- What does golf teach us about investing? Endowus’ CEO, Gregory Van, reflects on his experiences.

- Making choices on the course requires one to strike a careful balance between risks and rewards.

- Emotions often impact the outcome. Ultimately, golfers and investors alike are always playing against themselves.

On the surface, golf might seem a world apart from financial markets. Yet, as a keen observer of both, I have come to appreciate the striking parallels that offer invaluable lessons for anyone seeking to build lasting wealth.

The 153rd Open Championship, the oldest golf tournament in the world, wrapped up this past weekend at Royal Portrush on the coast of Northern Ireland. It was exciting to see world number one Scottie Scheffler and Li Haotong, a rare occurrence to see a Chinese golfer, in the final grouping. Scottie’s win by a healthy margin is, of course, impressive, but what got me was that he went 32 holes bogey-free, showing his consistency and dominance under pressure. For non-golfers, bogey-free means finishing all of those holes at par or better.

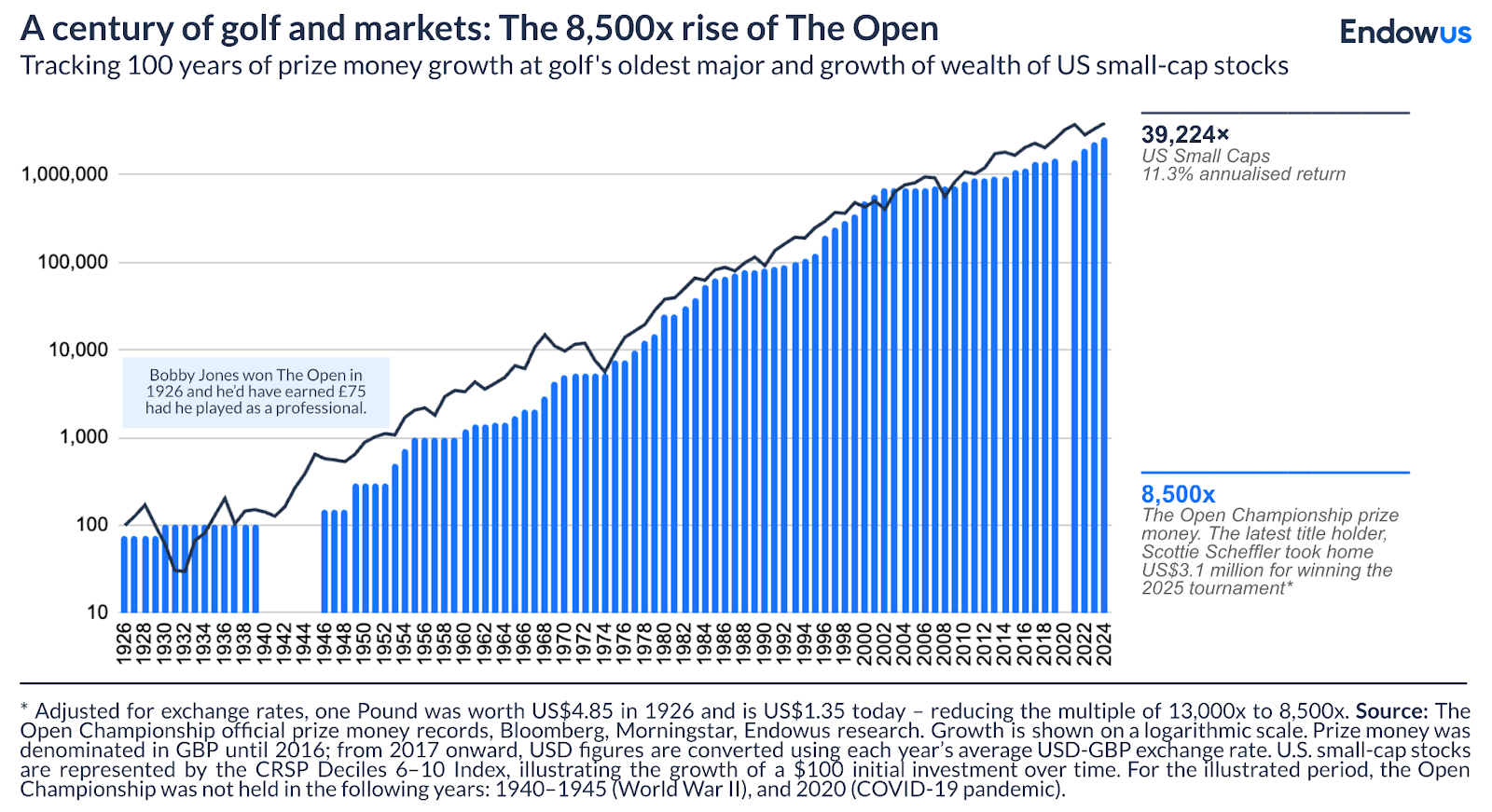

I was curious and looked up the compounding of reward money over the past 100 years. In 1926, the famous Bobby Jones – lawyer by trade, golfer by passion – won for the first time. As a career amateur, he wasn’t entitled to any prize money, so the whopping GBP 75 was awarded to the runner-up.

Fast forward to 2025, Scottie took home US$3.1 million of the total purse of US$17 million for the tournament. This multiple of growth seems mindblowing at almost 31,000x, but only translates to about 9.5%, similar to the historical track record of equities.

Returning to golf with a new set of eyes

I played competitively as a junior, and with my own kids reaching an age to start swinging, I have been fortunate to have the chance to get back on the course.

Playing as an adult has brought on a whole new appreciation for the mental side of the game – the risk-reward trade-offs, the need to make decisions and live with them, the pressure, the choice of equipment, and so many other nuances draw parallels to evidence-based investing.

Staying on course by taking appropriate amounts of risk for return

In golf, you are constantly faced with choices. From tee to green, you need to pick the line, shot, trajectory, taking into account bunkers, water, out of bounds, rough, wind, rain, emotions, what your competitor just did, and the world around you. You could carry that water to try to get on the green in two, or lay up with a surer chance of making par.

Investing presents the same choices. You could take on lots of risk for the chance of making a big short-term return, but you could also catch a bad swing and end up in a ditch.

