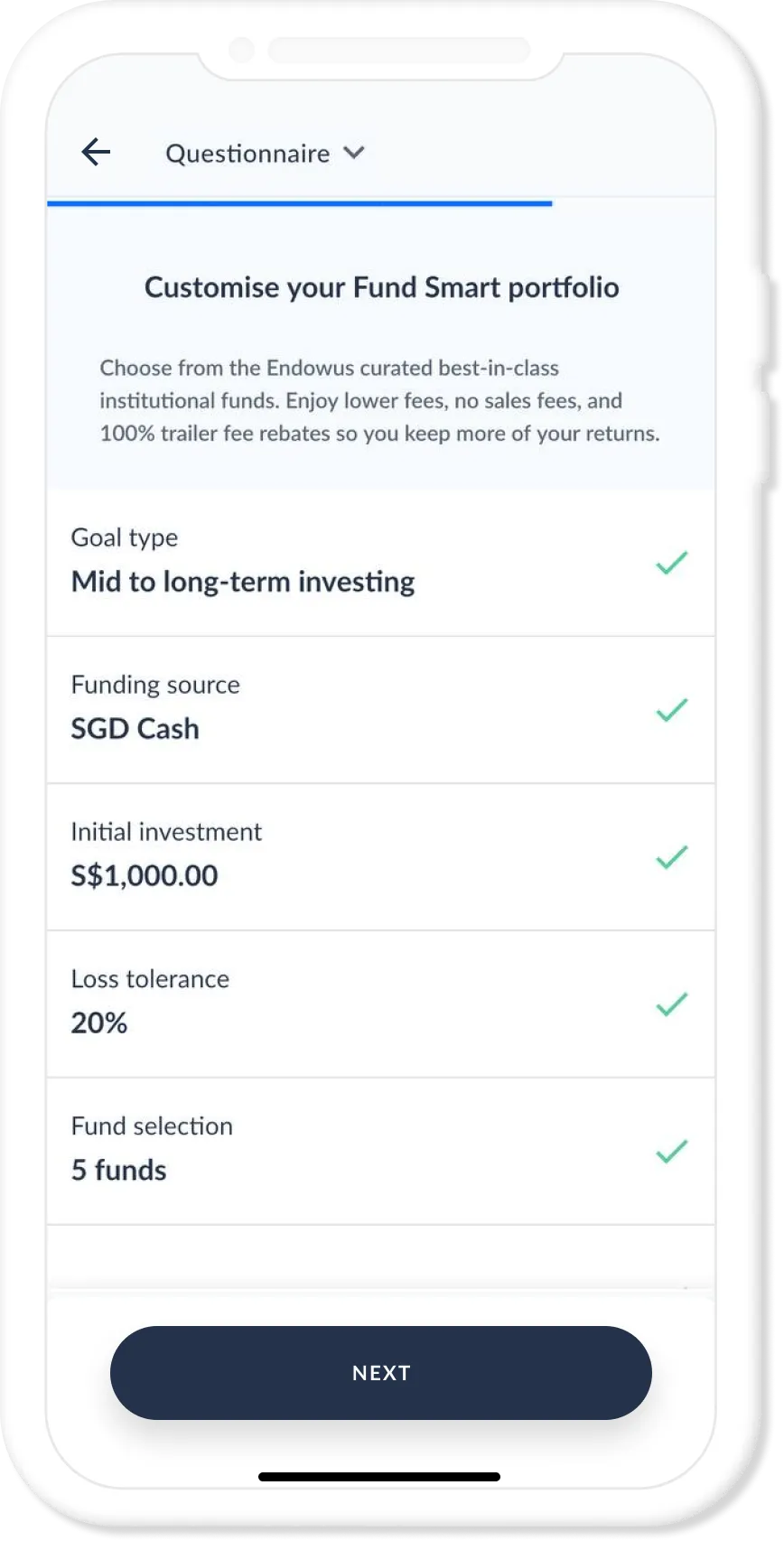

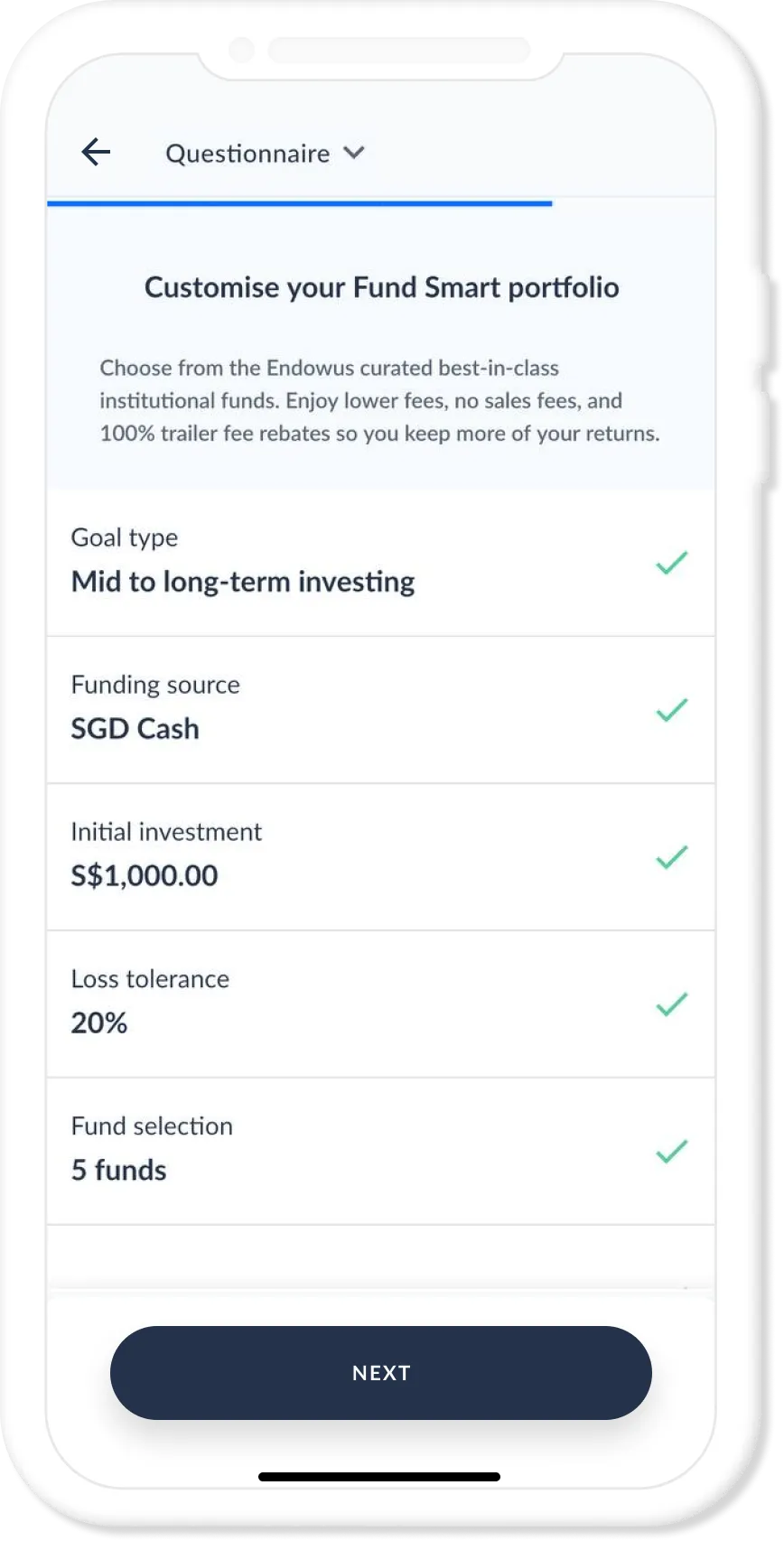

Invest on Fund Smart in just a few clicks

1. Create an Endowus account

Onboard online in 10 minutes. When you create an Endowus account, we’ll create a trust account in your own name at UOB Kay Hian, Singapore’s largest broker. This trust account will handle your assets and process the transactions you make on the Endowus platform.

You get the ease of use of the Endowus platform, and the trust that UOBKH brings to all its clients, including you.

2. Add a Fund Smart goal

Build your optimal portfolio using best-in-class funds at low cost with Fund Smart. Select your funding type — Cash, CPF or SRS.

3. Choose from 200+ funds

Explore our curated range of funds across asset classes, geographies, sectors, and styles. Our platform also guides you with real-time data on fund characteristics, like holdings and performance, to help you make better decisions.

