Investing smarter for the world you want

Leading global asset manager offering a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes

.webp)

assets held in your own name at

.webp)

assets held in your own name at

Grow all your wealth

0% sales charges

100% Cashback on trailer fees

Safety first

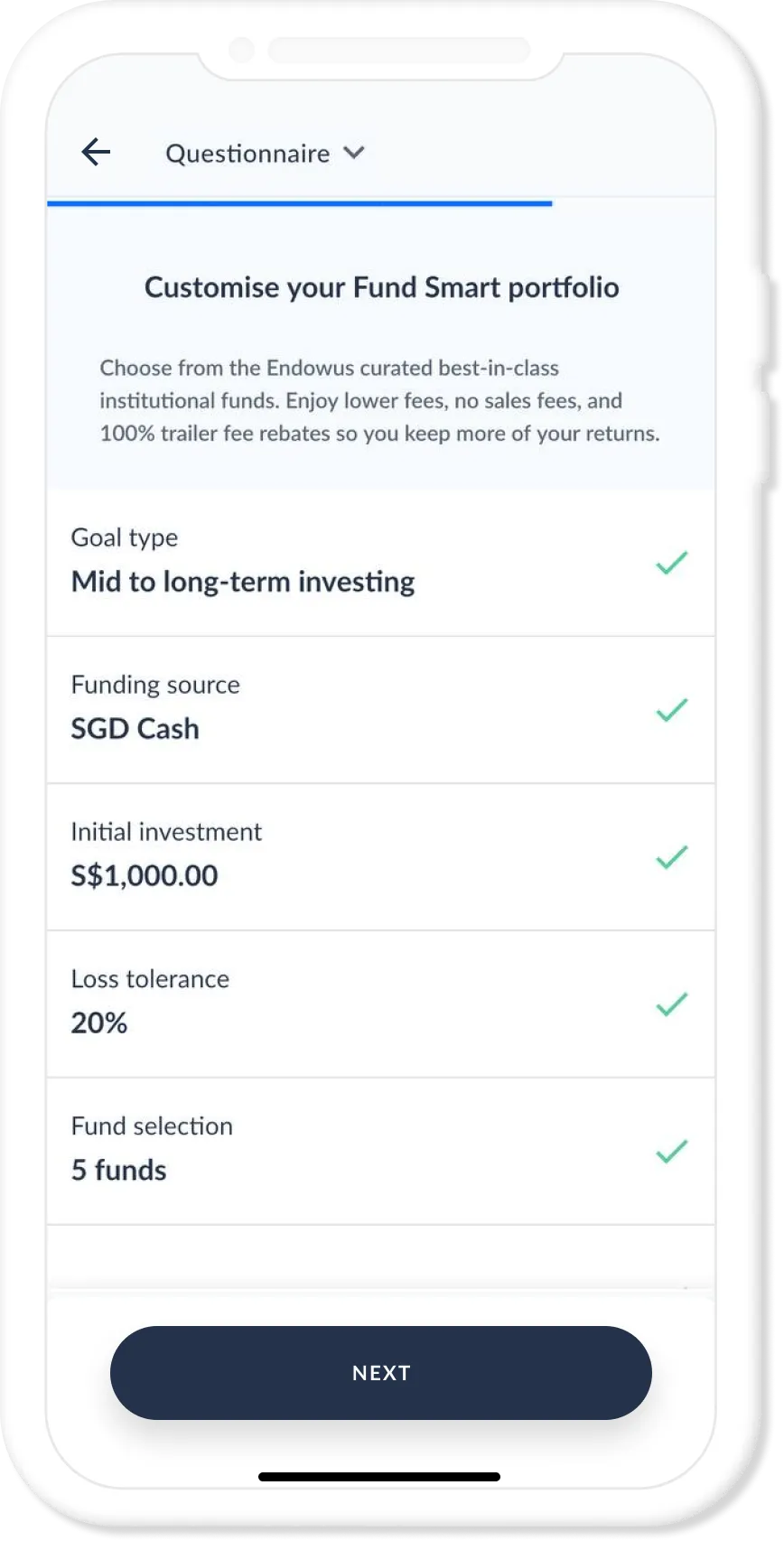

