"Don’t look for the needle in the haystack. Just buy the haystack!"

— Jack Bogle, founder of Vanguard

You may have heard friends talking about buying a fund that tracks the S&P 500 index. But what does investing through this US index mean for an investor? Here’s a simple way to learn about the S&P 500, and whether buying exposure to this index is suitable for you.

What is the S&P 500 index?

Apple, Amazon, Google — these are famous American brands that we as consumers are all too familiar with. But as investors, our aspiration goes beyond being their customers. We want to participate and profit off their growth as leaders in their industries.

A country’s stock markets allow us to become an owner of the profits and future growth of various businesses in each respective country.

These businesses can be owned by the public, because they permit fractions of their business — known as a share — to be bought and sold through a marketplace by being listed. In this marketplace, the prices of each share of these businesses are determined by how actively traded these shares are, and the daily demand and supply for these shares.

Now the problem is, it’s tough on the pocket for most retail investors to buy the shares of all listed companies in a country. There are thousands of companies listed on two major US stock exchanges, NYSE and Nasdaq, alone.

Then came a sampling benchmark to show how well a country’s top listed businesses are collectively performing, based on their share prices. One such index is the S&P 500 — it is built by combining the representative stock performance of the top 500 companies in the US. (S&P is short for the index constructor Standard and Poor’s.)

The S&P 500 index represents some US$40 trillion in market value of these 500 top firms.

These are usually large, stable companies that are leaders in their industries, and have shares that are actively traded. They include well-known names such as Apple, Amazon, Alphabet (Google), Microsoft, and Tesla. The larger and more actively traded these companies are, the higher their represented portions would be in this market sample.

This scientific process of figuring how much a company’s share price should be reflected in a benchmark like the S&P 500 index is known as weighting; the weighting of the index, which has officially been around since 1957, is regularly reviewed so as to make sure that the S&P 500 index stays representative of the large companies listed in the US stock markets.

So by buying a fund that tracks the S&P 500 index, you are buying units of the index to be invested in a representative benchmark of big American brands — with these US corporate giants trading at a combined US$40-trillion valuation. Without this sample or benchmark, investors would have to buy the shares of hundreds of companies to get the same exposure — such trades would cost too much for the average individual investor.

The first S&P 500 fund was first available to individual investors in 1976 through fund house titan Vanguard. Jack Bogle, the founder of Vanguard, pioneered index investing using research showing that actively picking stocks does not consistently beat the market. It is better to just invest in the broad markets.

How does investing in the S&P 500 index work?

The easiest way for a retail investor to “buy the index” would be through an S&P 500 exchange-traded fund (ETF) or unit trust. The fund manager takes investors’ money to buy and own the underlying stocks, such as Apple and Google, so as to mimic the index performance. Fund managers are institutional investors and have access to faster trading systems and much cheaper trading fees that retail investors do not, so they are able to buy these individual stocks efficiently.

Investors earn not just the capital gains — that is, the returns from higher share prices — but also from receiving dividends that these companies offer to their shareholders. Depending on how the fund is structured, the dividends earned can either be distributed to investors, or reinvested into the markets on behalf of investors.

Investing in the US from Singapore

Investing in S&P 500 ETFs or unit trusts comes with various fees and cost considerations. Let’s break them down.

Investing in S&P 500 with cash

There are options of investing in the S&P 500 with cash that include US-listed ETFs such as VOO, IVV and SPY. Their main draws are high liquidity, and low fees. Many low-cost brokerages also offer zero commissions for trades into the US markets.

But foreign investors investing in US-listed securities — such as US-listed ETFs — have to watch for estate taxes. Once your investment holdings exceed US$60,000, you will be charged up to 40% on most of your holdings.

To add, as a Singapore or Hong Kong-based investor with no US tax treaty, there is a dividend withholding tax of 30% levied at the fund-level for US-listed ETFs.

