SRS investment options:

Make your money work harder

Learn more about SRS

Your guide to the Supplementary Retirement Scheme

SRS account and compounding: Grow your nest egg

Best SRS investment options available

Frequently asked questions about the SRS account

SRS is a voluntary scheme to encourage individuals (Singapore citizens, PRs, and foreigners working in Singapore) to save for retirement with tax benefits and employer contributions. Invest your SRS with Endowus to generate potentially higher retirement savings.

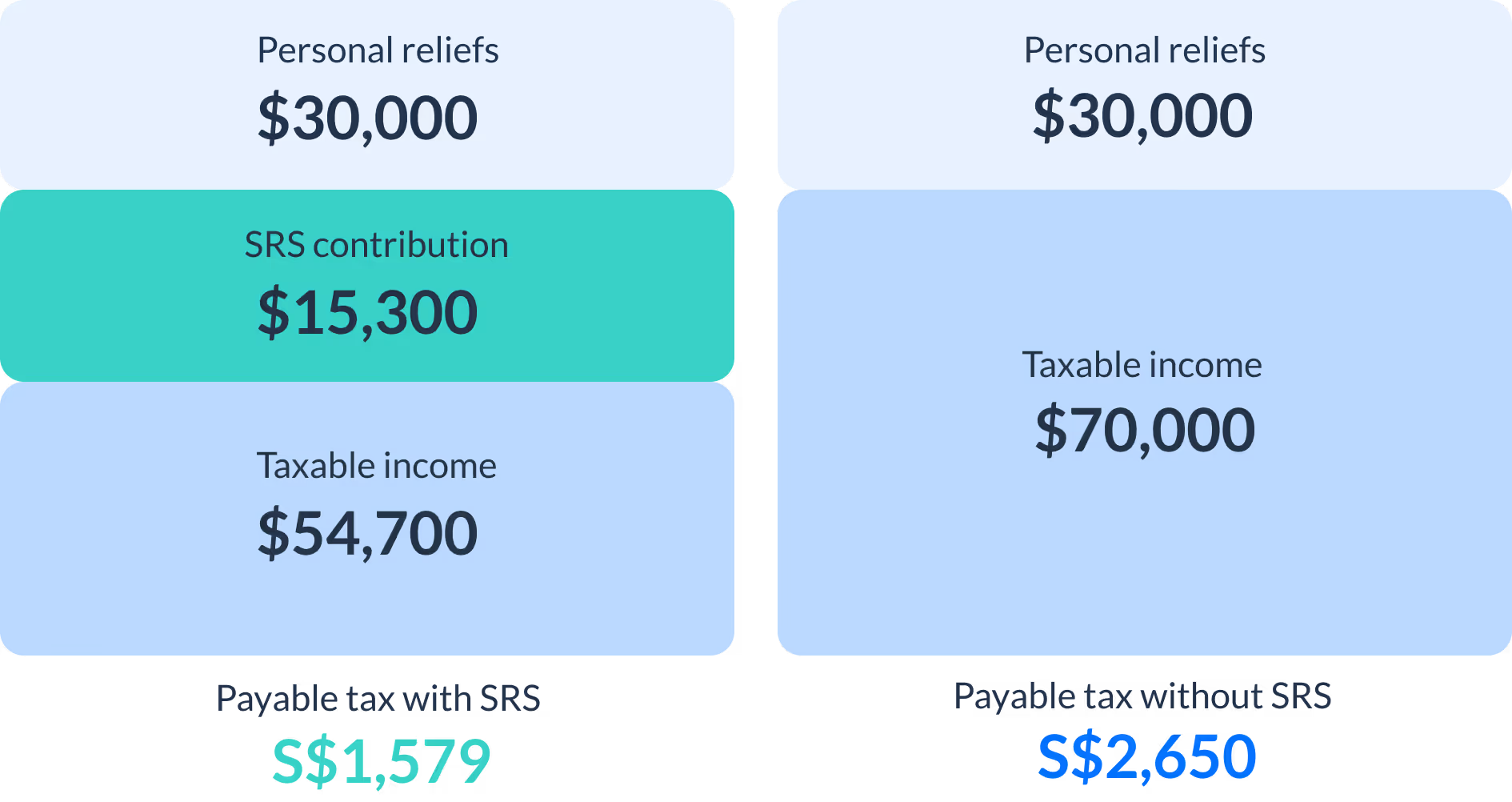

Dollar for dollar tax savings

For every dollar that you contribute, your taxable income is reduced, subject to the personal income tax relief cap of $80,000. The money contributed has restricted use and can mainly only be used for investment purposes.

Annual contribution cap

There is an SRS annual contribution cap of $15,300 per annum for Singapore citizens and SPRs, and $35,700 for foreigners.

Example of tax savings

The more you contribute to SRS, the more tax savings you can get. Here’s an illustration of how much tax you can save as a Singapore citizen or PR:

- Annual income: S$100,000

- Personal reliefs (CPF, qualifying child, etc.): -S$36,000

- SRS contribution: -S$15,300

- Chargeable income: S$51,300

- Taxes due with SRS contribution: S$1,159

- (Taxes due if no SRS contribution: S$2,230)

Annual tax potentially reduced by 48% with SRS contribution

For general investing, Endowus Flagship Portfolios are composed of global equities and fixed income funds managed by best-in-class fund managers such as PIMCO, Dimensional, and Amundi. For Cash Smart portfolios, please refer to the Cash Smart page here.

Unlike other fund platforms, financial advisors, brokers, banks or distributors, Endowus accesses the institutional share-class of funds that have lower fees, never charges a sales fee, and rebates 100% of trailer fees so you keep more of your returns.

To see more information on the exact portfolios at each level of risk, underlying holdings, historical returns, fees, and more, create your Endowus account for free.

1) Simply log in to your Endowus account,

2) Go to "Invest | Redeem"

3a) "Add new goal" and select "Invest my SRS", or

3b) select an existing goal, and "add my SRS to this goal".

If you do not see SRS as an investment option, you need to link your SRS account here.

You can open an SRS account if you are:

- A Singaporean, Permanent Resident (PRs) or foreigner working in Singapore

- At least 18 years old

- Not an undischarged bankrupt

There are three SRS operators (UOB, DBS & OCBC). You can register for an SRS account with any of them on their online platforms. You can fund your SRS account by internal bank transfer.

Once you have have your SRS account number, you only have to link it to your Endowus account and start investing!

%20F1.avif)

%20F1(2).webp)