Endowus IncomeUp Portfolios

.png)

.png)

.webp)

CE NO. bqr225

Overview of the IncomeUp Portfolio

- IncomeUp Portfolios are custom-built from funds of globally reputable fund managers like PIMCO, Pinebridge, Invesco, AllianceBernstein, Neuberger Berman, JP Morgan, Fidelity, Barings, Capital Group, and Schroders, ensuring expert diversification and strategic asset allocation.

- This approach is intended to optimize returns while managing risk, even in a changing interest rate environment.

Balancing between higher-yielding and higher-quality assets, which perform differently in varying growth environments, Endowus Investment Office focuses on meeting your income investing goals by seeking to provide consistent target income distribution and attractive potential returns.

With thoughtful and deliberate asset allocation and portfolio construction, the IncomeUp Portfolios enable investors to navigate through market noise and distractions, allowing them to prioritize what truly matters, including their individual circumstances and life stages.

Science over speculation. Backed by the research of Nobel Laureate academics, our portfolios are broadly diversified across geographies and sectors to achieve higher risk-adjusted return along the efficiency frontier, lowering idiosyncratic risk with the ability to outperform in the long-run.

CPF Core Flagship portfolios have strategic passive asset allocation with the equities providing broad market exposure that is diversified and passive in developed markets and diversified and more active in emerging markets, and fixed income allocations focused on higher quality debt instruments.

Evidence-based investing does not try to time the market. It requires a disciplined and systematic investment strategy so you have the highest probability of success in reaching each of your financial goals. Each of your goals should have its own SPAA based on its objective and risk tolerance.

Endowus does not believe in tactically or actively changing your allocations based on market conditions or economic indicators, and will not change your target asset allocation without your explicit consent.

Top-down, we believe that you asset allocation must be passive and broadly diversified so that you are rewarded for the risk you take by investing intelligently.

Stand on the shoulders of financial giants rather than try to reinvent the wheel.

We implement our portfolios by accessing leading global fund managers with the expertise, scale and real, proven track records in implementing their strategies successfully over time. We access their best-in-class funds at the lowest cost possible, so you grow your money like professional investors around the world.

These funds, some of which are exclusively available at Endowus, are carefully selected bottom-up to best represent your goal's top-down SPAA.

CPF Core Flagship portfolios tap on the leading global and local experts including Schroders, FSSA, Franklin Templeton, Eastspring, UOBAM, and Vanguard's passive index funds managed by Lion Global.

Endowus has worked hard to bring Vanguard-managed, passive index funds at the lowest cost achievable to CPF members, in order to attain globally diversified low-cost equities exposure. The Infinity 500 Stock Index Fund and the Global Stock Index Fund are both exclusively available to Endowus clients at the lowest cost in Singapore.

