Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

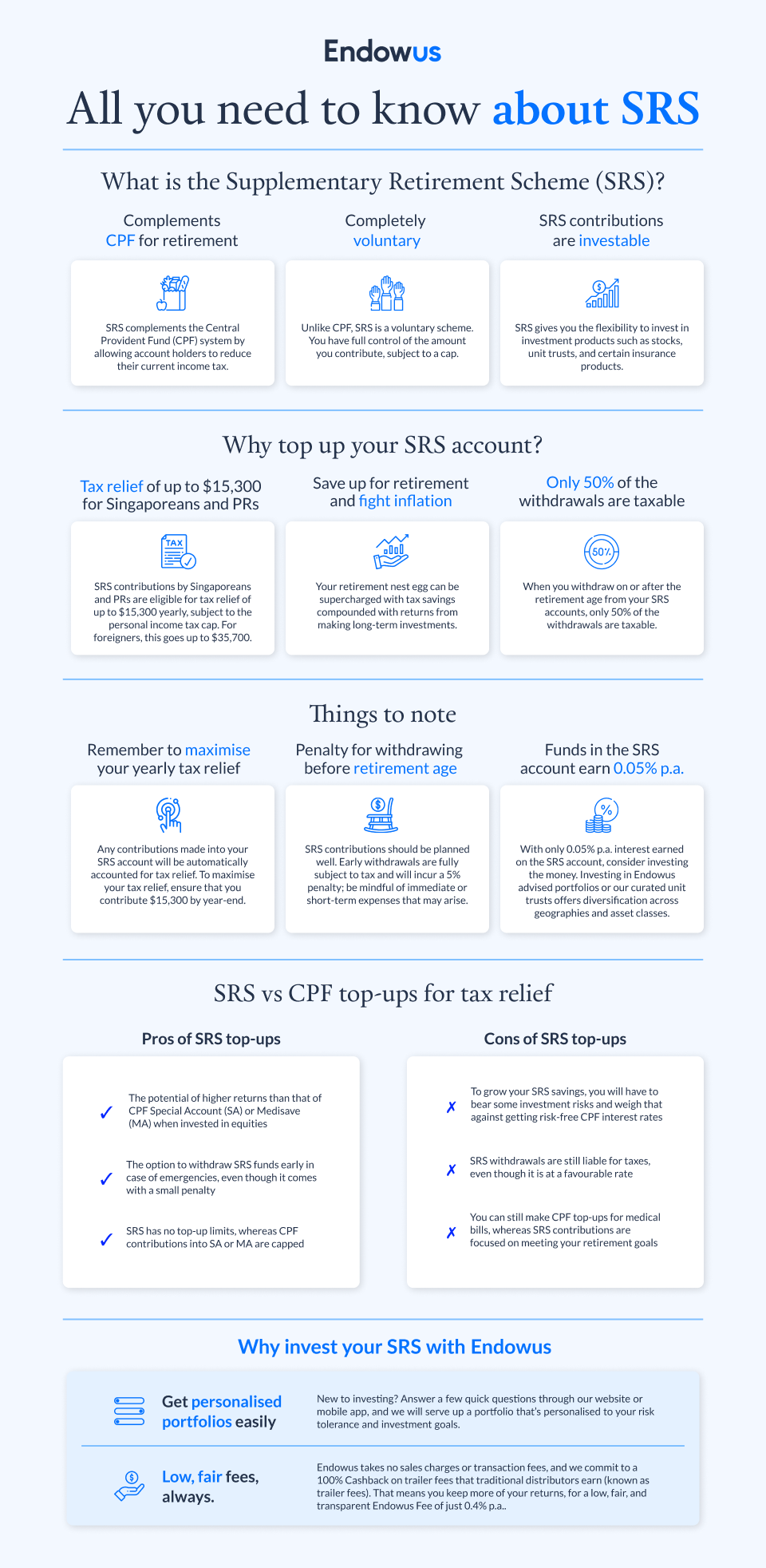

- Discover how to reduce income tax in Singapore through the Supplementary Retirement Scheme (SRS)

- As the SRS interest rate is only at 0.05% per annum, SRS members should invest their funds to boost retirement savings.

- Learn about contribution processes and strategies to maximise SRS tax relief.

- Invest your SRS with Endowus to get access to globally diversified funds at a low fee.

Nothing is certain except death and taxes, so the saying goes. But you can cut your tax bill if you know where to look.

The Supplementary Retirement Scheme (SRS) offers a dual benefit of tax reduction and saving for your retirement. There are two parts to this tax incentive:

- Postpone the tax bill

- Pay less tax later in your retirement years.

If you manage how much you withdraw from the SRS account each month for your spending needs at retirement, you can even withdraw without paying taxes on these sums annually.

