Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

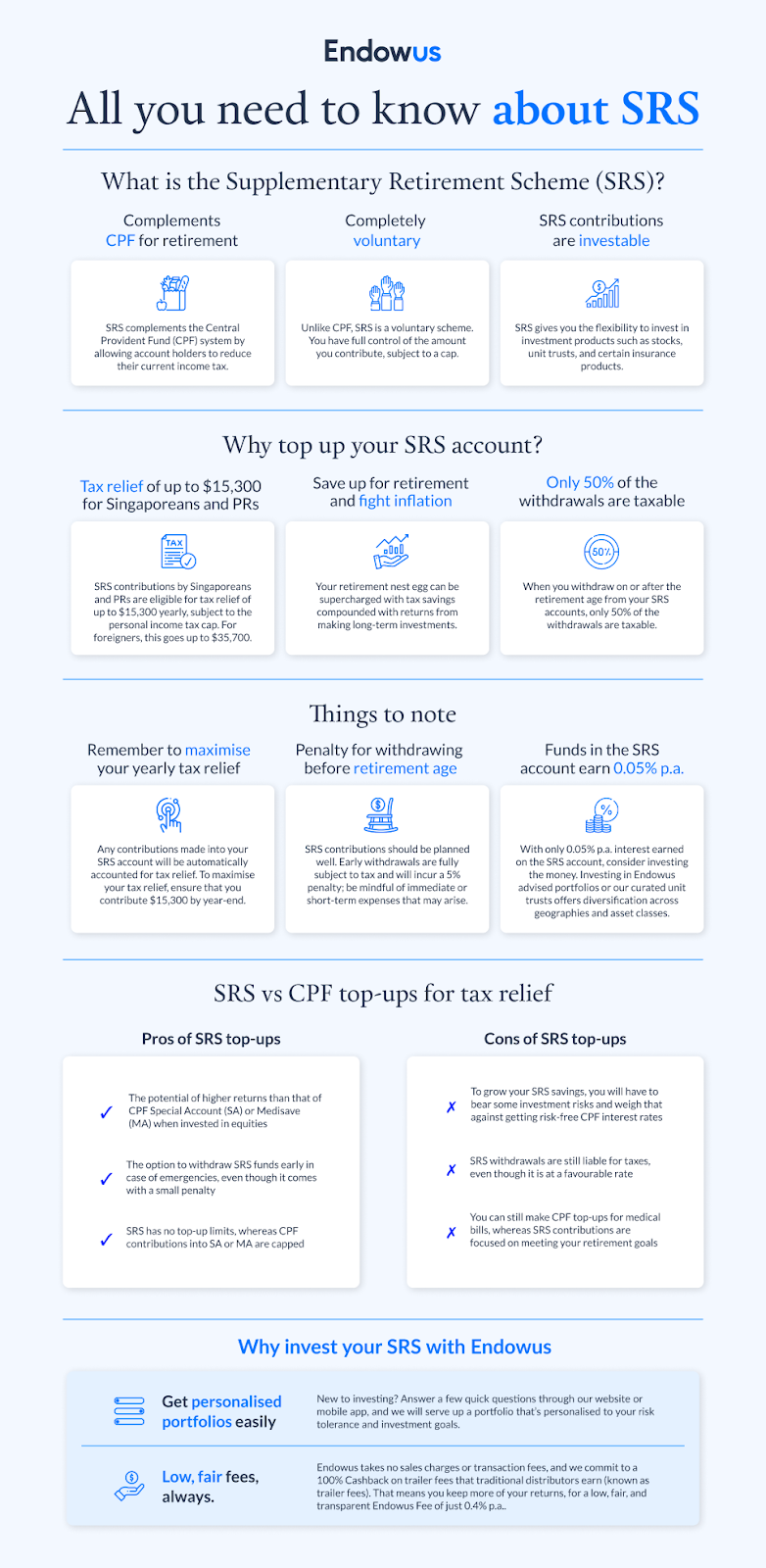

The Supplementary Retirement Scheme (SRS) is one of Singapore’s best kept secrets. Not only is the scheme a great way to save more for your retirement, it is also a nifty hack to lower your tax bill today.

- Singaporeans & Permanent Residents (PRs) can save up to S$3,366* from SRS tax relief

- Foreigners can save up to $7,854* from SRS tax relief

*assumes $0 for current eligible tax relief, and SRS contribution made from the 24% tax bracket.

To help you get started, here’s a comprehensive guide for all you need to know about SRS.

What is SRS?

SRS is a voluntary savings scheme that complements your CPF savings for retirement. It encourages Singaporeans, Permanent Residents (PRs) and foreigners to build their nest egg by offering attractive tax reliefs on SRS contributions.

To open an SRS account, you have to be at least 18 years old, not an undischarged bankrupt and mentally capable of managing your own affairs.

As much as 50% of SRS withdrawals made on or after the retirement age are taxable. Thus, SRS is essentially an income tax deferment scheme. Depending on your withdrawal strategy, you might not have to pay income tax at all.

<divider><divider>

How does SRS work?

