Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- Supplementary Retirement Scheme (SRS) contributions should not just be set aside for tax efficiency, but can also be used to boost your long-term retirement savings by investing them.

- With the increase in retirement age and Singaporeans living longer, investors should give serious consideration to SRS to grow their nest egg.

- There are a few SRS investment options, including investing in low-cost, globally diversified unit trusts through Endowus—learn which is the most suitable for you

The Supplementary Retirement Scheme (SRS) helps to address the financial needs of Singapore’s future retirees. The SRS is a voluntary scheme that complements the CPF. Local tax residents can contribute varying amounts to SRS (subject to a top-up cap) at their discretion.

The age at which you can start withdrawing from your SRS depends on the retirement age when your first contribution is made. Starting from 1 July 2026, the retirement age will increase to 64, and by 2030, it will rise to 65.

Following the scrapping of the CPF Special Account for those aged 55 and above in 2025, coupled with the fact that Singaporeans are living longer, the SRS has gained attention as a viable option to grow our retirement nest egg.

For middle and high-income taxpayers in particular, SRS account contributions provide attractive tax savings. However, with a low 0.05% per annum (p.a.) interest rate on SRS accounts and high inflation, SRS contributions should not just be set aside solely for tax efficiency, but can also be invested to boost your long-term retirement savings.

How to invest SRS: Top SRS investment options to grow your monies

There are various ways you can invest the money in your SRS accounts, including investing in unit trusts.

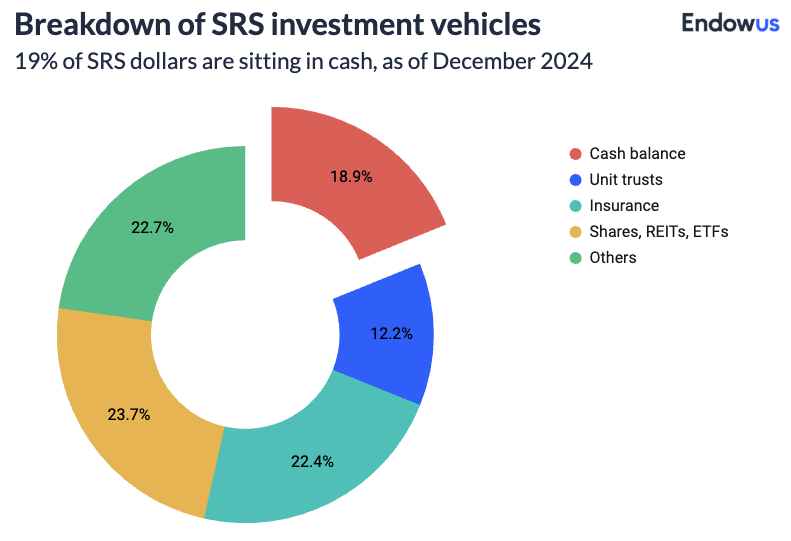

As of December 2024, uninvested SRS money amounts to 19% of the $20.6 billion scheme, according to data from the Ministry of Finance. That means this idle cash of $3.9 billion is earning minimal returns and is susceptible to erosion by inflation.

Starting your investment journey early is crucial. The SRS is designed to encourage long-term investment discipline, partly due to penalties on early withdrawals.

Imagine two SRS account holders, each contributing S$10,000 annually to their SRS accounts from age 35, but one invests in a portfolio with a 5% annual return while another keeps the SRS funds in a savings account earning just 0.05%, they will see a notable difference by age 60.

The stay-invested one would see the account grow to $511,135, whereas the account leaving the SRS funds uninvested would only reach $261,632—a disparity of almost $250,000. In this article, we consider how you can invest with SRS, and what the best SRS investment options would look like.

Singapore Government Securities

Singapore Government Securities (SGS) are government bonds issued by the Monetary Authority of Singapore (MAS) and are fully backed by the government.

There are mainly two types of SGS offered:

- Treasury bills (T-bills): Typically have a maturity of 6 or 12 months

- SGS bonds: Can have a maturity of 2, 5, 10, 15, 20, 30 or even 50 years

T-bills

T-bills are short-term SGS bonds issued at a discount to their face value, with investors receiving the full face value at maturity.

Face (or par) value refers to $100 in the principal amount of the T-bills applied for and the discount rate is the cut-off yield at auction. Interest is paid at maturity and it is the difference between the purchase price and the face value.