The scheme may seem complicated at first glance, so here’s an overview of the SRS scheme:

What is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme (SRS) is a voluntary programme designed to complement your Central Provident Fund (CPF) savings for retirement. It's part of the Singapore government's strategy to help you save more for your golden years. As an SRS account holder, you'll enjoy attractive tax benefits:

- Contributions are eligible for tax relief

- Investment returns accumulated are tax-free

- Only 50% of withdrawals are taxable at retirement

You're eligible to open an SRS account if you're at least 18 years old, not bankrupt, and have the mental capacity to make own decisions. You can invest your SRS funds in various instruments, including stocks, bonds, and unit trusts.

How much can you contribute to your SRS?

Every year, the maximum contribution amount for Singaporeans and permanent residents (PRs) in an SRS account is no more than $15,300 (and for foreigners, $35,700). You can set up an SRS account at one of three local banks here, UOB, DBS or OCBC. When you do so, $15,300 will be deducted from your personal income before your current tax bill is calculated (more on taxes upon withdrawal at retirement later).

To break it down further, Singaporeans can make their annual SRS contributions in three main ways:

- Setting aside $1,275 a month to make the full $15,300 by 31 Dec;

- Topping up the SRS account as and when your cash flow allows, right up to the limit;

- Putting in a lump sum of $15,300 by 31 Dec.

How much SRS tax relief can you get?

SRS offers significant tax benefits, making it an attractive option for savvy investors. When you contribute to your SRS account, you can enjoy immediate tax relief in the following year.

Here is a simple illustration on how to postpone tax:

We take an annual income (excluding employer CPF) of $4,000, assume zero personal relief, and a full contribution of $15,300 for a Singaporean.

We make calculations for another two other income brackets, loosely defined by adding $48,000 per income tier (that’s $4,000 more, multiplied by 12 months).

There could be realistic constraints that prevent you from committing to a full SRS contribution each year. Here is a second illustration that assumes just half of the SRS contribution of $7,650, with the rest of the factors held constant.

You can also use our SRS calculator to find out how much tax savings you can get for your intended SRS contribution.

Grow your SRS beyond the 0.05% interest rate

Funds in your SRS account earn only 0.05% interest per annum, which is insufficient to keep pace with inflation averaged at 2% over the long term. While SRS is a highly tax-efficient scheme, its structure should also motivate retirement planners to invest for stronger returns.

Available options include unit trusts, ETFs, stocks, and bonds. Because of the long-term nature of such illiquid SRS savings, investing your SRS regularly compounds returns that you can enjoy in your retirement even despite market volatility.

Endowus is one of the few digital wealth platforms where you can invest your SRS savings seamlessly. Investors can automate monthly SRS investments to ensure that every dollar saved in your SRS account is optimised to grow for your long-term needs.

You can find out more about Endowus' SRS offerings here.

SRS tax relief upon withdrawal at retirement

Your retirement age is determined by the statutory retirement age of the year you had put in your first dollar in your SRS account. Withdrawals can start when you reach the age, but note that withdrawals have to be made within a 10-year period. These funds can supplement your income, cover medical expenses, or finance leisure activities.

Apart from postponing tax bills, you also enjoy SRS tax reliefs at withdrawal. For every two dollars withdrawn from the account, only one is subjected to taxation.

Withdrawing $40,000 per year from your SRS account allows you to enjoy a tax-free withdrawal of $3,333 per month. This is because only half of the amount ($20,000) is taxable, which falls below the chargeable income threshold of $20,000 in Singapore.

Even if you’d like to withdraw more than $40,000 annually in subsequent years, the tax concession means you’d only be charged taxes on half of your SRS withdrawal amount, making such retirement savings highly tax efficient.

What if you withdraw your SRS funds before the statutory retirement age?

You can access your SRS funds before the statutory retirement age, but it comes with a 5% penalty on the withdrawn amount. Additionally, the entire sum will be subject to income tax in the year of withdrawal.

However, exceptions exist for specific circumstances like medical grounds or bankruptcy, where the penalty may be waived.

Maximise your SRS tax relief, but be mindful of your liquid cash flow

SRS offers a powerful way to reduce your personal income tax in Singapore whilst encouraging saving for your retirement.

With that said, be mindful that SRS tax reliefs are not unconditional – premature withdrawals are subjected to a penalty fee and tax, and investments are subject to market volatility. Therefore, SRS contributions or investments should be done only if you have sufficient liquidity.

To make the most of your SRS account, consider investing your funds in a globally diversified portfolio with potentially higher returns than the standard interest rate.

Have more questions about SRS? Here are a few articles that might help:

Should a new Singapore Permanent Resident make voluntary contributions to CPF accounts?

Understanding the different returns for CPF SA through a MCQ question

Webinar: Tax hacks: Pay less tax with CPF & SRS top-ups

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)