To start, you have to set up an SRS account with a local bank, which are UOB, DBS, or OCBC. To keep the process of making SRS contributions seamless, choose a bank which you already have a savings account with, so you can make direct top-ups to your SRS account via your bank app. Each individual can only have one SRS account.

There is an annual SRS contribution limit—every year, a Singaporean or PR is allowed to top up no more than S$15,300 to their SRS account. For foreigners, the annual contribution limit is S$35,700.

You can choose to make multiple SRS contributions throughout the year, or a single lump sum. The contribution has to be made before the cut-off time of your bank on 31 December to secure your tax relief for the following Year of Assessment. It is best to make your final top-up at least a few days or weeks before the last day of the year in case of any system disruptions.

SRS contributions will be automatically granted dollar-to-dollar tax relief (up to the contribution limit) by the Inland Revenue Authority of Singapore (IRAS), so you don’t have to manually file for it.

Read on for a simple illustration showing how you can cut your tax bill and tackle inflation with SRS.

<divider><divider>

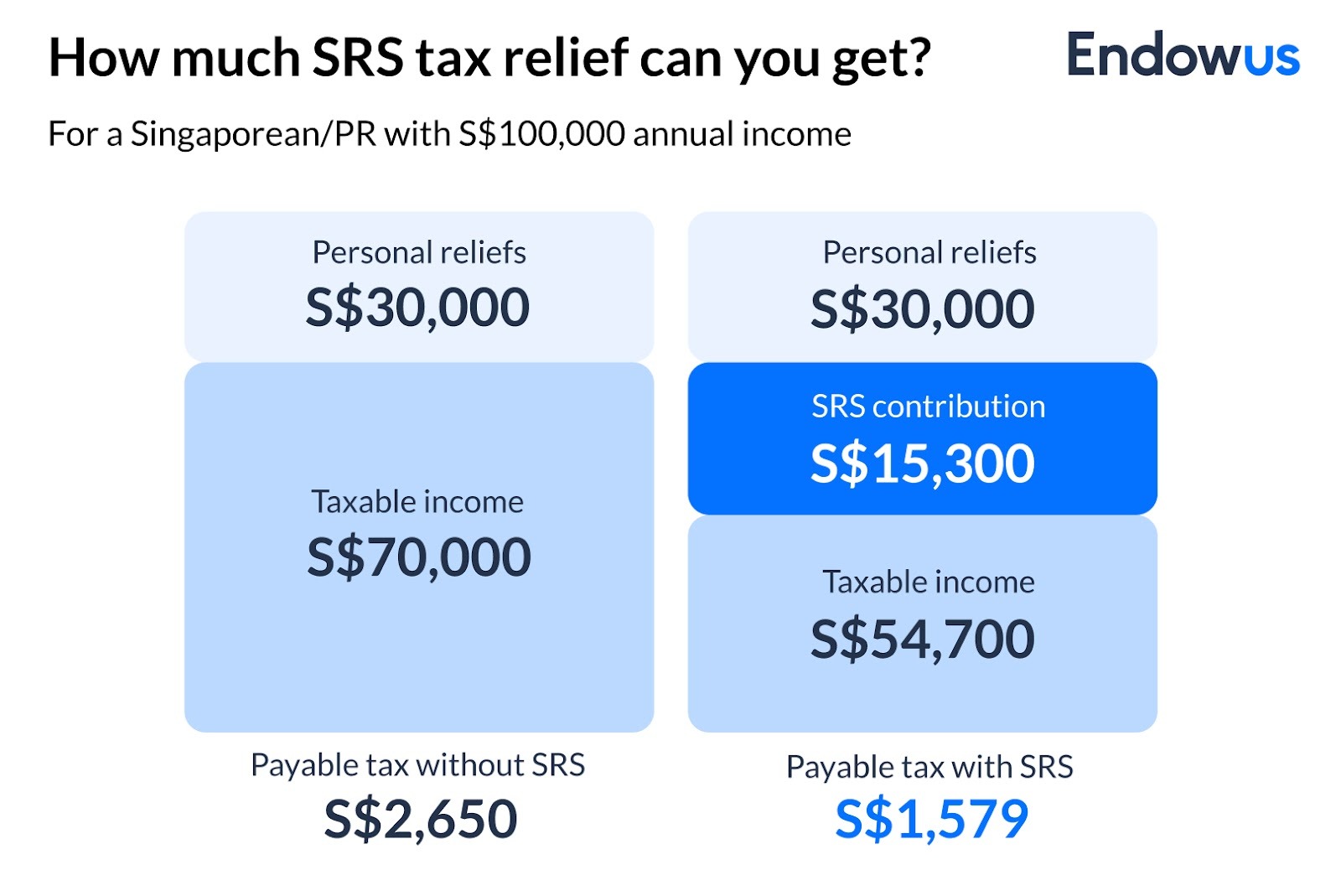

How much SRS tax relief can I get?

Below is an example of how much SRS tax relief a Singaporean or PR can receive.