For instance, if you were to apply for a 6-month T-bill that has a cut-off yield of 3.32% with $1,000 in your SRS account, you would only invest $983.45 upfront. After six months, you would receive the full $1,000 back to your account, which includes the interest.

T-bills are AAA credit-rated and have a minimum investment amount of $1,000.

The 6-month T-bills are more frequently launched compared to the yearly ones. For 2024, there were only a total of four 1-year T-bills auctions versus 25 in total for the bi-yearly ones.

When investing in T-bills, the unique aspect is that the exact yield remains unknown at the time of subscription. The yield is determined through the auction process, and you will only know the final yield once the auction concludes based on demand and supply dynamics.

Yields on T-bills have gradually declined amid interest rate cuts—view here for the latest yields.

Trading T-bills in the secondary market is allowed. However, if you wish to sell before maturity, prices may fluctuate and could be above or below what you initially paid.

SGS bonds

SGS bonds are mostly similar to T-bills, except for two differences.

Unlike T-bills, SGS bonds pay a fixed coupon every six months. Another difference as seen earlier is the maturity period, ranging from two to 30 years and beyond.

Singapore Savings Bonds

Singapore Savings Bonds (SSBs) are also fully backed by the Singapore government and offer interest rates that progressively increase the longer you hold them, within a 10-year maturity.

SSBs are very flexible in that you can get your investment capital back in full with no losses and you can choose to exit your investment in any given month, with no penalties.

It also offers a low minimum investment amount of $500, compared to $1,000 for T-bills and SGS bonds.

The below table shows a comparison of T-bills, SGS bonds, and SSBs.

SGS and SSBs are seen as low-risk investments but compared to other investment options like stocks and low-cost unit trusts, they generally offer lower potential returns.

Fixed deposits

Another option to consider would be fixed deposits, also known as time deposits.

It is important to note that some of the rates can be promotional for a limited period and may not be applicable for SRS savings. It’s best to check with the bank on this aspect.

A caveat is that even though US dollar fixed deposit rates can be higher compared to the Singapore dollar counterparts, foreign currency risk should be considered.

Insurance

The "Supplementary Retirement Scheme" is meant for retirement preparation. Retirement investment is associated with building long-term income streams, making annuity products an intuitive choice. As the 10-year withdrawal period limit for your SRS account does not apply to annuities, this makes SRS annuity products even more attractive.

As of December 2024, almost 23% of SRS monies were invested in life insurance products, mainly single premium annuity/non-annuity plans, as well as endowment plans.

Yet, SRS insurance options are not favourable due to the following:

- Being "safer" investment products with some guaranteed returns, the insurer has to invest in low volatility, fixed income products, which typically yield lower returns

- It has larger investment requirements

- It has extended lock-in periods

Given the long investment horizon of most SRS accounts, if you need to commit to a long-term investment option, it is more prudent to invest in relatively higher return investments to grow your SRS retirement monies more meaningfully. But of course, it must be within your risk tolerance.

Shares, REITs and ETFs

With a brokerage account, you would be able to invest in SGX-traded real estate investment trusts (REITs), exchange-traded funds (ETFs), stocks, and other products.

This is a popular SRS investment option because of the familiarity with Singapore stocks, and higher expected returns from REITs and stock investments.

However, there are some notable disadvantages of investing your SRS in income instruments such as REITs.

Firstly, you are limited to using local brokerages to trade, typically charging high minimum fees of $25 or 0.28% of trading value, excluding Goods and Services Tax (GST). This means that you have to invest around $9,000 per trade to make the most of your brokerage fees for your investments.

Secondly, due to the brokerage charges, you cannot invest small amounts cost-efficiently. This means that you are forced to:

- Make larger SRS contributions before you can invest

- Leave dividends or interest received from SRS investments in cash without being able to invest it efficiently.

Of course, there’s individual company risk as investors must be knowledgeable about the company’s business fundamentals and growth prospects before investing.