4. Investing better, at your fingertips

Invest in a single fund or build a portfolio of up to eight funds. There is no limit to the number of portfolios you have on Endowus. Monitor your performance and manage your investments online.

Featured in these portfolios

About

Carlyle

Carlyle is one of the world’s largest and most diversified global investment firms, with $385 billion of assets under management across 3 business segments and 576 investment vehicles. Founded in 1987 in Washington, DC, the firm’s global team today is comprised of more than 2,200 professionals operating in 29 offices across 5 continents. Together, across the firm, Carlyle’s mission is to drive long-term value for our investors, companies, shareholders, people and communities.

Since Carlyle’s founding over 30 years ago, the firm has always looked to create lasting partnerships across all of its businesses. Carlyle works with its partners to find solutions that drive sustainable value and impact over the long term. Carlyle has built trust and credibility by leveraging its global scale, industry expertise and diverse insights to deliver better solutions and build better businesses. By approaching every investment with the firm’s full platform, Carlyle uncovers new opportunities, transform businesses and foster innovation.

*All figures are as of June 30, 2023, unless otherwise noted.

Awards

Why

Strong performance starts with strong partnerships. Once Carlyle invests in a company, it puts full resources behind it, leveraging Carlyle’s Global Credit platform, as well as the resources of the Carlyle network to accelerate business objectives. The firm provides creative solutions and scale to borrowers, resulting in differentiated opportunities for investors to capture value across the credit spectrum.

Leading with Trust

Trust is foundational to Carlyle’s growth and delivering exceptional outcomes. Carlyle’s team of credit investment professionals has established long term, trusted relationships with hundreds of credit partners worldwide and the firm benefits from Carlyle’s long-standing sourcing relationships. Carlyle has access to approximately 1,000 lending relationships across the globe.

Advancing Solutions and Expanding Opportunities Through Carlyle’s Integrated Platform

Carlyle’s Global Credit platform manages $152 billion in assets across the risk return spectrum: from liquid, to illiquid, to real asset strategies. Since 1999, such a platform has leveraged Carlyle’s global scale, network and industry expertise to offer borrowers creative, holistic capital structure solutions. Carlyle’s Global Credit platform also works with investors to create value across a wide range of credit strategies.

Managing Risk through Rigorous Due Diligence

Investors and borrowers see Carlyle as a trusted partner, helping drive business growth across market cycles. The firm has an ability to provide creative structures to borrowers while minimising downside risk through its rigorous approach to due diligence and credit selection. Carlyle is highly selective in its approach and closes on less than 5% of originations. Carlyle is equally focused on monitoring our credit risk across its portfolios, which has enabled it to minimise its default rate while maximising long term returns.

*All figures are as of June 30, 2023, unless otherwise noted.

*By reason of this offering, purchasers of interests in iCapital-Carlyle Tactical Private Credit Access Fund (International), Ltd. ("Interests") will not be limited partners of Carlyle Tactical Private Credit Fund (the “Underlying Fund”) or any other fund sponsored, managed or advised by Carlyle Investment Management L.L.C. (“Carlyle”) or any of its affiliates, and will have no voting rights or direct interest in, and will have no standing or recourse against the Underlying Fund, Carlyle or any of its affiliates, the general partners of the Underlying Fund, the investment advisers to the Underlying Fund, or any of the officers, directors, employees or members of any of the foregoing. The offering of the Interests does not constitute an offering of interests in the Underlying Fund.

Carlyle is not responsible for the formation of Interests. None of the Underlying Fund, Carlyle or any of its affiliates, the general partners of the Underlying Fund, the investment advisers to the Underlying Fund, or any of the officers, directors, employees or members of any of the foregoing have endorsed, and no such person makes any representations or recommendations with respect to the Interests, nor are they responsible for the contents hereof. No such person makes any representation regarding Interests or the iCapital Advisors, LLC (the “Investment Manager”) and each of them expressly disclaims any liability or responsibility to any investor in the Fund.

The information contained herein relating to the Underlying Fund was obtained by the Investment Manager and its affiliates from certain materials furnished by the Underlying Fund and their affiliates to prospective investors in the Underlying Fund. Carlyle and their affiliates do not make any representation regarding, and each of them expressly disclaims any liability or responsibility to any investor in Interests for, such information or any other information relating to the Underlying Fund and their affiliates set forth herein or in Interests PPM or omitted herefrom or therefrom.

.webp)

%20(1).gif)