The astute investor begins by picking the right "shot" for each of their goals. This isn't about chasing the latest market fad; it's about crafting a well-thought-out investment strategy and asset allocation that aligns with your unique goals, time horizon, and risk tolerance. Do you need a conservative iron shot to lay up, or can you confidently unleash the driver for a long-term gain and take on the volatility?

Understanding your personal "course conditions" and making strategic choices before you swing is paramount to improving your probability for success, and knowing when to go for it or protect capital.

Working backwards from the goal

Visualisation is important in golf, and it’s not just about the next shot. A good golfer visualises from the green and the hole, and works backwards to the optimal shot they want to play off the tee to put themselves in the best position.

If I want to hit 120 yards into the green on a 350-yard hole, I should try to hit 230 yards off the tee. I don’t have to take out the driver and put myself a more awkward 60 yards from the hole even if I strike it in the middle of the fairway. Watching Scottie at the Open reminded us of this strategy, where he consistently made choices off the tee that set himself up for success.

Investing is the same. We start with the life goal, and work backwards to how we allocate our assets today. Liabilities-driven asset allocation has long been the way institutions invest, and now with the power of access, advice, lower costs, and technology to implement this method, individuals can do the same.

Like golf gear, every investor needs their personalised set of strategies

There are a few sports where you can buy so much gear that becomes outdated every few months. Shafts, heads, balls, bags, woods, irons, wedges, putters, and so much more. As a golfer, you have to comb through all the noise and find what suits you, to get on the course with fourteen golf clubs, each with their own purpose.

To consciously build investment portfolios, we must assemble an efficient collection of strategies that complement each other. When combined, they must be suitable for our goals and our ability to tolerate volatility and complexity. Ideally, you can do this in a cost-conscious way and with unbiased advice.

It is probably fair to say most golfers spend more time thinking about and researching how to improve their set of clubs, combing through dozens of websites and consulting multiple experts and friends before making their choice. We can all apply the same discernment to how we grow and manage our hard-earned wealth.