To allow investors to diversify their investments instantly, ETFs may be a good option. Some popular Singapore-listed ETFs among SRS investors include:

- SPDR Straits Times Index ETF (ES3)

- Lion-OCBC Securities Hang Seng Tech ETF (HST/HSS)

- SPDR S&P 500 ETF (S27)

Unit trusts

Given the longer investment horizon for SRS monies, you would want to invest in a manner that gives you the highest return when you withdraw your SRS. Many SRS account holders have a long investment horizon till the age of 63 and beyond. This would mean:

- Investing — through a low-cost platform such as Endowus — into low-cost unit trusts to minimise loss of return through fees

- Allocating to riskier asset classes, such as equities, to maximise investment returns

- Being globally diversified across geographies and industries to minimise risk

Read more: The real difference between unit trusts and ETFs

While investing in unit trusts exposed to global markets can be a compelling strategy, ensuring that you have the lowest cost access to this SRS investment strategy and funds is key. Through a traditional fund platform or bank unit trust platform, you have to pay for:

- Higher cost retail share class funds, which can go beyond 1.75% in fund total expense ratio;

- A one-off sales charge, typically at 1% of your investment value;

- A recurring platform fee, at up to 0.35% p.a. of your investment value.

Weighing the risks and rewards

Investing your Supplementary Retirement Scheme (SRS) funds offers the potential for significant growth and diversification. However, to fully capitalise on these benefits, it's essential to understand and manage the associated risks.

- Market volatility: Investments in stocks, REITs, and ETFs are subject to market fluctuations, and capital losses can occur, especially during economic downturns.

- Fees and costs: Traditional platforms with high fees can erode returns over time. Be mindful of management fees, commission fees, and other hidden costs. Choose platforms like Endowus that provide funds at the lowest possible costs.

- Liquidity constraints: Certain investments, such as Singapore Savings Bonds or Insurance Annuities, have long lock-in periods, limiting flexibility. Make sure your liquidity needs are considered before committing.

- Returns vs risk: Lower-risk investments like fixed deposits or T-bills offer predictable returns, but these may lag behind inflation and fail to significantly grow your retirement savings.

By evaluating these factors, you can make more informed investment choices that align with your financial objectives and risk tolerance.

Introducing Endowus: A comprehensive solution for SRS investments

At Endowus, you can gain access to advised portfolios that are aligned with your risk tolerance. You pay only 0.15% to 0.4% p.a. of your assets under advisory in Endowus Fee.

Through the Endowus Flagship Portfolios, you can get broad market exposure through low-cost funds that target long-term outperformance.

Our Very Aggressive Portfolio, which consists of 100% equity allocation, has generated an annualised five-year return of 9.4% p.a. (as of 31 August 2025), even after accounting for fund fees. For those who want to bear less risk, the classic 60/40 portfolio allocation, which is our Balanced Portfolio , has given investors an annualised five-year return of 5.8%, beating the SRS base interest rate of 0.05% p.a.

For do-it-yourself (DIY) SRS investors, you can pick from 150+ different funds (as of 31 August 2025) on the Endowus Fund Smart platform, or a curated list for long-term investing.

Some low-cost funds include the Amundi Prime USA Fund, the Dimensional Global Core Equity Fund, and the PIMCO GIS Global Bond Fund.

You can learn more about Endowus SRS offerings.

Why choose Endowus?

Endowus offers a low-cost, all-in fee that includes trailer fee rebates, ensuring there are no hidden charges.

Moreover, Endowus prioritises long-term, strategic asset allocation over short-term trends, providing diversified portfolios that help reduce risk and capture higher returns over time. Additionally, client assets on Endowus are securely held under individual names at UOB Kay Hian, enhancing protection against any unforeseen platform risks.

Read more: Not all robo-advisors are created the same

Pick your best SRS investment option

We understand that selecting the right investment for your SRS account can be challenging due to the variety of options available, from low-risk options such as SSBs to higher-risk ones like stocks and REITs. As with any investment, you have to consider your own circumstances, such as risk tolerance and investment goals, before making a decision. You also have to consider the pros and cons of each option.

For instance, fixed deposits offer a stable interest rate but have limited flexibility and potential for reinvestment risk. Conversely, low-cost unit trusts that you can invest in through Endowus may carry varying levels of risk. But, historically, they offer the potential for greater returns over the long term that beat inflation.

Leaving your SRS funds uninvested isn’t risk-free. Inflation is eroding your hard-earned money away. Therefore, the crucial step is to avoid settling for the low base interest rate of 0.05% p.a. and make your SRS funds work harder to maximise your retirement savings.

Learn more about SRS

Endowus CPF Portfolios outperform average returns of CPF Investment Scheme (CPFIS)-included funds in 2020

5 Things to know before investing your CPF

Webinar: Starting your CPF Millionaire journey early

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)