The amount of tax relief you enjoy for a particular Year of Assessment depends not just on your SRS contribution amount, but also other tax reliefs from schemes such as CPF cash top-ups. There is a S$80,000 personal income tax relief cap, so plan your SRS contributions accordingly to ensure you are not topping up more than you intend to.

Use our SRS calculator to find out how much tax relief you can get.

<divider><divider>

What should I know about SRS withdrawals?

As SRS is designed for long-term savings and retirement adequacy, there are guardrails to discourage behaviours that are counterproductive to these objectives.

This applies to SRS withdrawals: if they are made before the statutory retirement age of the year you put in your first SRS dollar (referred to as “prescribed retirement age”), the withdrawal amount will be fully subject to income tax and receive a 5% penalty. Premature withdrawals must be made in cash.

There are exceptions to this, such as withdrawals made due to medical reasons or bankruptcy, which you can find out further on the IRAS website.

As for SRS withdrawals made on or after the prescribed retirement age, only 50% of the amount is subject to income tax. For Singaporeans and PRs, from the first time you make this penalty-free withdrawal, you will have a 10-year window to withdraw the remaining monies. If they are in investments, you don’t have to liquidate them but instead, transfer them out of your SRS account to be considered a “withdrawal”.

Note that once you have made a withdrawal on or after the prescribed retirement age, you will not be allowed to make new contributions to your SRS account.

If you are a foreigner, there is a different set of withdrawal rules and taxes. Read the next article for more information.

<divider><divider>

A comprehensive guide to SRS for Singapore expats

With soaring rental costs, high costs of ownership of cars, and expensive private school fees, Singapore can be an expensive place for expatriates to live in. SRS can be one way for foreigners working in Singapore to defer taxes paid on income earned.

Foreigners (non-PRs) have a higher SRS contribution limit of S$35,700, as they are excluded from tax relief via CPF contributions.

Expats will need to note the rules specified for foreigners. For instance, foreigners can withdraw in one lump sum with no penalty if they have maintained the SRS account for at least 10 years from the date of the first contribution, and 50% of the withdrawal amount will be taxable.

In our article about SRS for foreigners, find out: :

- The penalty on early SRS withdrawal;

- Which tax rates will apply at the point of withdrawal;

- How withholding taxes are imposed on SRS withdrawals.

<divider><divider>

Why should I invest my SRS?

While SRS is a highly tax-efficient scheme, SRS monies earn just 0.05% interest per annum (p.a.). These monies may be taxed less in the future, but are losing their purchasing power if left idle, especially with high inflation now.

An increase in long-term inflation from 1% to 3% will mean a whopping 45.8% decrease in retirement savings in real terms.

Investment returns are tax-free before withdrawal. While enjoying SRS tax reliefs, you should consider investing to protect your retirement savings against inflation.

<divider><divider>

Where can I invest my SRS?

There are many ways to invest your SRS money — including unit trusts, SGX-listed stocks, real estate investment trusts (REITs), and exchange-traded funds (ETFs). Some may also wish to keep their savings in fixed deposits or use them to buy insurance products.

While there are advantages to the different investment options, there are also some disadvantages to consider when investing your SRS in high-yield instruments.

Read about which SRS investment options might be suitable for you and which are unlikely to be favourable.

When investing your SRS with Endowus, you get globally diversified exposure easily, you do not incur any foreign exchange charges, and there are no rebalancing and transaction costs.

<divider><divider>

Frequently asked questions (FAQs) about SRS in Singapore

Are monies in my SRS locked up like CPF?

SRS is voluntary. Unlike CPF where there are restricted uses for monies from each account, SRS monies are not locked up. However, premature withdrawals may be subject to penalty and tax.

Other than myself, who can contribute to my SRS account?

Employers can contribute to your SRS account on your behalf, if you have given written instruction or authorisation.

Such contribution is still considered part of your remuneration, it must be declared by your employer in your Form IR8A. Based on the information provided by the SRS operator, you will then be given tax relief for such contributions in the subsequent year of assessment.

When can I start making penalty-free SRS withdrawals?

The answer depends on what the statutory retirement age was in the year you made your first SRS contribution. For example, the statutory retirement age from 1 Jul 2026 is 64—assuming you topped up your SRS account for the first time then, you will be able to make penalty-free SRS withdrawal upon turning 64 years old.

As a Singaporean or PR, what happens if I don’t withdraw all of my SRS monies within the 10-year withdrawal period?

The balance can remain in your SRS account, but 50% of the amount will still be subject to income tax.

More resources on SRS

Curious to learn more? Here are further tips to optimise your SRS savings and supercharge your retirement plan.

- How to reduce your income tax through CPF and SRS top-ups

- Understanding the latest Singapore income tax reliefs

- Can you pay too much taxes for SRS withdrawal?

- Webinar: Score more than tax savings with your SRS

Here's how to start investing your SRS money in best-in-class funds with Endowus. If you're new to Endowus, you can join us by creating an account seamlessly.

.webp)

%20(1).gif)

.webp)

%20F1(2).webp)

.webp)

.webp)