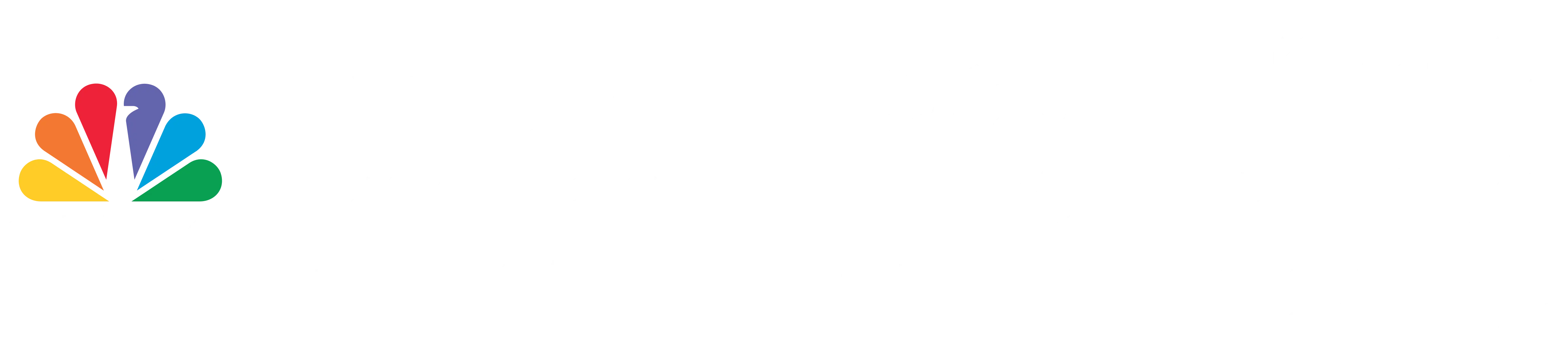

100+ global fund managers

Access customised portfolios backed by decades of research and performance, or build your own from hand-picked, world-class funds.

Unbiased advice

We return all trailer commissions from fund managers to you. This means no conflicts of interest. You get advice and strategies driven only by what’s best for you.

Low, fair fees

Take advantage of savings with access to low-fee institutional share classes, once reserved for the ultra-wealthy. Only pay an all-in, transparent, fair fee.

300,000+

Clients in Hong Kong & Singapore

HK$1 billion

Total fund raised from UBS, Citi, MUFG and more.

HK$80+ billion

Client assets

Clarity for all your goals

Choose from expert-built portfolios or design your own with world-class funds handpicked by the Investment Office

fund smart

Take full control of your portfolio

Access 300+ curated strategies from 100+ global fund managers.

satellite

Express your views

Model portfolios on China Equities, Technology, Sustainability and Future Trends.

private markets

& hedge funds

& hedge funds

Diversify beyond traditional markets

Exclusive fund and portfolio access from US$50,000.

for professional investors only

*For full portfolio details, fees, and risk disclosures, please refer to the specific pages for Flagship, Fixed-Rate Savings, CashUp, and IncomeUp

Endowus Exclusive:

HK$4,000 Citi Prestige Rewards

INVEST WITH CLARITY. LIVE IN PRESTIGE.

A special collaboration between Endowus and the Citi Prestige Card for you to enjoy your life while your investment works hard for you. Unlock HK4,000 welcome rewards and exceptional privileges when you complete designated missions, including successfully applying for the Citi Prestige Card.*

*Terms and conditions apply.

Access to 100+ world-class fund managers

.webp)

and more...

.webp)

BalYaSNY • BREVAN HOWARD • BRIDGEWATER • JANUS HENDERSON • JUPITER • SCHONFELD • M&G • POINT72 • UBS O’CONNOR

Exclusive access to PI-only funds, private markets, hedge funds and alternatives

We keep the same promise of no subscription fees, 100% Cashback on trailer commissions, low fair fees, and our expert opinion & advice.

