Passive or Active investing is not the only choice in town

Most investors focus on the distinction between passive index investing and active investing that tries to beat benchmark indexes and generate alpha.

However, those are not the only choices investors have. We already know that active investing in equities is a difficult game to play with more than 75% of active investors typically underachieving passive market returns.

Even for passive, it's not as simple as we think. First, passive is different from indexing. Indexes can be passive, but it's something created to follow a certain subset of the total market. It could be the S&P 500, but it can also be the Tech sector index or Robotics index. The only way to be truly "passive" is if we own every listed stock in the exchanges and that will be the broadest measure of ownership.

Factor-based investment strategies are evidence-based and combine the best of indexing — low cost and broad diversification — with flexible active implementation to emphasise higher expected returns and manage risk.

Factor investing explained

At the heart of factor investing is a question for the ages: why do certain stocks and bonds rise or fall more than the rest?

Dr Eugene Fama and Ken French discovered in 1992 that three factors explain over 90% of stock returns — those are market returns (we call market beta), size (smaller companies tend to outperform larger companies) and value (cheaper companies tend to outperform more expensive companies). This marked the beginning of factor investing.

Fast forward to today, the endeavour of factor discovery is still ongoing, and there is an expanded set of factors. For stocks, these have expanded into factors such as quality, momentum, and minimum volatility. In the fixed income space, these factors include term and credit.

To qualify as an investment factor, the factor needs to be persistent across time, and prevalent in different markets.

This is why people like to say that factor-based investing is evidence-based. It is based on empirical evidence by studying decades of observations in multiple markets and is fundamentally supported by economic rationales.

Long-term factors used by Dimensional Fund Advisors

Dimensional summarised the essence of systematic factor investing very well: “Systematic (factor) investing typically seeks to outperform markets by structuring investments around factors linked to differences in expected returns. This differentiates systematic investing from traditional indexing, which typically seeks to deliver market returns, and traditional active investing, which may seek outperformance by identifying so-called mispriced securities or timing markets.”

How has factor investing performed?

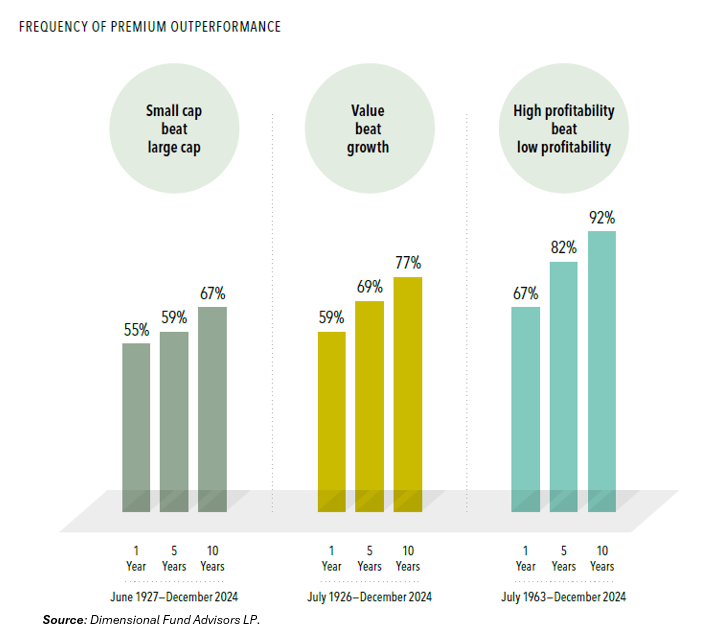

In the equities market, over the long term, the statistical evidence for the outperformance of small, cheaper and higher quality companies compared with their respective counterparts is overwhelmingly positive in US, developed ex-US and emerging equity markets. This is illustrated in the charts below.

In the fixed income market, the charts below indicate higher average term and credit premiums during months when term and credit spreads are wider. There is a body of academic research that provides support for the reliable relationship between the width of credit and term spread, and the subsequent premiums.

Why Dimensional and how do they manage their funds?

Dimensional Fund Advisor is one of the pioneers in systematic factor investing it traces its origin to academia back in 1981, dedicating itself to translating academic insights on factor returns to real world investment strategies.

