fixed-rate savings

.png)

.png)

It's easy to get started with Fixed-Rate Savings.

Why clients choose Endowus

Why clients choose Endowus

Make your idle cash

work harder for you.

FAQs

The terms and conditions for FRS can be found here.

Fixed-Rate Savings (FRS) is a service provided by Endowus in partnership with bank(s) to access typically higher yielding corporate fixed return rates. This enables clients to earn fixed returns on their cash balance, while they consider their investment options with Endowus.

Clients can place amounts from either US$10,000 or HK$100,000 at 1, 2, 3, or 6-month tenors.

The minimum amount for FRS starts at US$10,000 or HK$100,000, with increments of US$1,000 or HK$100,000 (e.g., US$11,000, US$12,000, and beyond or HK$110,000, HK$120,000, and beyond). The maximum amount for a single account is US$25M per day.

Currently, FRS is available in USD and HKD. You can transfer USD or HKD directly to your Endowus account, or seamlessly convert currency on the platform. Learn more about currency conversions on Endowus here .

You can select from tenors of 1 month, 2 month, 3 months, or 6 months.

FRS applications are processed daily. If submitted before 1pm, the FRS will be executed on the same day. If submitted after 1pm, it will be processed the next working day. You’ll have the option to cancel if you wish before 1pm. If it is a public holiday in Hong Kong or the placement currency’s region, or in the case of a Severe Weather conditions or any unforeseen circumstances where the Partner Bank declares a non-placement day, the FRS will be placed on the next available business day. The Severe Weather conditions are typically defined by the issuance of Typhoon Signal No. 8 or higher, or a Black Rainstorm Warning issued by the Hong Kong Observatory.

If you do not have sufficient balance in the currency you’ve chosen for your FRS application, it will be automatically cancelled. To join the next placement, simply submit a new application.

The rates on your FRS order remain constant regardless of the principal amount. For example, a 1-month tenor rate of 3.8% applies equally whether a client invests US$10K or US$10M.

You cannot terminate early or top-up a FRS order once it has been confirmed.

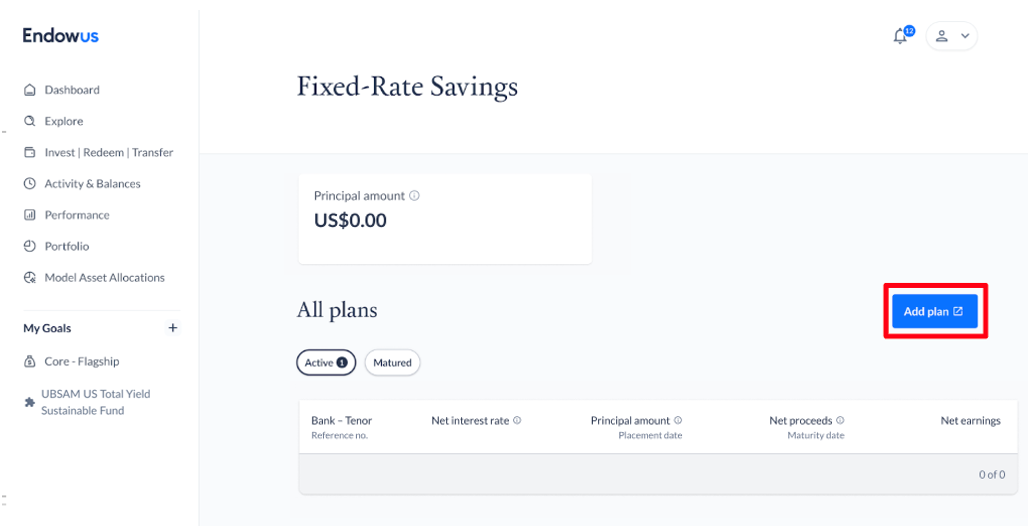

- Log in to your Endowus account.

- On the Dashboard, click on the “Fixed-Rate Savings” tile next to the Uninvested Cash Balance.

- On the Fixed-Rate Savings page, click the “Add Plan” button.