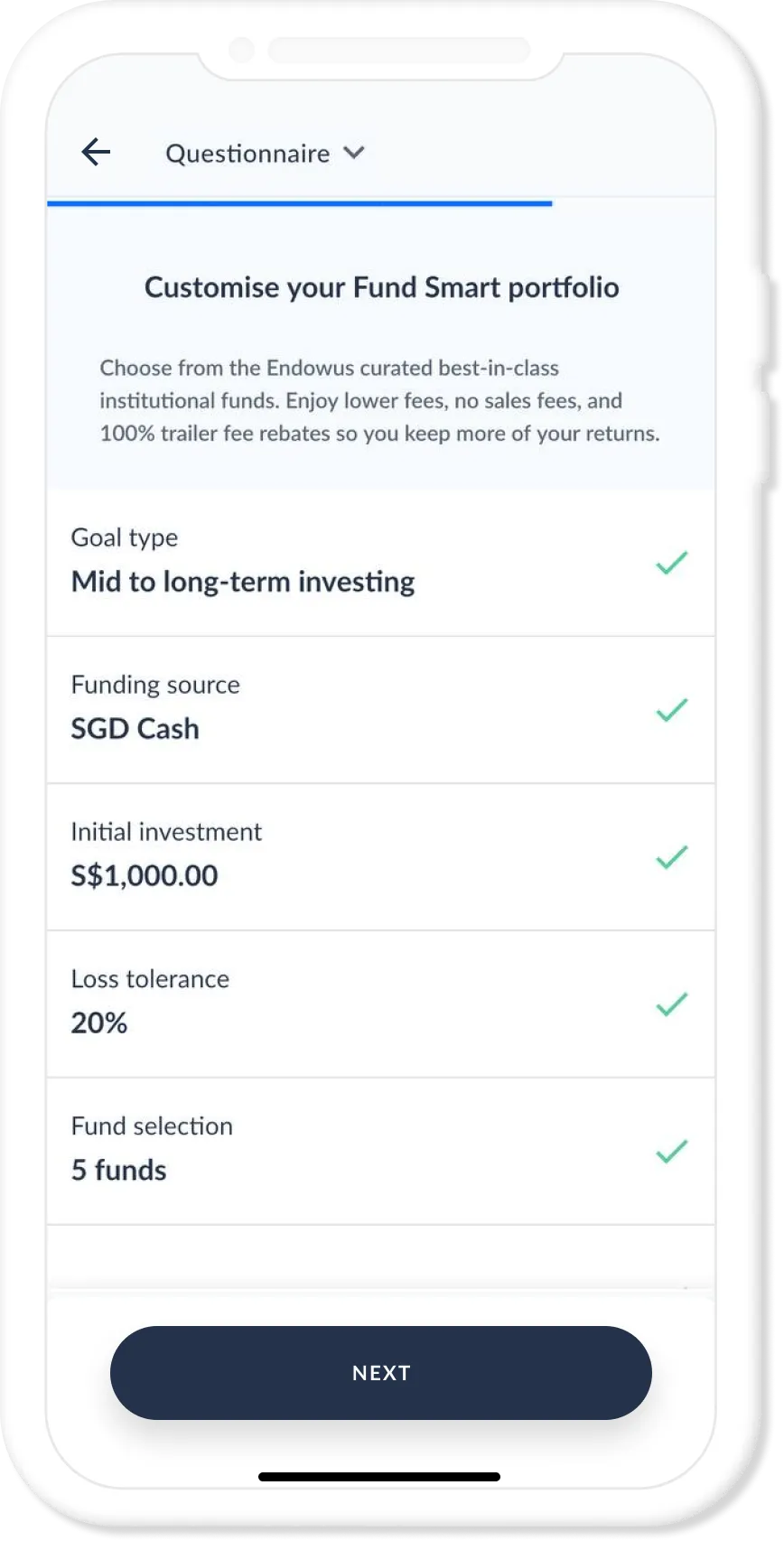

Invest on Fund Smart in just a few clicks

1. Create an Endowus account

Onboard online in 10 minutes. When you create an Endowus account, we’ll create a trust account in your own name at UOB Kay Hian, Singapore’s largest broker. This trust account will handle your assets and process the transactions you make on the Endowus platform.

