37% of your monthly salary goes into your CPF. Are the 2.5% returns from CPF sufficient for retirement? How should you leverage your CPF money to better plan for retirement?

Sin Ting, our Chief Client Officer, and Sheng Shi, our Personal Finance Lead will share:

- An introduction to the world of CPF

- Why "Pay Yourself First"?

- What we can do with CPF

- Strategies to maximising your CPF

- CPF priorities by age group

0:00 Intro

6:19 How much do we contribute into CPF

9:08 "Pay yourself first" concept in budgeting

10:52 How CPF make us "pay ourselves first"

12:00 Why we associate CPF with housing strongly

14:50 Different type of CPF accounts, and what we can do with CPF

17:04 Question from viewer - OA to SA transfer better, or to invest?

19:48 Different in OA monies with investing, transferring to SA, and not doing anything

21:55 Maximising your CPF

24:28 What can I invest my CPF in?

31:05 CPF priorities for the young

32:50 CPF priorities for the mid career

36:08 CPF priorities for the cruisers (retirement)

39:27 QnA

Excerpts from the Webinar

How much do we contribute into CPF (6:19)

Sin Ting: (If you are below 55) Every month you contribute about 20% of your paycheck to CPF and your employer contributes 17%. To dive deeper into the statistics, the median salary in Singapore is $4,500, this means that an average person's take-home salary is $3,600 per month and therefore he/she contributes $19,980 to CPF per year. This would mean that most of us will be CPF millionaires by the time we can withdraw money at 55.

To give another example, let's say that you started off working at the age of 25 with a starting salary of $3000 at 4% growth per year and two months of bonus, this means you will end up contributing approximately $800,000 in your CPF by the age of 55. Despite this, many Singaporeans still have major financial issues. A survey done by OCBC in 2019 revealed that 65% of Singaporeans thought they were not accumulating enough funds to maintain their lifestyle after retirement.

Sheng Shi: Another issue Singaporeans face with their CPF monies is that we tend to neglect it even though it is a big part of our net worth. One reason why we neglect our CPF monies is that we are conditioned to do so. When you receive your paycheck, the CPF amount is already deducted. This means that we only ever see our net pay not the full gross pay, leading us to think that the amount deducted for CPF is not really our money.

Different types of CPF accounts, and what we can do with CPF (14:50)

Sheng Shi: There are three different buckets of CPF monies: Ordinary Account (which acts like a high yield savings account), Medisave Account (which acts as a medical emergency fund and medical insurance) and Special Account (which is a locked-in retirement savings plan).

Sin Ting: There are several things you can use your CPF in the meantime before you reach the age of 55. Firstly, you can use it to pay for housing, however, it is important to note that there is a trade-off when you use your CPF monies to pay for housing. When you sell your house and return the CPF monies you used, you'll have to pay the accrued interest as well. Secondly, you can pay your insurance premiums on your Dependant's Protection Scheme and Home Protection Scheme (HPS). Thirdly, you can spend it on education for a tertiary education for yourself or your family.

The fourth and fifth options are great for maximising and growing your CPF. You can transfer your OA funds to your SA and get a higher guaranteed interest rate, however, these transfers are irreversible. We advise to have a clear idea on whether or not you are looking to use your OA funds to pay for housing or education before you make any transfers to your SA.

Question from viewer - OA to SA transfer better, or to invest? (17:04)

Sheng Shi: This would depend on your life stage and your risk appetite. How I see it is that your CPF SA fund is a locked-in retirement savings plan and would equate it to buying an endowment plan with a financial advisor. The funds in your SA are locked-in, meaning that it acts more like a forced savings plan rather than an investment therefore, any funds you want to transfer from your OA to your SA are immovable till you are 55. This is very different to investing because you will always have the option to liquidate your investment to use it for other purposes.

So if you are someone who tends to be more of an emotional investor or who tends to trade in and out, I would recommend choosing to go with the savings plan. However, if you are a seasoned investor and you are comfortable with investing in the long term it would be a better option to invest your CPF OA money. That is not to say you can't do both. If you have already reached the max transfer amount (your full retirement sum), you can look to investing your CPF OA money. At the end of the day, it all depends on your own risk appetite and the outcome you are looking for.