It was founded by David Booth, (key benefactor to the University of Chicago, which has now named its Business school in his name), and advised by Eugene Fama, the father of "efficient market hypothesis" and factor-based asset pricing models, as well as Robert Merton, Bill Sharpe and Myron Scholes, all of whom are Nobel Prize laureates.

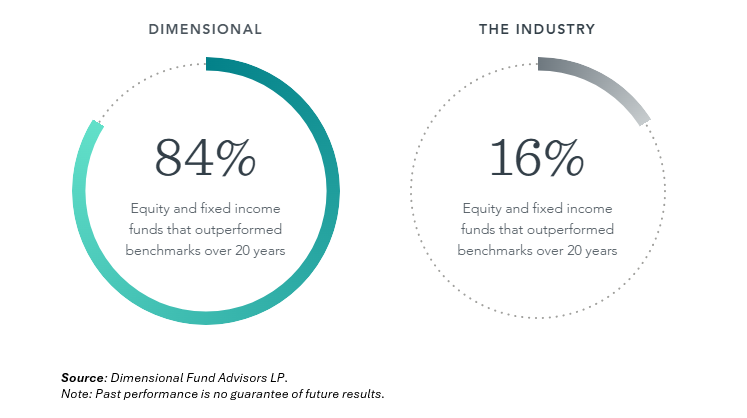

The diligence of its framework have translated into outperformance of its funds relative to the market over the years and has grown to become a global investment giant with over US$900 billion of assets under management (as of December 2025).

On a high level, Dimensional’s process combines the best of indexing, such as broad diversification, low turnover, and transparency, with flexible active implementation to emphasise higher expected returns and manage risk.

It is important to note that, unlike pure factor strategies that narrowly invest in single factors exclusively, Dimensional always starts with this concept of broad passive exposure to the overall markets in its funds first. For example the Dimensional World Equity Strategy, which is the broadest measure of global equity markets has over 10,000 stocks compared to the commonly used MSCI All-Country World Index (ACWI) which has around 3,000 stocks.

Then, instead of weighting securities simply based on market capitalisation (as done by most plain-vanilla index funds), Dimensional weights the securities based on how much exposure it has to the proven factors of expected return.

Devil is in the details when it comes to factor investing. What really sets Dimensional apart is its sophisticated design, implementation, and risk management process.

Take the equities portfolio for example. The decision to target size, value and profitability premiums is just a starting point. A myriad of questions come in when you consider how to incorporate these premiums into a real world portfolio. For example:

- How do you weigh the different factors?

- Is it better to get exposure to the premiums by building standalone single factor portfolios and “mixing” them together, overlaying a satellite multi-factor portfolio on a market portfolio, or through an integrated approach that goes overweight on stocks with higher expected returns and vice versa across the entire market?

- How do you capture changing price information every day? (note: price to book, market cap and profitability ratios for each security would change as prices move and companies report earnings)

Dimensional makes deliberate decisions to each of the above questions based on robust research. For example, their research paper “Assessing the Relative Magnitude of Premiums” found “no reliable differences in the expected premiums, either individually or jointly, across US, developed ex-US, and emerging markets” and “no reliable differences across premiums within any region or globally”. This informs the weighting decision across different factors. Dimensional also found that an integrated approach of combining factors, which accounts for the interactions among multiple premiums and maintains a strong tie between security weights and market prices, leads to greater reliability of outperformance, better risk control, and lower costs. This is how they implement their strategies.

Dimensional’s portfolio management team has a daily rebalancing process centred on keeping the strategies consistently focused on the premiums they are intended to capture. While it is important to assess the changing factor exposures on each security and sell down those with lower exposure and purchase those with higher exposure, Dimensional balances such consideration with information on short-term and intra-day expected returns, as well as transaction cost. For example, even if a stock looks attractive on long-term factor exposure, if it is experiencing downward momentum on that day, it has lower short-term expected returns than its peers and it might be better off holding off the purchase temporarily. Such a process reduces unnecessary turnover and allows for a flexible trading approach that enables opportunistic execution and minimises costs.

Continuous innovation is in Dimensional’s DNA and we are encouraged to see the incremental improvements of their process, such as the implementation of the “investment factor” (exclusion of high asset growth stocks in the small-cap universe) in equities strategies, and their foray into lower quality bonds as the data becomes more abundant for systematic managers. Their rigour in research, focus on delivering better results for clients, and transparency in their process, are key pillars that provide us conviction and desire to partner with them on behalf of our clients.