You get the ease of use of the Endowus platform, and the trust that UOBKH brings to all its clients, including you.

2. Add a Fund Smart goal

Build your optimal portfolio using best-in-class funds at low cost with Fund Smart. Select your funding type — Cash, CPF or SRS.

3. Choose from 200+ funds

Explore our curated range of funds across asset classes, geographies, sectors, and styles. Our platform also guides you with real-time data on fund characteristics, like holdings and performance, to help you make better decisions.

4. Investing better, at your fingertips

Invest in a single fund or build a portfolio of up to eight funds. There is no limit to the number of portfolios you have on Endowus. Monitor your performance and manage your investments online.

Featured in these portfolios

About

Columbia Threadneedle

Columbia Threadneedle Investments is a leading global asset manager, entrusted with USD$584bn on behalf of individual, institutional and corporate clients around the world. We have more than 2,700 people including over 650 investment professionals based in North America, Europe and Asia. We offer our clients a wide range of strategies across equities, fixed income and alternatives, as well as specialist responsible investment capabilities and a comprehensive suite of solutions. Columbia Threadneedle Investments is the global asset management group of Ameriprise Financial, Inc. (NYSE:AMP), a leading US-based financial services provider. As part of Ameriprise, we are supported by a large and well-capitalised diversified financial services firm.

All data as at 31 December 2022

Awards

103 ★★★★ and ★★★★★ Morningstar-rated funds globally

Source: Morningstar as of 03/31/21. Columbia funds are available for purchase by U.S. customers. Out of 92 Columbia funds (Inst. shares) rated, 18 received a 5-star Overall Rating and 34 received a 4-star Overall Rating. Out of 89 Threadneedle funds (highest rated share class) rated, 21 received a 5-star Overall Rating and 30 received a 4-star Overall Rating. The Overall Morningstar Rating is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. Not all funds are available in all jurisdictions, to all investors, or through all firms.

Why

At Columbia Threadneedle, we invest to make a difference to your world, and the wider world we invest in. Our investment approach is underpinned by a culture that is dynamic and interactive and by processes that are team-based, performance driven and risk aware. Our investment teams share a common set of values and a commitment to delivering the investment outcomes our clients expect, underpinned by these four pillars:

Global perspectives

From meeting companies on the ground and around the world, to gaining an understanding of the economic, social and political trends that shape our future, the continuous exchange of insights across asset classes and sectors is ingrained in our process. These insights are debated by analysts and portfolio managers around the globe to ensure every perspective is considered.

Research intensity

Our team of 200 analysts and research associates is dedicated to original, independent research. Working collaboratively across all major asset classes our teams utilize big data and analytics, such as machine learning and augmented intelligence, to turn information into forward-looking insights that can add real value to our investment decisions enhancing our ability to help deliver good outcomes for our clients.

Responsible Investment

Well-managed companies that look to the future are better positioned to navigate the risks and challenges inherent in business and achieve sustainable performance and long-term value creation. Responsible Investment (RI) principles are an important factor, and we have developed proprietary tools that provide a robust RI framework and better analysis for portfolio managers to enhance their decision-making. Although RI research is made available to all portfolio managers, each portfolio management team within our firm makes its own investment decisions and certain teams may place more, less or no emphasis on ESG factors in any given investment decision.

Continuous improvement

Across our global business, our Investment Consultancy & Oversight team uses a government framework to ensure the integrity of an investment strategy. The team engages with our portfolio managers — reviewing their performance, discussing their decision-making and analysing their processes, all to ensure we remain faithful to our clients’ objectives and identify opportunities to continually improve. This process is tangible evidence of our commitment to accountability.

.webp)

%20(1).gif)