We’re excited to begin our partnership with Ninety One to introduce an All China Bond Fund and a Global Environment Fund. We’ve also worked with PIMCO to launch an SGD share class for the PIMCO StocksPLUS Fund, which has been available in USD since February. Here are three new funds added in June.

China

Ninety One GSF All China Bond Fund

ISIN: LU2469424472 (SGD), LU1057755800 (USD)

The fund provides a good exposure into the Chinese bond market, allocating primarily into government-issued onshore bonds (which are relatively rare in the SGD retail space), complemented with opportunistic exposure to offshore and USD-denominated bonds to enhance returns. It is managed by a duo of experienced PMs, supported by Ninety One’s China rates & credit team. Endowus has worked with Ninety One to launch the lowest cost SGD share class for Singapore retail investors.

<medium-btn-link>Find out more<medium-btn-link>

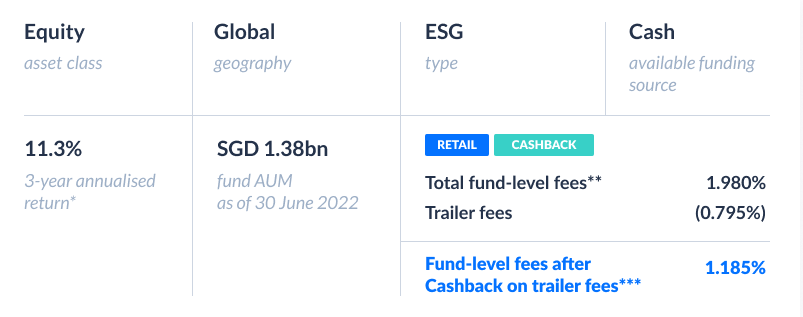

ESG

Ninety One GSF Global Environment Fund

ISIN: LU2257466305 (SGD), LU2420245750 (USD)

The fund invests purely in companies that benefit from sustainable decarbonisation, offering investors a differentiated portfolio with little overlap to other equity funds that are more traditional in scope. Companies are assessed through a stringent screening process to qualify for the “sustainable decarbonisation” theme. The strategy is led by two PMs with experience investing in the renewable energy and natural resources sectors.

<medium-btn-link>Find out more<medium-btn-link>

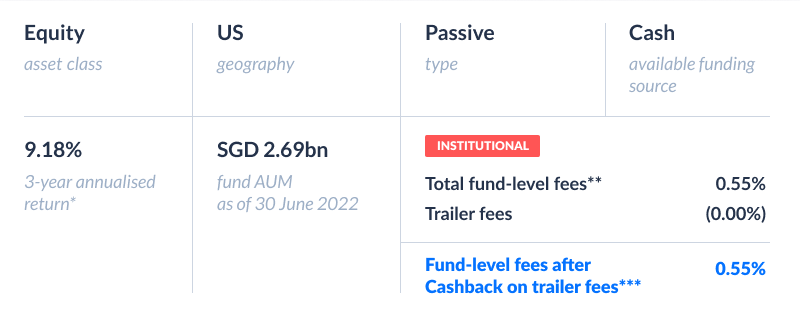

US

PIMCO GIS StocksPLUS Fund

ISIN: IE000PPSY6G6 (SGD), IE0002459539 (USD)

After onboarding the USD version of the fund in February, we have worked with PIMCO to launch the SGD share class for retail investors in Singapore as well. Using a time-tested strategy established in 1986, the fund seeks to track the S&P 500 Index, while generating additional alpha from an active bond strategy, to achieve a meaningful outperformance of the S&P 500 in the long term.

<medium-btn-link>Find out more<medium-btn-link>

<divider><divider>

Investment involves risk. Past performance is not necessarily a guide to future performance or returns. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Rates of exchange may cause the value of investments to go up or down. Individual stock performance does not represent the return of a fund.

Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endow.us Pte. Ltd (“Endowus”) and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus Pte. Ltd., its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider (i) whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. You may also wish to seek financial advice through a financial advisor or the Endowus platform and independent legal, accounting, regulatory or tax advice, as appropriate.

Investment into collective investment schemes: Please refer to respective funds’ prospectuses for details of the funds, their related fees, charges and risk factors, The listing of units of the fund on a stock exchange does not guarantee a liquid market for the units. Before making an investment decision, you are reminded to refer to the relevant prospectus for specific risk considerations.

For Cash Smart Secure, Cash Smart Enhanced, Cash Smart Ultra: It is not a bank deposit and not capital guaranteed, and is subject to investment risks, including the possible loss of the principal amount invested. Investment products are not insured products under the provisions of the Deposit Insurance and Policy Owners Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme. Interest rates are indicative and subject to change at any time.

Product Risk Rating: Please note that any product risk rating (the “PRR”) provided by us is an internal rating assigned based on our product risk assessment model, and is for your reference only. The PRR is subject to change from time to time. The PRR does not take into account your individual circumstances, objectives or needs and should not be regarded as advice or recommendation to purchase, hold or sell any fund or make any other investment decisions. Accordingly, you should not solely rely on the PRR in making your investment decision in the relevant Fund.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

%20(1x).webp)

%20(1).gif)