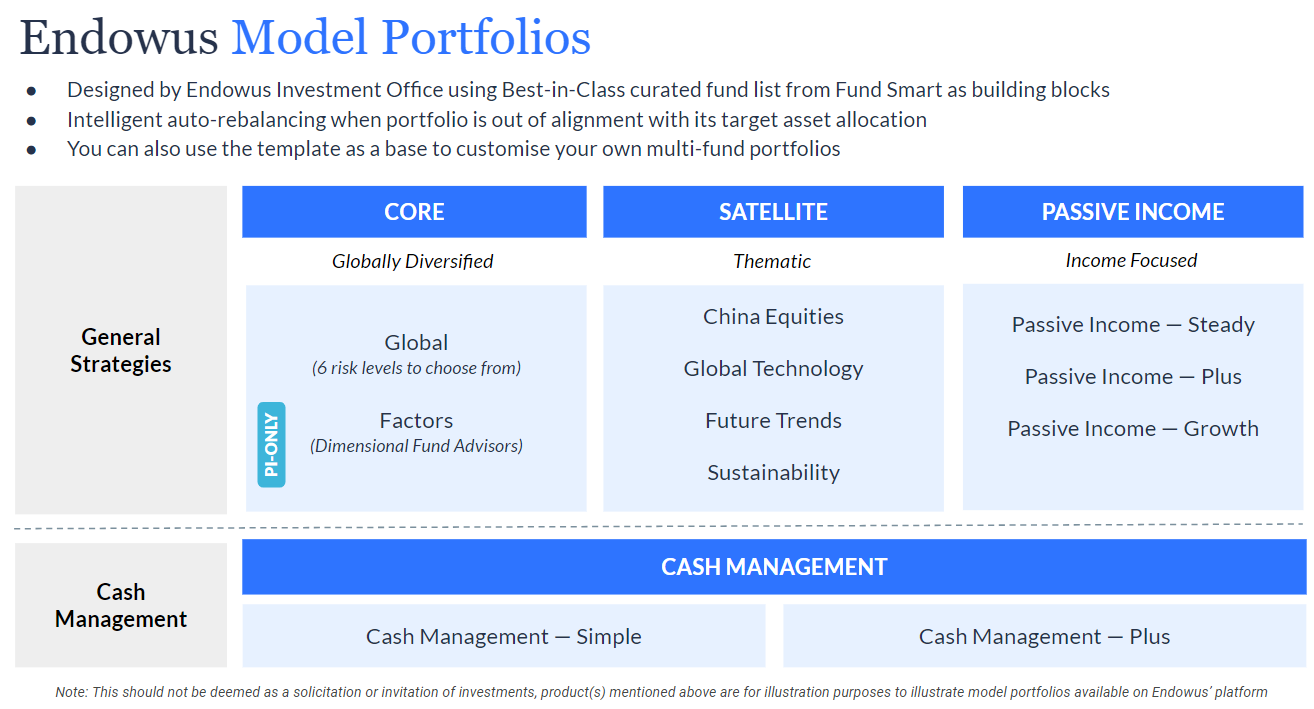

- Endowus model portfolios to get you going: Endowus has curated and optimised model portfolios using our Best-In-Class Funds as building blocks for various investor needs from short-term cash management, core global portfolios, income portfolios to satellite portfolios for sectors, geographies and themes. We also have factor-based portfolios from Dimensional and alternative multi-strategy hedge fund-of-funds portfolios for professional investors through Endowus Private Wealth.

- Easier way to implement a Core-Satellite investment strategy: We offer pre-built and optimised Core portfolios that are diversified, well-balanced, efficient and low cost, such as the Global model portfolio for your core equities and fixed income allocation. You can also select a Satellite model portfolio to complement your core goals and express your tactical views.

- Built with Best-In-Class building blocks from top fund managers: Too much choice can be a bad thing and having thousands of funds to choose from is a daunting task for individual investors. The Endowus Investment Office sifts through thousands of funds globally from the best fund managers through a rigorous, institutional grade, quantitative and qualitative screening process called SMART+ to select only 150 to 200 Best-In-Class Funds that are category leaders.