Accessing Dimensional’s investment strategies through Endowus Hong Kong

Reasons why Dimensional might still be unknown to many retail investors is because their products are only sold through selected financial advisors, which in turn have to go through a lengthy approval process. And to keep costs low for end investors, DFA does not pay trailer commissions or “kickbacks” to distributors who recommend their funds.

We are delighted to share that Dimensionals’ investment strategies, in Hong Kong for the first time, are now available to retail investors to access through Endowus Flagship Portfolios. Endowus Flagship Portfolios are curated and discretionary managed by the Endowus Investment Office with the aim to provide clients globally diversified exposure with Best-In-Class Funds at low and fair fees.

Professional Investors can also access Dimensionals’ investment strategies as individual strategies or use them as building blocks to build your own portfolios.

Click here to get started on your wealth journey on Endowus Hong Kong or schedule a free 1-on-1 consultation with our SFC licensed advisors today.

Appendix: Is Value coming back?

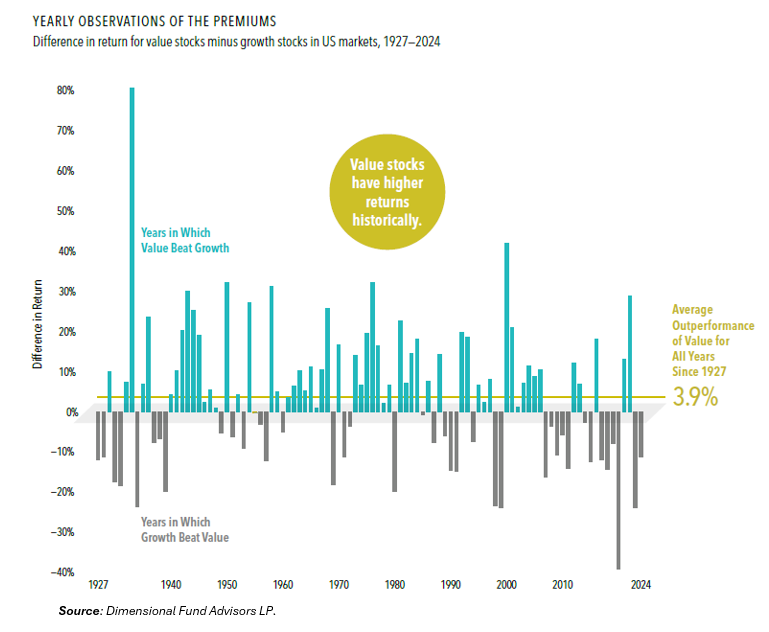

Historically, value stocks have outperformed growth stocks when we look at long periods of data. However, some might note that the prevoius decade has been a golden one for growth stocks, particularly in the US with the recent bull cycles enjoyed by mega-cap growth tech stocks such as the Magnificent 7.

While disappointing periods emerge from time to time, based on historical data, Dimensional maintains the principle that lower relative prices would lead to higher expected returns remains the same. To note, value premiums historically have shown up quickly and in large magnitudes. For example, in years when value outperformed growth, the average premium was nearly 15%.

Per Dimensional, looking at data in the US since 1927, on average, value stocks have outperformed growth stocks by 3.9% annually.

Read more:

- The first index fund ever, and an introduction to Dimensional Fund Advisors

- Introducing Endowus Flagship Portfolios: a core strategy for your financial goals

- Exclusive Interviews with Dimensional Fund Advisors

- Wealth management conflicts of interest are failing investors. Here’s what’s needed

<divider><divider>

Risk Warnings

Investment involves risk. Past performance is not an indicator nor a guarantee of future performance. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested.

Opinions

Whilst Endowus HK Limited (“Endowus”) has tried to provide accurate and timely information, there may be inadvertent delays, omissions, technical or factual inaccuracies or typographical errors.

Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endowus and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus, its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider (i) whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances.

No invitation or solicitation

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation or offer by Endowus or its affiliates to buy or sell any securities, collective investment schemes or other financial instruments or services, nor shall any such security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This advertisement has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

.png)