On the other hand, investing in a SGD-denominated unit trust does not incur estate tax liability, does not require currency conversion, and can automatically reinvest the dividends from the underlying stocks into the unit trust. With some of these funds, the headline fee may appear to be higher, but Endowus rebates distributor commissions known as trailer fees to our clients, so that brings our fee down. More importantly, it does not include the other forex and estate tax-related costs associated with investing in US-listed ETFs that may not be so obvious at first glance.

A low-cost SGD-denominated unit trust that tracks the S&P 500 index is part of the popular iShares range by BlackRock. The BlackRock iShares US Index Fund has a fund-level fee of only 0.08% — offering a cost-effective way to invest in top US stocks. The synthetic replication of this fund also means that it does not pay any US withholding tax, and is more efficient than UCITS ETFs in investing in the S&P 500 index. The iShares US Index Fund has been available on the Endowus Fund Smart platform since 2022.

Other options for investing in the index with cash include UCITs ETFs such as CSPX or VUAA. Domiciled in Ireland, these funds are not subjected to estate taxes, and reinvest dividends directly. However, they still have dividend-withholding taxes of 15%, reflecting the relatively favourable tax treaty between the US and Ireland.

Read more: Introducing BlackRock's lowest-cost iShares passive index funds for retail investors in Singapore

A lower-cost alternative that tracks a US stock index

A little-known fact is that the S&P 500 is not the only index that can give you efficient exposure to major US equities. There are actually much lower-cost alternatives if you're open to considering other indices.

For example, the Solactive US Large & Mid Cap Index spans the biggest 530 companies in the US, and closely tracks the performance of both the S&P 500 index and the MSCI USA Index. Since 2007, the correlation of returns between the Solactive index and the other two indices has been at 0.999, which indicates an almost perfect positive correlation. This means that the returns of all three indices move together by almost the exact same percentage and direction.

The Amundi Prime USA Fund is an SGD-denominated unit trust that tracks this Solactive index, with a fund-level fee or total expense ratio of just 0.05%. You can invest in it using cash, CPF, or SRS. It has been exclusively made available first to Endowus for CPF investing.

With its 0.05% total expense ratio, this is the most affordable fund available in Singapore and on the CPF Investment Scheme. It is cheaper than SGX-listed ETFs and most UCITS ETFs. The Amundi Prime USA Fund's performance has very closely tracked the three aforementioned indices — the S&P 500, the Solactive US Large & Mid Cap Index, and the MSCI USA Index — with a correlation of about 0.98.

Correlation between Amundi Prime USA Fund and main US indices

High correlation with major US equity market indices

Investing in S&P 500 with CPF

As of 29 March 2022, Endowus is the first and only digital advisor that allows investors to invest in the S&P 500 using their CPF savings. You can invest your CPF Ordinary Account (OA) money in unit trusts such as the LionGlobal Infinity US S&P 500 Stock Index Fund.

The BlackRock iShares US Index Fund is not available for CPF investments, as of March 2023.

Investing in S&P 500 with SRS

There are currently very limited investment options if you wish to use your Supplementary Retirement Scheme (SRS) savings to invest in the S&P 500.

A low-cost unit trust you may wish to consider for SRS investments is the iShares US Index Fund by BlackRock. It is denominated in SGD, and is also available for investments using cash. As mentioned above, the iShares fund does not pay any US withholding tax due to its synthetic structure, making it more efficient than UCITS ETFs and other passive index funds.

There is also an S&P 500 ETF listed on SGX. As this ETF is domiciled in the US and denominated in USD, it will have a similar investing cost as that of US ETFs.

Invest in index funds easily through Fund Smart

A simple way to invest your cash, CPF, or SRS in index funds is through Endowus Fund Smart platform — you can buy a single fund or customise your ideal portfolio with multiple funds in just a few minutes.

When you invest in a single fund, you will pay an all-in Endowus Fee of 0.3% per annum to Endowus, as well as the fund-level fee to the fund manager, after any Cashback on trailer fees. Find out more about our transparent pricing here.