Target income payouts according to your needs

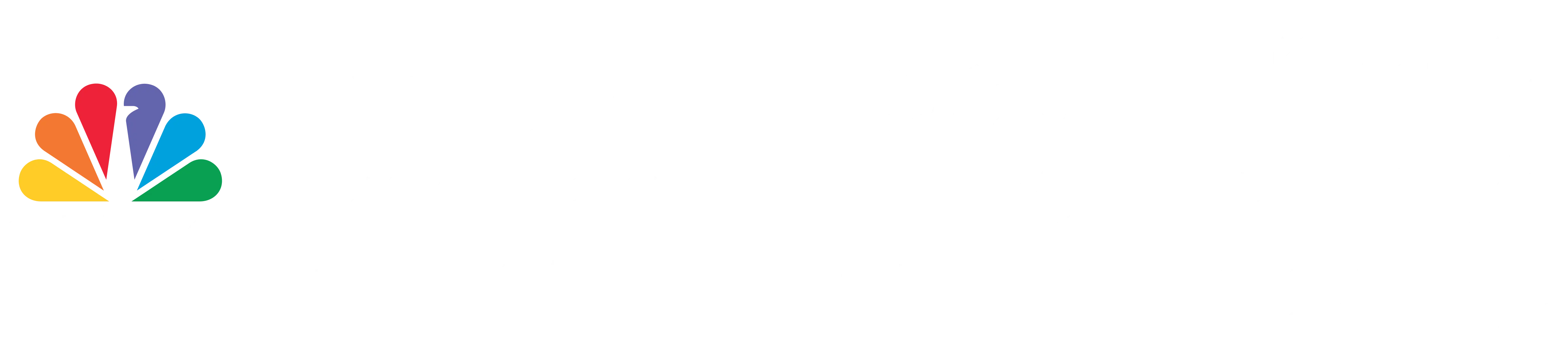

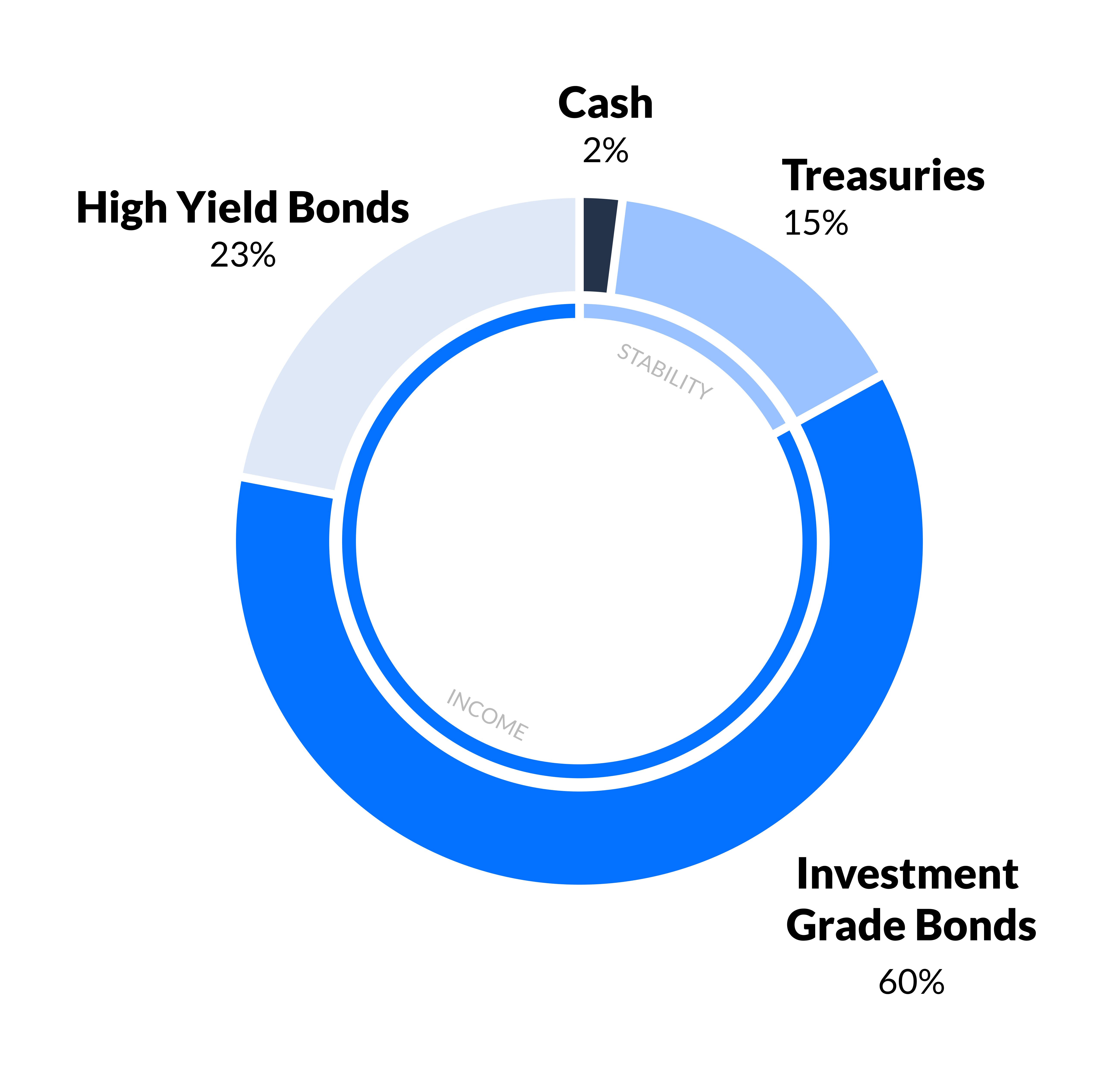

IncomeUp — Steady

30.0%

PIMCO GIS Income Fund17.0%

JP Morgan AM Income Fund16.0%

Neuberger Berman Strategic Income Fund12.0%

AllianceBernstein American Income Portfolio Fund10.0%

Neuberger Berman Short Duration Emerging Market Debt Fund8.0%

Fidelity Asian Bond Fund7.0%

Pinebridge Asia Pacific Investment Grade Bond Fund

Generate reliable passive income to cover regular expenses.