- Independent, conflict-free advisor, offering products at the lowest achievable costs to our clients: We are bringing global best practices to fund distribution in Hong Kong. We offer transparent, low and fair costs for funds we have selected. Endowus works with the largest global and local fund managers to gain access to institutional or clean share classes with zero sales charges. We introduced an industry-first 100% Cashback on trailer fees back to investors. This means we are not conflicted and are only paid by our clients to recommend Best-In-Class and most suitable solutions to them.

- Keen to get going? Get started with Endowus HK here.

We are excited to introduce Endowus model portfolios on the Fund Smart platform in Hong Kong. You can tap into the expertise of the Endowus Investment Office who have created a suite of model portfolios that are optimised and handcrafted for your investment needs.

For those who want to set up your own core-satellite investing strategy with diversified, multi-fund portfolios, you can consider the Endowus Global model portfolios for your core equities and fixed income allocation, which offer broad, global diversified exposures. We offer six portfolio choices across the risk spectrum for clients to blend these two asset classes into a 60/40 or 80/20 portfolio, for example. For clients with specific preferences or views on certain long-term trends and sectors, you can pick any of the Satellite portfolios to complement your core goals.

We also have a selection of Passive Income and short-term Cash Management model portfolios to cater to your specific needs for passive income generating dividend/yield income portfolios or short-term cash liquidity management choices.

1. Endowus Global model portfolios for your core investments

In taking a core-satellite approach, most investors should allocate the bulk of their asset allocation to the core portfolios. Investors would therefore typically begin their journey with the Endowus Global model portfolios. The core portion of your portfolio serves as the anchor to the long-term growth of wealth in a passive, diversified, and low-cost way.

The Endowus Global model portfolios are designed to give investors broad diversified exposure to global markets for your long-term, general wealth accumulation needs.

The overall portfolio is diversified in terms of sector allocation, geographical breakdown, and market capitalisation. You can start from one of six risk levels, which vary in their allocations to equities and fixed income, and customise it to suit your personal needs. It is also called a target risk portfolio, as the asset allocation determines the appropriate risk and this asset allocation should determine the level of long term returns that investors should target.

Read more: Introducing Global model portfolios: a core investment for everyone

2. Passive Income model portfolios for income investors

We have three Passive Income model portfolios created with different client demographics in mind. These portfolios are designed to meet your real-world needs for different types of passive income. Whether you prefer stable payouts, higher payouts, or higher capital appreciation, we balance higher-yielding assets and higher-quality assets to meet your unique income and wealth accumulation needs. The asset allocation and yield target is what drives the design and optimisation of the portfolio to make it more suitable to your personal needs.

Read more: Introducing Passive Income model portfolios: earn payouts effortlessly

3. Cash Management portfolios for short-term liquidity management

The Endowus Cash Management model portfolios consist mainly of cash funds, money market funds (MMFs) and/or short-duration fixed-income funds (unit trusts). They are designed to have relatively lower risk with exposure to more stable returns as compared to other fixed-income portfolios of longer durations and maturities. Nevertheless, there are risks in investing in these portfolios, and they are not capital-guaranteed.

The Cash Management model portfolios offer high liquidity and no lockups, and therefore provide flexibility for individuals, corporates or institutions to manage their short term liquidity, cash, treasury across different risk and return profiles. Compared to bank fixed deposits, money market funds are not subject to asset liability mismatching risks, which is a hot topic these days with the bank failures in the US. You can withdraw your investments at the daily NAV of these money market funds with no asset liability mismatching.

The return potential of each Cash Management model portfolio is positively correlated to the risk profile of the underlying investments. Cash Management Plus takes more duration and credit risk in exchange for higher return potential. Cash Management Simple is the lower-risk portfolio, targeting to preserve capital with good yield. All of them again, with no lock up and daily liquidity.

Read more: Introducing Cash Management model portfolios: earn more on your cash with no lockups

4. Thematic portfolios as your satellite investments

After allocating the bulk or all of their asset allocation to core portfolios, some investors may then look at the satellite portfolios as an option to diversify further or focus on certain geographies, sectors, themes or factors you want additional exposure to.