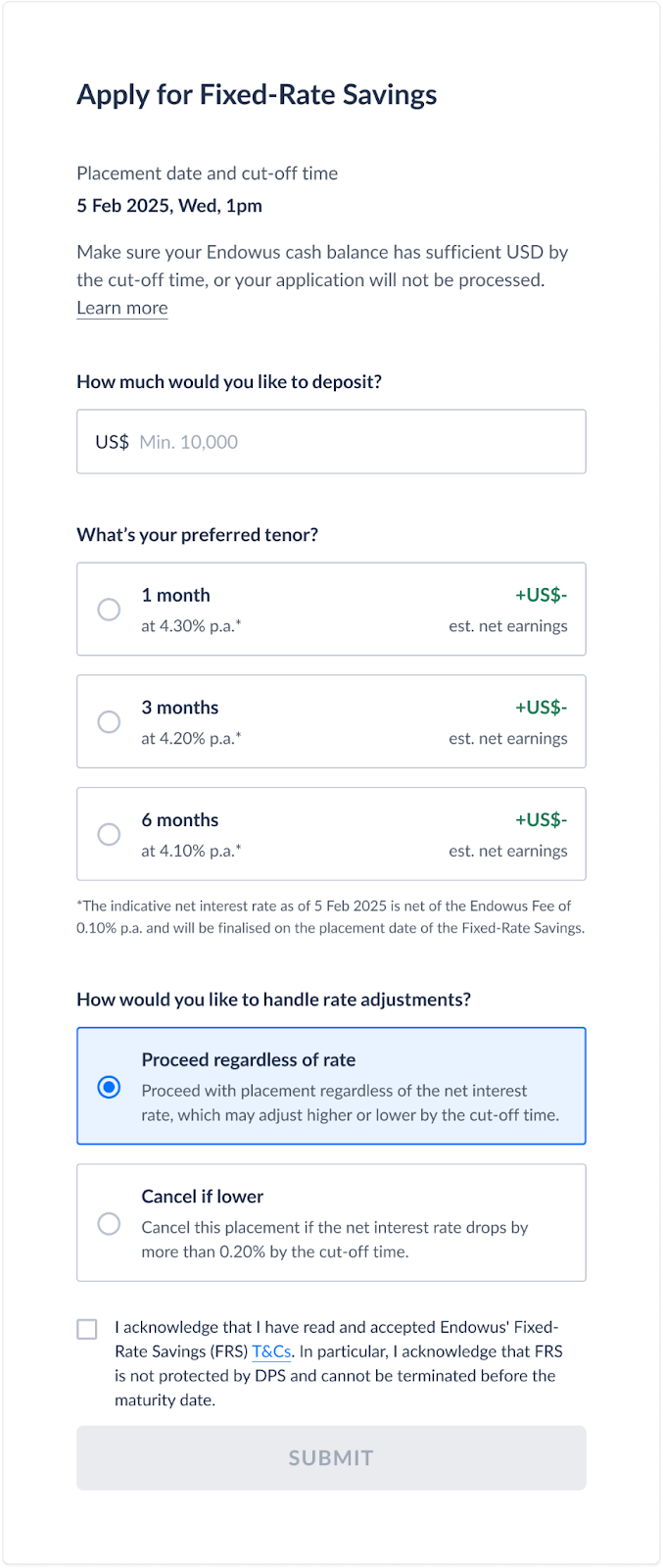

- Fill out the FRS application form by entering the deposit amount, select the desired tenor, and choosing (*) rate adjustment handling.

- Please review the trade details, tick the acknowledgment box, and click submit to proceed with the FRS application.

- Ensure your USD or HKD cash balance is sufficient. You can deposit USD or HKD or convert currency via the platform. Please note that FX conversion may take time and should be completed at least one day before the cutoff time.

(*) Rate adjustment handling: This is the option which you can choose to proceed with, regardless of rate changes, or cancel the FRS submission if the net interest rate decreases by 0.2% p.a. This is because the rate may fluctuate between the submission date and the placement date due to our daily FRS submission schedule. If the FRS is canceled, the funds will remain in your USD/HKD cash balance.

The indicative net interest rate is the rate displayed on our platform and submission form, updated daily after 10:30am.

The net interest rate is the rate on which we execute your FRS on the placement day, referring daily at 1pm.

Both rates are provided by our bank partner and net of Endowus Fee of 0.10% p.a.

The FRS will be executed if:

(1) You have sufficient USD/HKD cash balance, and

(2) The rate adjustment handling preference is met.

Clients can choose the preferred rate adjustment handling on the FRS application form when applying for FRS.

Example: On Friday after 1pm, you sees the rate on the FRS form as 3.85% p.a. and applies for the FRS with this rate. On the following Wednesday, the final rate provided by HSBC is 3.6% p.a.:

- If the client chose to proceed regardless of the rate, the FRS will be executed at 3.6% p.a.

- If the client selected the “cancel if lower” option, the FRS will be canceled.

- If the net interest rate drops to zero or below zero, the FRS will be rejected automatically and will not be processed.

If the placement is successful, you will receive a placement confirmation, including details such as the final rate, maturity date etc, via email one business day after the placement date.

If the placement is not successful, you will receive a notification email regarding the FRS cancellation, and the funds will remain in your USD/HKD cash balance.

If there is sufficient cash in your Cash balance and no pending investments, the cash will be reserved after you submit your FRS application.

You can set maturity instructions 7 days before and up until 12 a.m. of maturity date. The options are: auto-rollover for another tenor, auto-invest into an existing goal, and receive in cash balance. After you have set your maturity instructions, you can still update them up until 12 a.m. of maturity date.

For auto-rollover, we will automatically use the maturing FRS net proceeds (i.e., sum of principal amount & net earnings) for a new FRS placement at the next available placement date. Auto-rollover is a one-time action. Each newly placed FRS will not rollover automatically; you must set a new maturity instruction at every subsequent maturity. The new FRS will have the same tenor and bank partner to your maturing FRS. The net proceeds will be rollovered regardless if it meets the minimum increment amount.

For auto-invest, we will automatically invest the maturing FRS net proceeds to a selected goal. If your goal is in a different currency, we will handle the conversion for you. Endowus does not take a spread or earn from the bid-ask spread from these FX transactions.

We currently do not support this functionality. Please set your maturity instructions to "Receive in cash balance", then apply for a new FRS placement afterwards with your desired tenor, bank, and amount.

At maturity, by default, the principal and net earnings will be credited to your USD/HKD cash balance. Automatic renewal of FRS after maturity is not currently supported.

If your maturity instructions are set to auto-rollover, the principal and net earnings will be used to place a new FRS of the same tenor and bank partner. Auto-rollover is a one-time action, so you will need to set new maturity instructions for each subsequent maturity.

If your maturity instructions are set to auto-invest into an existing goal, the principal and net earnings will be invested into the selected goal.

If we are unable to process your auto-rollover or auto-invest, the principal and net earnings will be credited to your Endowus cash balance.

FRS is not a fixed deposit product. It does not fall within the scope of the Hong Kong Deposit Protection Scheme.

FRS is not an investment product or a collective investment scheme. The rates offered are not due to pooling of invested funds by Endowus, and Endowus is not offering FRS as a fund, scheme, or a portfolio with a pooling element.

You can cancel your FRS request and simply submit a new one. If there are any changes made to the amount, kindly also ensure that you have sufficient cash balance in USD or HKD by the same cut-off date and time for a successful placement.