Only take necessary risk from fixed income to increase the chance of capital preservation.

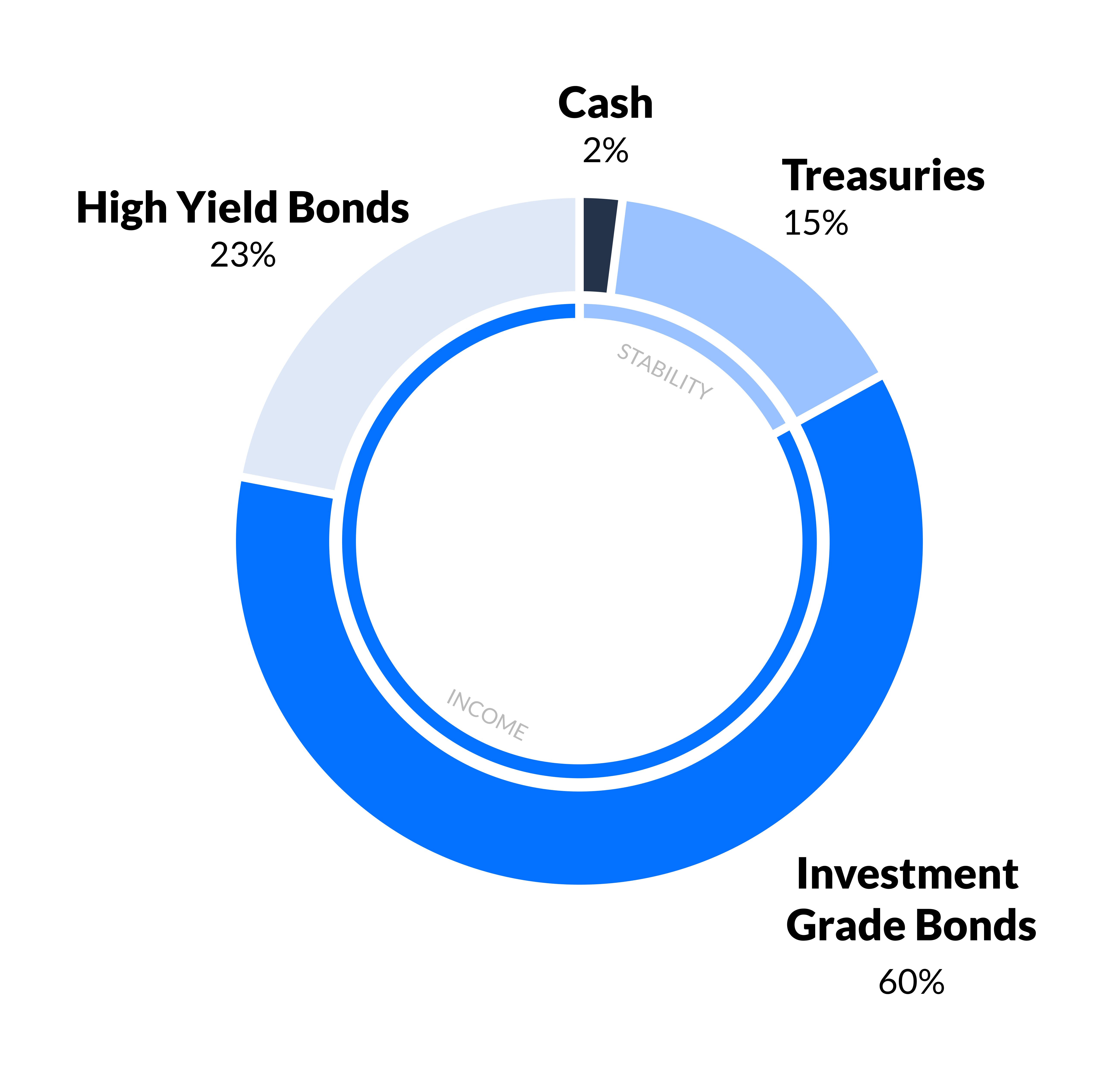

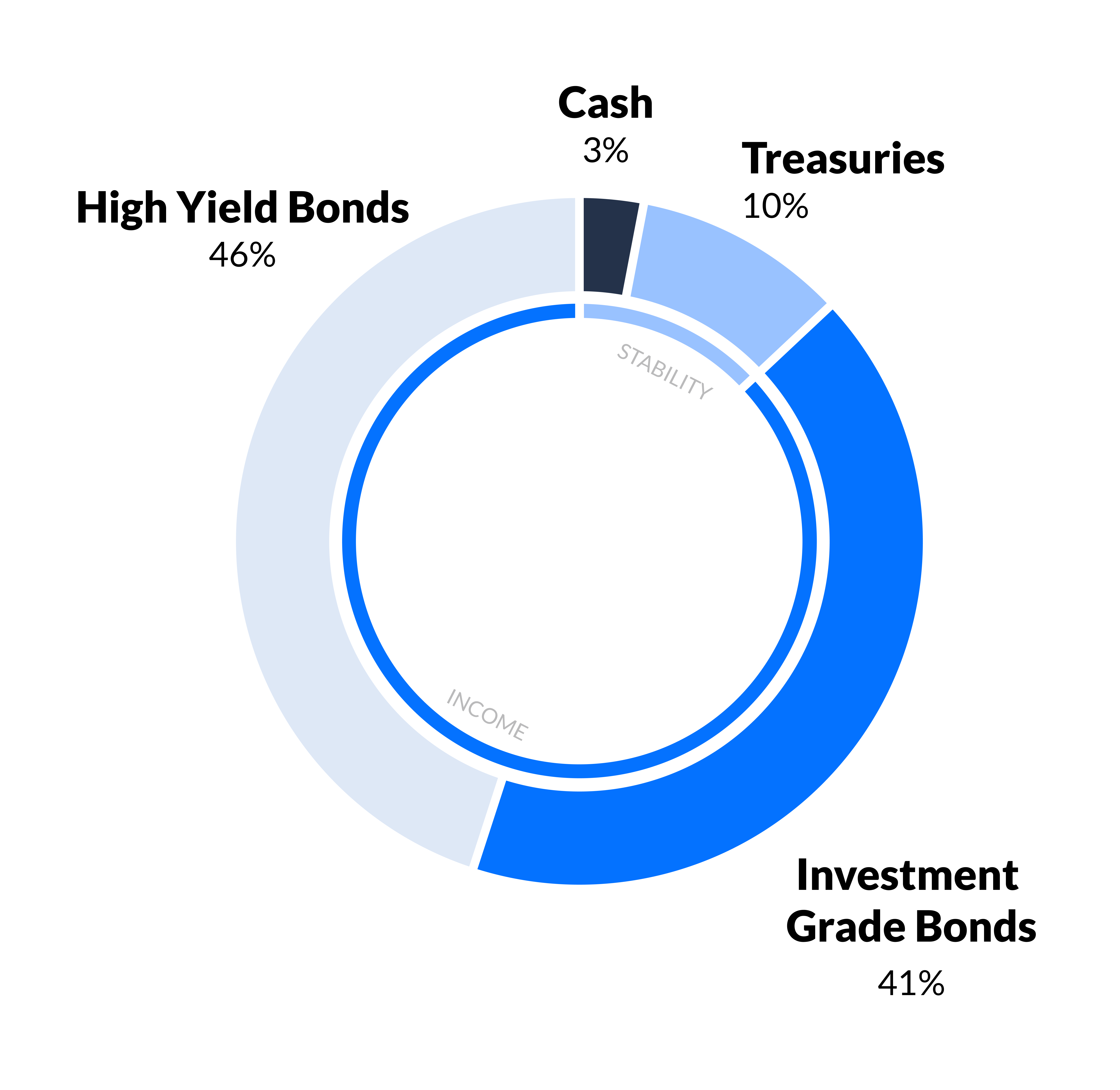

IncomeUp — Plus

25.0%

PIMCO GIS Income Fund20.0%

Barings Global High Yield Bond Fund15.0%

Neuberger Berman Short Duration Emerging Market Debt Fund10.0%

AllianceBernstein American Income Portfolio Fund10.0%

Barings Global Senior Secured Bond Fund10.0%

JP Morgan AM Income Fund10.0%

Neuberger Berman Strategic Income Fund

Cover bigger payments like your mortgage, childcare and parents’ healthcare.

Take slightly higher risk to achieve higher current payout target with limited to no capital appreciation.