While not everyone would need or want to have a satellite allocation, at Endowus we understand everyone has different circumstances or preferences. The Endowus Satellite model portfolios are designed for those who would like to supplement their core portfolios and offer specific exposure to opportunities in selected regions, themes, asset classes, factors and trends.

We have launched an initial list of four most popular themes — Sustainability - Equities, Global Technology, China Equities, and Future Trends. These are model portfolios curated to give clients an institutional-grade, professional and diversified portfolio for each satellite category.

Endowus Investment Office will continue to curate other model portfolios that are popular requests from our clients in Hong Kong.

Read more about the satellite model portfolios:

- Introducing the Future Trends model portfolio: invest in the biggest forces of change

- Introducing the Global Technology model portfolio: ride the wave of tech innovation

- Introducing the China Equities model portfolio: capture Greater China’s high growth potential

.png)

DIY your own multi-fund portfolios

The Endowus core model portfolios — such as Global, Passive Income, and Cash Management — are designed to serve our clients’ main investment goals, ranging from short-term to long-term goals, and varying in risk appetite. You can use them for general investing or for long-term goals such as retirement preparation. These portfolios are carefully built and maintained by the Endowus Investment Office, and can be suitable for novice and expert investors alike.

That being said, we recognise that everyone is different and with varying personal needs, personal circumstances, different goals, and investment views that may require different levels of customisation. So we have also given investors the option to use the ready-made Endowus model portfolios as a base; you can easily tweak the portfolio allocations to suit your personal risk appetite, preference, and goals.

Alternatively, on the Fund Smart platform, you can build your own do-it-yourself (DIY) portfolios from scratch, through Endowus’ proprietary portfolio creation tool. This institutional-grade portfolio building tool allows you to select up to eight funds to build your personalised portfolios using the Best-In-Class single funds curated by our Investment Office as building blocks.

Once you select the funds and weights, immediately you are able to see detailed analytics of the overall portfolio and not the underlying single funds only. This includes data such as long term historical performance, analytics such as best and worst returns and average returns, country, sector, asset class breakdowns and detailed breakdown of cost at the portfolio level. This should allow individuals full flexibility, transparency, and analytics to make informed decisions in creating the personalised portfolio for each investor.

Single funds as an option on the Endowus Fund Smart platform

Other than choosing the Endowus model portfolios or DIY portfolios, you can also choose to directly invest into Best-In-Class single underlying funds from all the major global and local fund managers, curated by our experts at the Endowus Investment Office through the proprietary SMART+ fund manager due diligence and fund selection process.

This is all done at the lowest cost achievable with zero upfront subscription fees, no sales commissions (also known as trailer fees) on the institutional or clean share-class of funds, or with 100% Cashback on trailer fees for retail funds with embedded fees/commissions that we return back to our clients. We do not keep a single cent of product commissions, and not being paid or affected by product issuers, which allows us to stay truly independent and to only offer what we view is best and most suitable to our clients and only our clients.

At Endowus, we stand on the shoulders of giants, working with top-rated global and local asset managers who are aligned with our mission and vision. Being conflict free and not being paid by others allows us to be independent and objective in reviewing each fund to see whether they are truly Best-In-Class for each asset class and category leaders. You can view this list of 150 to 200 Best-In-Class Funds on Endowus Fund Smart vua our investment funds list.

%20-%20model%20portfolios%20n%20FS%20(as%20of%205%20May%202023).png)

The Endowus cost advantage

Cost and return are two sides of the same coin. By paying high costs, you are giving up your future returns. Lowering the cost has an immediate substantial and direct boost to your returns. This cost compounds just as returns compound and results in a meaningful difference in returns over a long period of time. That is why Endowus is so focused on reducing the cost of investing at every layer, as much as possible.

At Endowus, we offer you the lowest achievable cost by helping you get access to the cheapest accessible share class of the funds, known as the institutional or clean share-classes without any loaded fees. These were previously only accessible by big institutional investors such as endowment funds, or high-net-worth individuals through private banks. But not anymore — you can now invest in institutional share-class funds, some exclusively on Endowus, starting from just HK$10,000. These institutional and clean share-classes of funds bring your costs down significantly compared to industry average.