There is no undo button in golf or investing

Golf is a uniquely unforgiving sport. In tennis, for example, if you hit a lousy shot, the point is not necessarily over, and that particular game is far from over. But in golf, if you miss a two-foot putt, that shot is marked on your scorecard forever. Once you’ve hit a shot, you can never get it back.

In investing, the past is gone forever, too. Time lost and hindsight are constant frustrations. The market does not care if you are below your cost. The market does not care if you doubled your money on that stock in the last month, or if you missed out by sitting out for the last year.

You can only focus on how you are allocated today for your future.

If you’re watching the fun, light-hearted Apple TV comedy “Stick” starring Owen Wilson as a has-been golfer, there is a great “Grossweiner’s Law” repeated a few times, applied to different contexts. It talks about a golfer who “had a superpower on the course. He didn't care about his last shot. And he wasn't worried about where his next shot was gonna land. All this guy was focused on was his swing in the moment. It's like he knew that was the only thing he could control.”

You are playing against yourself

No one will move your ball. No one is moving the course. You are in total control of implementing your game.

A good swing requires consistent practice, focus, and discipline, so that you can perform when the pressure is on and distractions are everywhere.

Successful investing demands disciplined execution. This means sticking to your investment plan through market ups and downs, resisting the urge to panic during downturns, or chase fleeting highs. It means regular rebalancing to maintain your asset allocation, to improve your probability of success.

The true mastery in both pursuits comes from controlling your emotions, silencing the inner critic, and maintaining a clear, long-term perspective. Patience, resilience, and the ability to learn from every "shot" – good or bad – are the hallmarks of a champion, both on the course and in your financial life.

Final thoughts

When writing this article, I flipped-flopped many times: Is it golf teaching us about investing or investing teaching us about golf?

Whichever way you see it, improving your probability of success in managing wealth or playing golf will certainly lead to greater enjoyment in life.

At Endowus, we believe in empowering you to play your best game. Just as a good caddie helps you see the course clearly to make informed decisions, and a coach helps you improve your swing and mental game, we are here to be your trusted partner, empowering you to execute your strategy with confidence and achieve your long-term financial goals, one well-played shot at a time.

<divider><divider>

Risk Warnings

Investment involves risk. Past performance is not an indicator nor a guarantee of future performance or returns. Projected performance or returns is not guaranteed to materialise. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Rates of exchange may cause the value of investments to go up or down. Individual stock performance does not represent the return of a fund.

General risk warnings relating to collective investment schemes

Before making an investment decision, you are reminded to refer to the relevant prospectus/ offering document for specific risk considerations and related fees and charges. Funds are not a bank deposit and not capital guaranteed, and is subject to investment risks, including the possible loss of the principal amount invested. Some of the funds also involve derivatives. Do not invest in them unless you fully understand and are willing to assume the risks associated with them.

Opinions

Whilst Endowus HK Limited (“Endowus”) has tried to provide accurate and timely information, there may be inadvertent delays, omissions, technical or factual inaccuracies or typographical errors. Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endowus HK Limited (“Endowus”) and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus HK Limited, its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. You may also wish to seek financial advice through a financial advisor or the Endowus platform and independent legal, accounting, regulatory or tax advice, as appropriate.

No invitation or solicitation

Nothing contained in this article should be construed as a solicitation, an offer to buy or sale, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction in any jurisdiction in which such solicitation, offer to buy or sale would be unlawful under the securities laws in such jurisdiction. No information included in this article is to be construed as investment advice or as a recommendation or a representation about the suitability or appropriateness of any advisory product or service; or an offer to buy or sell, or the solicitation of an offer to buy or sell, any security, financial product, or instrument; or to participate in any particular trading strategy. Investors should seek independent financial and tax advice before making any investment decision.

Product Risk Rating: Please note that any product risk rating (the “PRR”) provided by us is an internal rating assigned based on our product risk assessment model, and is for your reference only. The PRR is subject to change from time to time. The PRR does not take into account your individual circumstances, objectives or needs and should not be regarded as advice or recommendation to purchase, hold or sell any fund or make any other investment decisions. Accordingly, you should not solely rely on the PRR in making your investment decision in the relevant Fund.

This article has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

.jpg)

.png)