Manulife Investment Management's thoughts:

Bonds are now an attractive asset class offering stable income and the potential for capital appreciation over the medium to longer term. As interest rates are approaching their peak, income-oriented investments could be the key to earning higher returns, especially with inflation remaining elevated. Fixed-income investments have been shown to deliver higher long-term total returns than cash, potentially outstripping inflation.

This article was syndicated by Endowus in partnership with Manulife Investment Management.

Fixed deposits vs fixed income — which is better?

Fixed-income investments may look set for a comeback. In Singapore, the central bank kept its nominal effective exchange rate (S$NEER) policy band unchanged at its April 2023 meeting, while fixed deposit rates at retail banks have also started to trend lower.

The US Federal Reserve (Fed) appears to be nearing the end of its interest rate hiking cycle; we expect the Fed to begin cutting interest rates in 2024, although we think it will be less inclined to ease relative to past cycles, particularly over the next six to 12 months.

When is a good time to consider bonds?

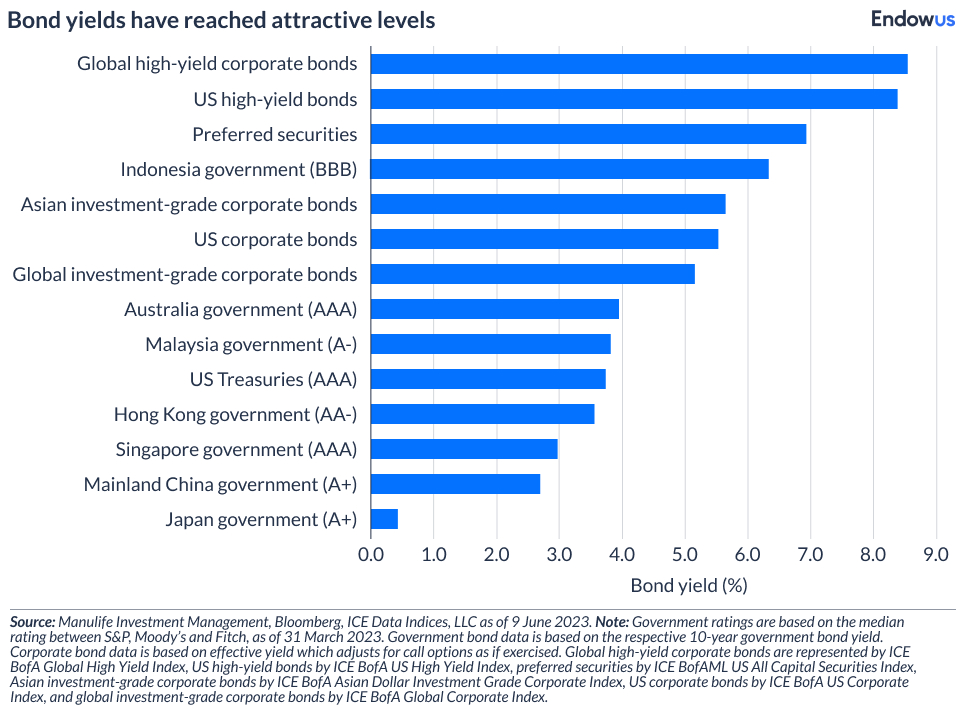

Over the past few years, the sharp repricing in yields has made bonds an attractive asset class that offers a stable income and the potential for capital appreciation over the medium to longer term. As interest rates are approaching their peak, income-oriented investments could be the key to earning higher returns, especially with inflation remaining elevated.

What types of fixed-income funds can help beat inflation and volatility?

If you are looking for regular payouts and to maximise your returns, Manulife Investment Management has a suite of income funds that can potentially meet both these objectives, including (i) the Manulife SGD Income Fund and (ii) the Manulife Global Fund – Preferred Securities Income Fund.

Manulife SGD Income Fund:

Singapore is one of nine countries globally that is rated “AAA” by all three external credit rating agencies (Standard & Poor's, Moody's, and Fitch) and the only “AAA” in Asia. Thanks to a stable monetary policy, the Singapore dollar (SGD) is currently on an appreciating bias, making SGD-denominated assets more attractive.

The Manulife SGD Income Fund aims to deliver regular income in SGD, and a potential for capital appreciation. The Fund aims to distribute income every quarter with a target payout of up to 4.5% per annum and has an average quality of investment grade (at least 70% of its portfolio in Asian investment-grade bonds) for stability, while up to 30% may be invested in high-yield bonds for better yields and growth opportunities.

It has an average duration of 4.42 years to manage interest rate fluctuations and not a single default in the portfolio since inception. The fund can also invest in other Asian corporates, sovereigns, and quasi sovereign bonds — providing access to diverse and deeper credit markets (179 underlying holdings in the Fund) while only needing a minimum investment of S$1,000.

Manulife Global Fund – Preferred Securities Income Fund:

Preferred securities have attributes of both fixed income and equity. They typically offer higher yields than bonds from the same issuer, but preferred investors have priority claims to dividend payments and company assets in a liquidation over common shareholders.

The Manulife Global Fund – Preferred Securities Income Fund targets income investors with a medium to high-risk tolerance who are looking for attractive yields. Over two-thirds of the fund’s holdings are in investment-grade bonds (2.85% “A” rated, 68.81% “BBB” rated). The average coupon of the fund is 6.68% and its yield to maturity is 8.32%, a level higher than that of the preferred securities market in the past 10 years.

While the fund is more diversified than the broad preferred securities market, an overweight in utilities (a regulated sector that generates defensive cash flows during economic uncertainty) helped the fund historically deliver stable income to its investors. The fund has the flexibility to invest in a variety of preferred securities and in response to rising interest rates and inflation, it currently has exposure to institutional preferred securities with floating-rate coupons.

Source: Manulife Investment Management, as of 31 May 2023. The preferred securities market is represented by the ICE BofA US All Capital Securities Index.

What does history tell us?

Fixed-income investments have been shown to deliver higher long-term total returns than cash, potentially outstripping inflation. The earlier you put your money to work, the more time it has to accumulate through the power of compound interest.

Finally, the general rule of thumb is that an investor should consider having fixed-income exposure equal to his or her age. For example, if you are 30 years old, you should have around 30% of your portfolio invested in fixed income and 70% in equities.

<divider><divider>

This article was written by Manulife Investment Management in July 2023.

Manulife Investment Management is the global wealth and asset management segment of Manulife Financial Corporation. It draws on more than 150 years of financial stewardship to partner with clients across its institutional, retail, and retirement businesses globally. Its specialist approach to money management includes the highly differentiated strategies of its fixed-income, specialised equity, multi-asset solutions, and private markets teams — along with access to specialised, unaffiliated asset managers from around the world through its multi-manager model. Its personalised, data-driven approach to retirement is focused on delivering financial wellness in retirement plans of all sizes to help plan participants and members retire with dignity.

Endowus has two funds from Manulife Investment Management (as of 9 July 2023), namely the Manulife SGD Income Fund and the Manulife Global Fund – Preferred Securities Income Fund.

Get started building your own portfolio with these funds on the Endowus Fund Smart platform.

Read more:

.jpg)

%20(1).gif)