Final checklist

The S&P 500 has performed well historically, with an annualised return of 9.49% between January 2003 to February 2022.

That said, an S&P 500 fund is fully invested in equities, and is only exposed to the top 500 US companies. How an index is reconstituted to take in new entrants can sometimes penalise passive index funds, as the Tesla case study showed.

To add, an investor needs to be comfortable with tolerating market volatility, including large fluctuations in a short time. Data showed that the worst historical 12-month return in recent history (from January 2003 to February 2022) is -37.1%. This assumed a starting investment in March 2008, during the Global Financial Crisis.

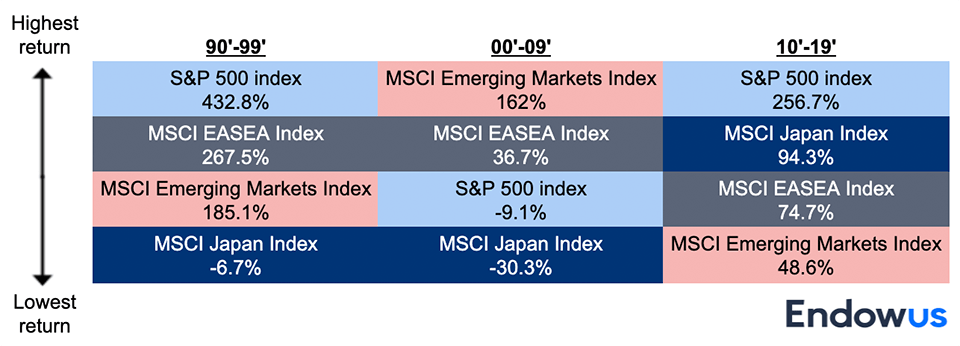

S&P 500 may also underperform more global portfolios over certain periods. Between 2000 and 2009, the S&P 500 total return is only -9.1%, compared to the MSCI EAFE ex Japan index of 36.7%.

Investors with a lower risk appetite and shorter term investment objective will need to look at a more risk-appropriate portfolio.

Investors can also consider investing in index funds that have a mandate to replicate all the developed markets or even the MSCI All Country World Index. Endowus uses Dimensional funds to construct our core Flagship Portfolios, giving our clients exposure to more than 10,000 companies.

Explore the Endowus Fin.Lit Academy for more tips on investing and personal finance.

<divider><divider>

Investment involves risk. Past performance is not necessarily a guide to future performance or returns. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Rates of exchange may cause the value of investments to go up or down. Individual stock performance does not represent the return of a fund.

Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endowus Singapore Pte. Ltd. (“Endowus”) and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus, its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider (i) whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. You may also wish to seek financial advice through a financial advisor or the Endowus platform and independent legal, accounting, regulatory or tax advice, as appropriate.

Investment into collective investment schemes: Please refer to respective funds’ prospectuses for details of the funds, their related fees, charges and risk factors. The listing of units of the fund on a stock exchange does not guarantee a liquid market for the units. Before making an investment decision, you are reminded to refer to the relevant prospectus for specific risk considerations.

For Cash Smart Secure, Cash Smart Enhanced, Cash Smart Ultra: It is not a bank deposit and not capital guaranteed, and is subject to investment risks, including the possible loss of the principal amount invested. Investment products are not insured products under the provisions of the Deposit Insurance and Policy Owners Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme. Interest rates are indicative and subject to change at any time.

Product Risk Rating: Please note that any product risk rating (the “PRR”) provided by us is an internal rating assigned based on our product risk assessment model, and is for your reference only. The PRR is subject to change from time to time. The PRR does not take into account your individual circumstances, objectives or needs and should not be regarded as advice or recommendation to purchase, hold or sell any fund or make any other investment decisions. Accordingly, you should not solely rely on the PRR in making your investment decision in the relevant Fund.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

.jpg)

%20(1).gif)