PRIVATE MARKETS

KKR • CARLYLE • HARBOURVEST • PARTNERS GROUP • EQT • OAKTREE

Hedge funds

MILLENNIUM • BRIDGEWATER • POINT72 • BALYASNY • BREVAN HOWARD • SCHONFELD • EISLER • HUDSON BAY • LMR • UBS O'CONNOR • BLACKROCK • FRANKLIN TEMPLETON • JUPITER • LUMYNA

and other handpicked strategies by global leading managers

Learn about Endowus Private Wealth

The Endowus Private Wealth difference

Unmatched access to

elite strategies

Unlock access to world-class private market and hedge fund strategies*, starting from US$50,000.

*Private market strategies and hedge funds are for Professional Investors only.

World-class expertise

in a portfolio

Invest in exclusive private market and hedge fund portfolios curated by investment veterans and execute sophisticated strategies seamlessly.

Your wealth

your way

Get honest, conflict-free advice that is not incentivised by commissions. Our advisors help tailor your unique needs to your ambitions.

Get a head start with "iAM Smart"

Sign up and verify your information instantly via “iAM Smart”.

Create your account in 5 minutes*

Skip ID upload

Start investing without a minimum deposit of $10K

*The actual account opening time may vary due to factors such as network, mobile device, and required documents. Applicable to Permanent HK Identity Card holders

We’d love to meet you!

Find our next events & webinars

Stay updated with our latest financial events!

Connect with our team

Have account-related inquiries? Our team is here to support you.

Low, fair fees

ENDOWUS fee (P.a.)

0.1-0.6%

Invest in top-tier funds and expert-built portfolios at low fees

sales fees

0%

No hidden fees, ever

CASHBACK ON TRAILER FEEs

100%

We rebate it all back to you

learn more about fees

Hear what our clients say about Endowus

“

Best-in-class fees and access to a broad range of funds. No conflicts of interest, nobody is pushing ad-hoc products to meet revenue targets.

Alfred C

Endowus Client

Endowus Client

“

The best wealth management platform in town for individuals who look for long-term financial investment solutions but are scared off by high fees charged by banks and fund houses.

SL

Endowus Client

Endowus Client

“

Gives me great confidence as a novice investor and it’s great to be able to speak to experienced advisors for allocation questions. A great combo of ease of self-directed use and personalised advice!

H CHU

Endowus Client

Endowus Client

Safety & security to invest with peace of mind.

Supported by HSBC

Your deposits are kept in a HSBC trust account (Client Money Account) and separate from Endowus’ balance sheet and operating accounts.

This means your investable assets are segregated, no matter what happens to Endowus.

This means your investable assets are segregated, no matter what happens to Endowus.

Find out more

.webp)

.webp)

No lending of your money or assets.

Bank runs happen because banks are in the business of taking your deposits (a liability for the bank) and lending your money out to earn interest.

As a non-bank platform, Endowus offers no leverage, does not lend out client monies or assets, and is not a custodian of your securities. Client assets are ultimately held by fund-appointed custodians.

As a non-bank platform, Endowus offers no leverage, does not lend out client monies or assets, and is not a custodian of your securities. Client assets are ultimately held by fund-appointed custodians.

Compliance for clients working in finance.

(i) Endowus only offer discretionary managed third-party funds, and do not carry single stocks/bond or exchange-traded securities, satisfying most personal account dealing (PAD) requirements.

(ii) As requested, our system can automatically configure to send monthly statements to a designated reporting email address.

(ii) As requested, our system can automatically configure to send monthly statements to a designated reporting email address.

hear what the industry says about endowus

“… aims to become leading

automated adviser in Asia”

automated adviser in Asia”

“... the ambition to define the

future of wealth management”

future of wealth management”

“... brought transformational

changes to the industry”

changes to the industry”

“... a new and better wealth

management experience”

management experience”

.webp)