In cases where the institutional share-class is not available, you can invest in the retail share-class of the fund while getting 100% Cashback on the trailer fees or commissions that are paid to the distributor of these funds, such as banks, brokers or fund platforms. Endowus does not keep a single cent and returns all of these commission trailer fees back to our clients achieving the same effect as access clean institutional share classes. This removes any conflict of interest as we are not paid by anybody other than our clients. It also helps our Investment Office to not be affected in selecting only the Best-in-Class Funds, maintaining our independence and allowing us to be a trusted advisor to our clients.

This access to the institutional and clean share-classes of funds, combined with the Cashback on trailer fees, has significantly brought down the costs of investing when compared to the industry average. As a result, as of April 2023, Endowus clients have collectively saved over US$15 million in investing costs since 2019.

Here are two examples to illustrate the cost savings by investing via Endowus Fund Smart in Hong Kong as compared with some other popular channels:

Cost saving example: access to institutional share class

Cost saving example: 100% Cashback on trailer fees

Access a curated list of Best-In-Class Funds selected for you on Fund Smart

You can access 150 to 200 Best-In-Class strategies offered by top-rated global and local fund managers via Endowus Fund Smart in Hong Kong. Some of the popular investment options available include cash/money market funds (MMF), fixed income, passive dividend/yield income, Global/China equities, natural resources, and thematics. The table below shows selected funds and themes curated by the Endowus Investment Office from the total list.

How to access the Endowus model portfolios in Hong Kong on Fund Smart

If you are new to Endowus in Hong Kong, you can get started either by opening an account with us here, or by clicking the button below.

Already have an account with Endowus HK? Here are a few simple steps to start using Fund Smart:

- Login to your Endowus account

- Click on “Invest | Redeem”

- Click on “Add Goal”, and then follow the instructions to select the fund or portfolio of your choice, based on your investment horizon and objective.

<medium-btn-link>GET STARTED WITH ENDOWUS<medium-btn-link>

Read more:

- Introducing Fund Smart — access top-rated funds and curated model portfolios in Hong Kong

- Why invest through Endowus

- Introducing the Endowus HK team

- Choosing Endowus when investing in Hong Kong

<divider><divider>

Risk Warnings

Investment involves risk. Past performance is not an indicator nor a guarantee of future performance or returns. Projected performance or returns is not guaranteed to materialise. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Rates of exchange may cause the value of investments to go up or down. Individual stock performance does not represent the return of a fund.

General risk warnings relating to collective investment schemes

Before making an investment decision, you are reminded to refer to the relevant prospectus/ offering document for specific risk considerations and related fees and charges. Funds are not a bank deposit and not capital guaranteed, and is subject to investment risks, including the possible loss of the principal amount invested. Some of the funds also involve derivatives. Do not invest in them unless you fully understand and are willing to assume the risks associated with them.

Opinions

Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endowus HK Limited (“Endowus”) and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus HK Limited, its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. You may also wish to seek financial advice through a financial advisor or the Endowus platform and independent legal, accounting, regulatory or tax advice, as appropriate.

No invitation or solicitation

Nothing contained in this article should be construed as a solicitation, an offer to buy or sale, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction in any jurisdiction in which such solicitation, offer to buy or sale would be unlawful under the securities laws in such jurisdiction. No information included in this article is to be construed as investment advice or as a recommendation or a representation about the suitability or appropriateness of any advisory product or service; or an offer to buy or sell, or the solicitation of an offer to buy or sell, any security, financial product, or instrument; or to participate in any particular trading strategy. Investors should seek independent financial and tax advice before making any investment decision.

Product Risk Rating: Please note that any product risk rating (the “PRR”) provided by us is an internal rating assigned based on our product risk assessment model, and is for your reference only. The PRR is subject to change from time to time. The PRR does not take into account your individual circumstances, objectives or needs and should not be regarded as advice or recommendation to purchase, hold or sell any fund or make any other investment decisions. Accordingly, you should not solely rely on the PRR in making your investment decision in the relevant Fund.

This advertisement has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

.png)