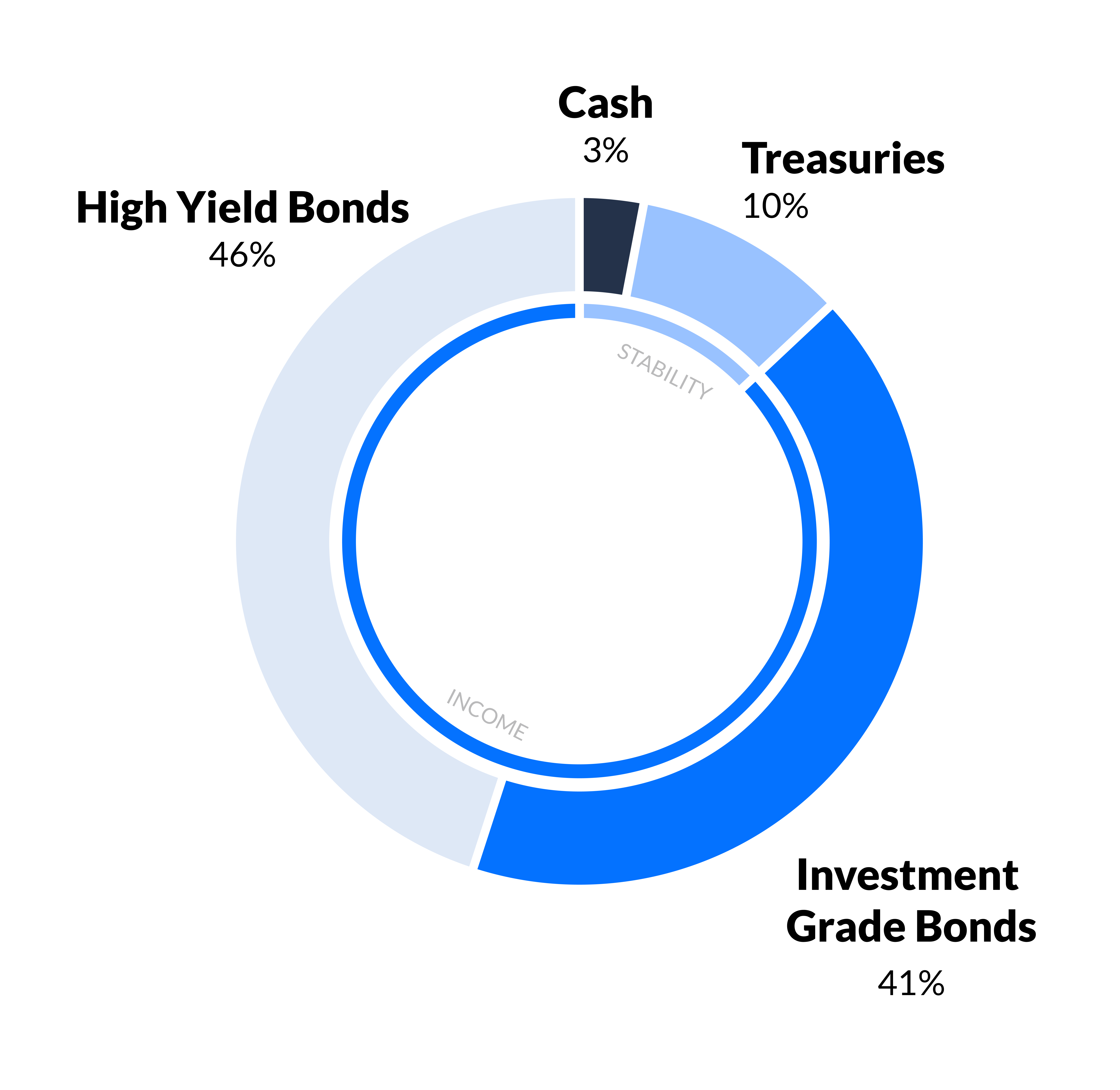

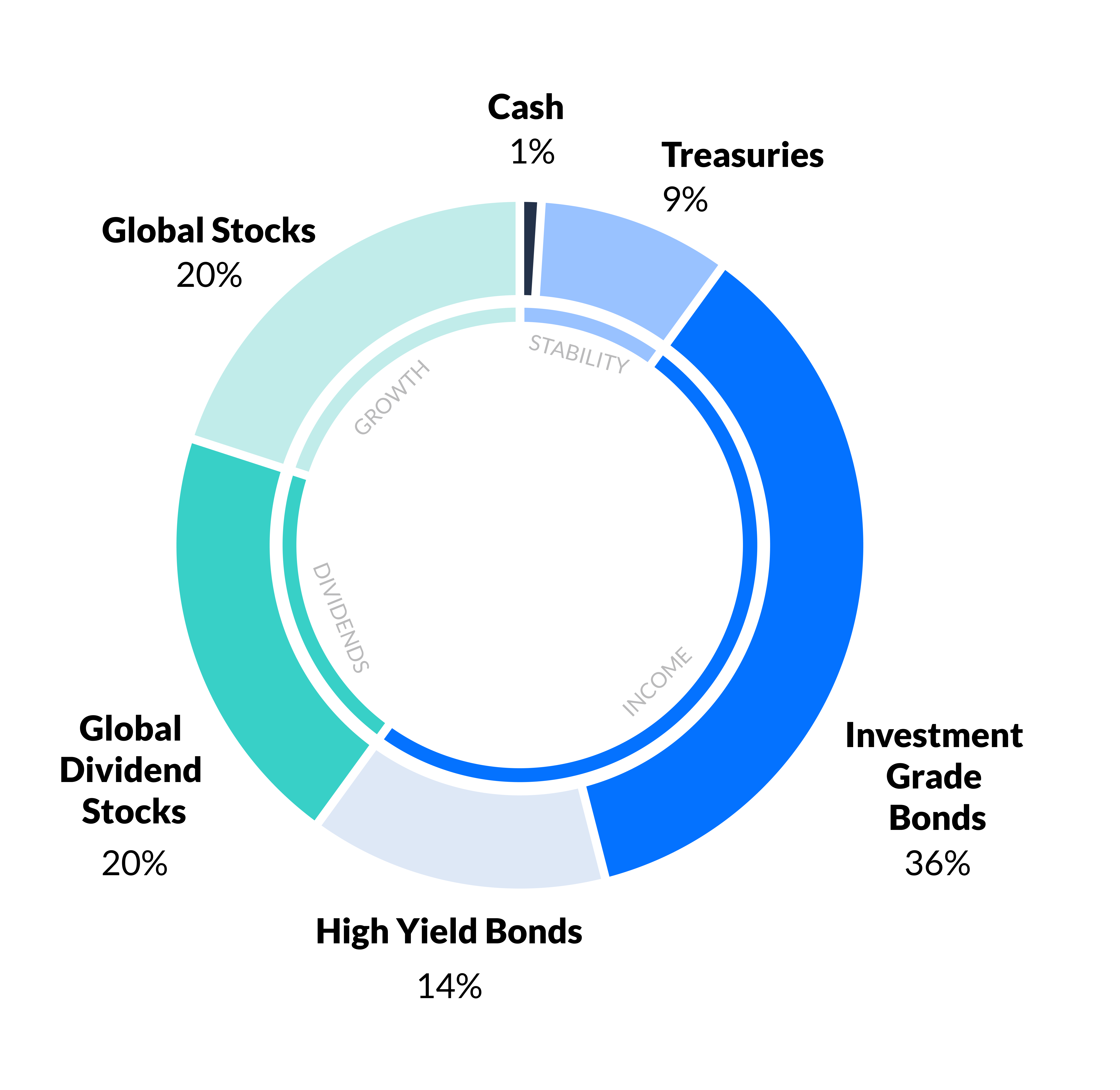

IncomeUp — Growth

18.0%

PIMCO GIS Income Fund10.0%

AllianceBernstein Low Volatility Equity Portfolio Fund10.0%

Invesco Global Equity Income Advantage Fund10.0%

JP Morgan AM Income Fund10.0%

Neuberger Berman Strategic Income Fund8.0%

Capital Group New Perspective Fund7.0%

AllianceBernstein American Income Portfolio Fund6.0%

Neuberger Berman Short Duration Emerging Market Debt Fund6.0%

Pinebridge US Large Cap Research Enhanced Fund6.0%

Schroders Global Emerging Markets Opportunitues Fund5.0%

Fidelity Asian Bond Fund4.0%

Pinebridge Asia Pacific Investment Grade Bond Fund

Balance your current income with long-term growth.

Take higher risk to grow your future wealth with an allocation to global equities.

IncomeUp — Steady

Generate reliable passive income to cover regular expenses.

Only take necessary risk from fixed income to increase the chance of capital preservation.

IncomeUp — Plus

Cover bigger payments like your mortgage, childcare and parents’ healthcare.

Take slightly higher risk to achieve higher current payout target with limited to no capital appreciation.

IncomeUp — Growth

Balance your current income with long-term growth

Take higher risk to grow your future wealth with an allocation to global equities.

.webp)

.webp)

(1).webp)

%20(1).webp)

.webp)