70%

of private wealth investors adjust their portfolio at least once a quarter.

2 in 5

private wealth investors plan to increase their allocation to alternatives in the next 12 months.

1 in 3

investors desire greater clarity and a deeper understanding of alternatives.

44%

cite retirement preparedness as a primary goal.

Introduction

Introduction

The Endowus Private Wealth Insights 2025 study brings together the perspectives of Accredited Investors in Singapore and Professional Investors in Hong Kong, offering one of the region’s most comprehensive views into how private wealth is evolving.

This year’s report uncovers how private wealth investors are redefining financial success, shifting from wealth accumulation toward more purpose-driven, multi-dimensional wealth strategies. As access to alternatives accelerates and advisory expectations rise, the 2025 edition highlights the behaviours, motivations, and strategic considerations shaping the future of private wealth in Asia.

This year’s report uncovers how private wealth investors are redefining financial success, shifting from wealth accumulation toward more purpose-driven, multi-dimensional wealth strategies. As access to alternatives accelerates and advisory expectations rise, the 2025 edition highlights the behaviours, motivations, and strategic considerations shaping the future of private wealth in Asia.

Read more

Read less

Methodology: YouGov was commissioned to conduct a survey in Q1 2025, with 227 Accredited and Professional Investors across Singapore and Hong Kong. These individuals meet the qualifying thresholds set by regulators: in Singapore, a minimum of S$1 million in net financial assets or at least S$300,000 of income in the preceding 12 months; in Hong Kong, a portfolio value exceeding HK$8 million.

Key Insights From Singapore Respondents

Nearly 70% of private wealth investors adjust their portfolios at least quarterly, with over a third reviewing them monthly. This level of activity reflects dynamic, hands-on management as investors adapt to shifting priorities, market conditions, and personal goals to stay informed in a complex environment.

Collapse

Private equity, private credit, real assets and other alternatives are moving from the fringes into the core of private wealth portfolios — as investors look for differentiated return streams to support long-term goals, from retirement to intergenerational wealth planning.

Collapse

These concerns include the high risk, long lock-ups, and elevated fees when evaluating alternative investments — signalling the need for more specialised advisory to navigate these complex asset classes.

Collapse

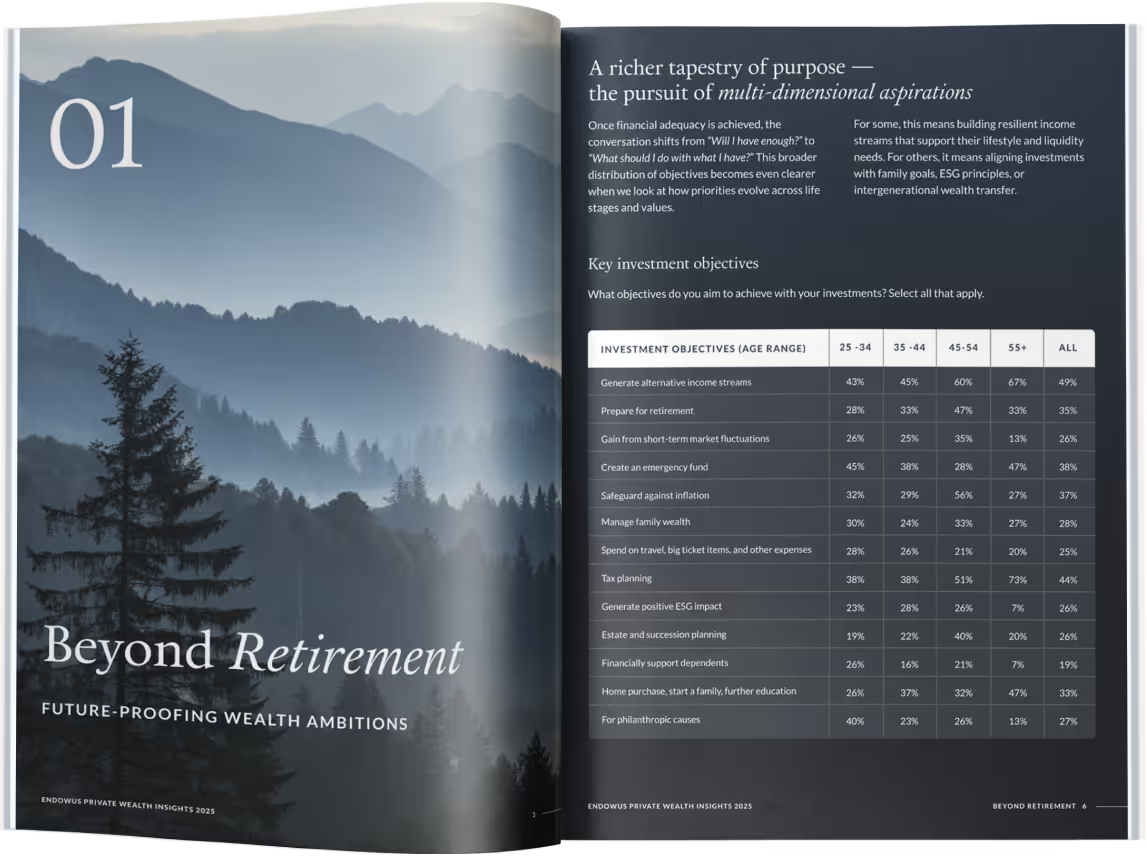

Retirement has shifted from generating resilient income to supporting values-driven objectives and intergenerational wealth transfer. Their definition of “success” is broader, more multi-faceted, and increasingly purpose-led.

Collapse

Tap on our Client Advisors’ wealth of expertise

Benefit from our dedicated wealth advisors' extensive experience in private and public market investing, private wealth management, and family offices.

Schedule an appointment

.webp)