What can I invest my CPF in? (24:28)

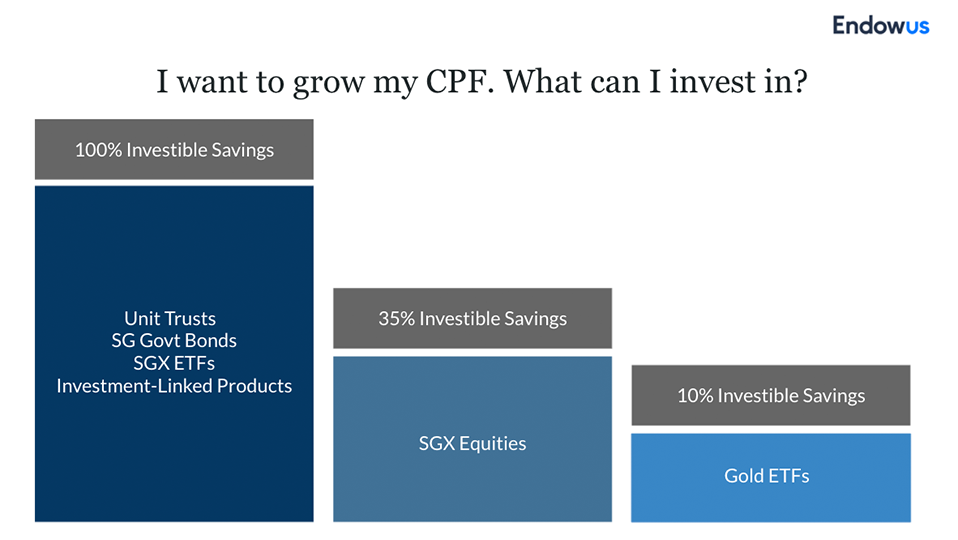

Sin Ting: So before you can start to invest your CPF, you have to set aside $20,000 in your CPF OA. The remaining amount can be categorized into your investable savings, which you can invest 100% of it into unit trusts, SG government bonds, SGX ETFs, and investment-linked products. Further, you can invest up to 35% of these savings into Singapore listed equities and up to 10% of these savings into Gold ETFs.

Start investing your CPF with Endowus here.

<divider><divider>

Investment involves risk. Past performance is not necessarily a guide to future performance or returns. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Rates of exchange may cause the value of investments to go up or down. Individual stock performance does not represent the return of a fund.

Any forward-looking statements, prediction, projection or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to market influences and contingent upon matters outside the control of Endow.us Pte. Ltd (“Endowus”) and therefore may not be realised in the future. Further, any opinion or estimate is made on a general basis and subject to change without notice. In presenting the information above, none of Endowus Pte. Ltd., its affiliates, directors, employees, representatives or agents have given any consideration to, nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Therefore, no representation is made as to the completeness and adequacy of the information to make an informed decision. You should carefully consider (i) whether any investment views and products/ services are appropriate in view of your investment experience, objectives, financial resources and relevant circumstances. You may also wish to seek financial advice through a financial advisor or the Endowus platform and independent legal, accounting, regulatory or tax advice, as appropriate.

Investment into collective investment schemes: Please refer to respective funds’ prospectuses for details of the funds, their related fees, charges and risk factors, The listing of units of the fund on a stock exchange does not guarantee a liquid market for the units. Before making an investment decision, you are reminded to refer to the relevant prospectus for specific risk considerations.

For Cash Smart Secure, Cash Smart Enhanced, Cash Smart Ultra: It is not a bank deposit and not capital guaranteed, and is subject to investment risks, including the possible loss of the principal amount invested. Investment products are not insured products under the provisions of the Deposit Insurance and Policy Owners Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme. Interest rates are indicative and subject to change at any time.

Product Risk Rating: Please note that any product risk rating (the “PRR”) provided by us is an internal rating assigned based on our product risk assessment model, and is for your reference only. The PRR is subject to change from time to time. The PRR does not take into account your individual circumstances, objectives or needs and should not be regarded as advice or recommendation to purchase, hold or sell any fund or make any other investment decisions. Accordingly, you should not solely rely on the PRR in making your investment decision in the relevant Fund.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

.jpg)

%20(1).gif)