Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- Recent bank interest rates for fixed deposits and corporate accounts have fallen in Singapore, in line with broader market expectations that interest rate cuts could happen in September.

- Corporate treasurers and CFOs should look beyond bank products if they want to generate higher yields on their company's idle cash

- Endowus can help corporate clients work through key factors to consider in prudent cash management, such as flexibility, FX risk, diversification, and safety of assets.

- For details on Endowus Treasury Solutions, please visit this link or contact us at institutional@endowus.com.

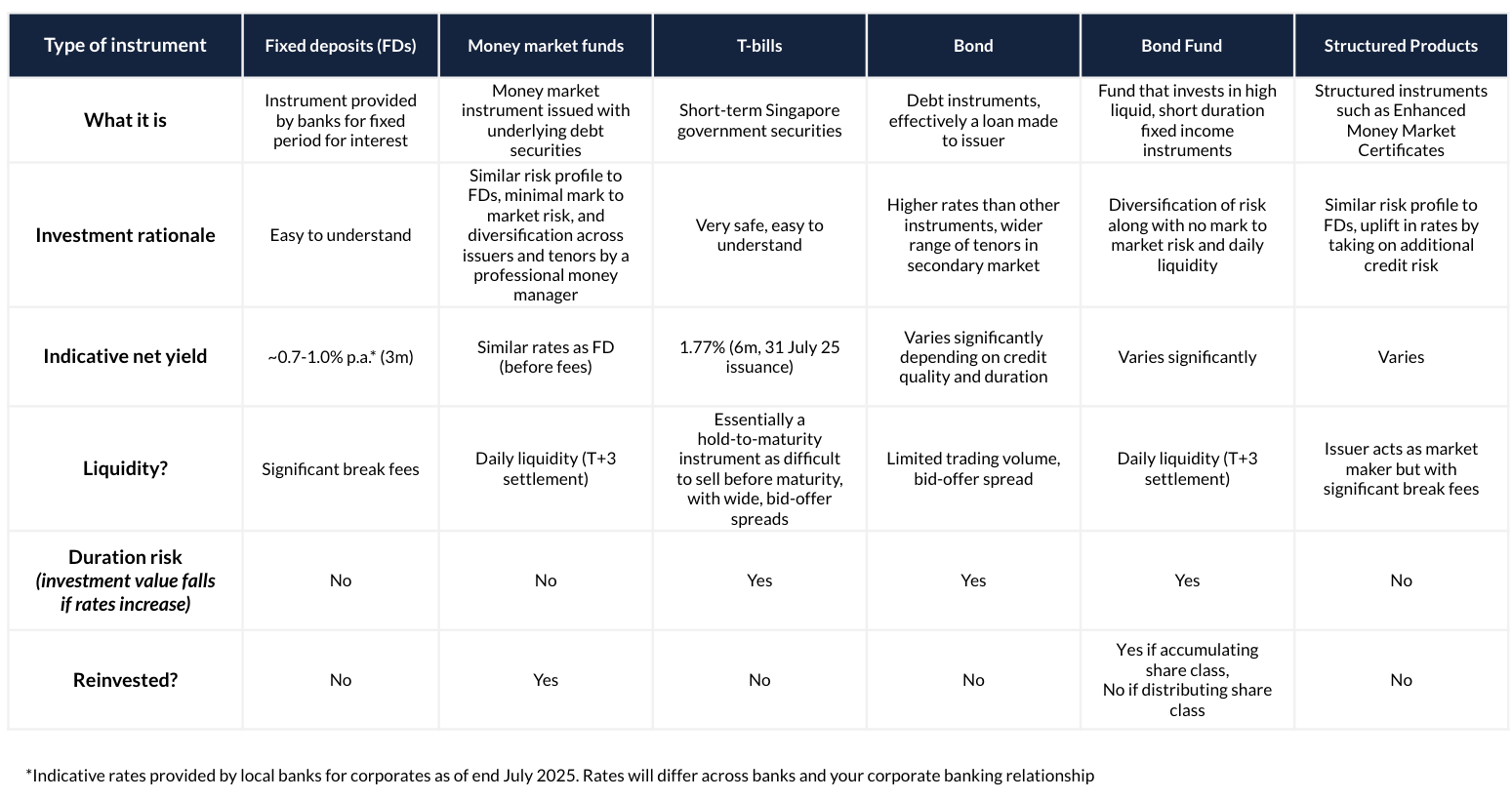

Beyond fixed deposits, there is a range of yield-enhancing products to consider

There are indeed challenges associated with first determining and then executing an effective approach for achieving a higher yield.

Beyond fixed deposits, there are other instruments that corporates can utilise to obtain a higher interest rate. However, corporate treasurers and chief financial officers (CFOs) need to have a clear-eyed view of the pros and cons of each of these instruments — they often come with trade-offs involving yield, level of risk taken, price volatility, and liquidity.

Many factors behind securing higher yield in corporate cash management

As the table above illustrates, the hunt for higher yield is not straightforward — and that is the key reason why many choose to leave idle cash in a current account. In addition to the headline yield figure, there are several key considerations that CFOs have to factor in, including:

Loss of flexibility

Many yield enhancement options, such as fixed deposits, have lock-up periods or hefty early termination penalties. To effectively use these products, finance executives must first accurately forecast their inflows and outflows in order to determine their excess cash levels and how long to lock it away for.

However, forecasts in the real world are often imperfect or incomplete, and treasurers and CFOs often compensate for this by keeping a significant cash buffer.

SMEs' cash needs are underserved by traditional banks

Small and medium enterprises (SMEs) typically use a limited range of banking services as compared to those offered by a traditional bank, making it unprofitable for banks to serve these businesses. They may not be approved for loans or have significant cash balances, and have limited foreign exchange (FX) or payment requirements. Hence, the SME segment is often overlooked by banks, or may be left with limited or no service.

The hunt for higher yield in cash management requires significant effort

Significant effort is needed to identify fixed deposits that offer the highest yield, as you would have to compare across tenors and banks. This invariably leads to the splitting of assets across different tenors and multiple banks — which then impacts the level and quality of service and attention you can receive from each bank, and can make it challenging to monitor and manage the different fixed deposits.

Venturing beyond fixed deposits, the plethora of corporate yield enhancement products, each with its specific risks, can be unfamiliar to corporate treasurers and CFOs. For instance, some treasurers and CFOs may be unaware that there is an additional layer of issuer risk when it comes to Enhanced Money Market Certificates — a type of structured product whereby the issuer “wraps” a fixed deposit in a structured note. As the adage goes, there is no such thing as a free lunch.

Mind the risks behind fixed deposits in Singapore

Fixed deposits are typically treated as risk-free instruments. However, the March 2023 collapse of Silicon Valley Bank (SVB) and UBS’ rescue of Credit Suisse are sobering reminders that beyond the deposit insurance limit, deposits rank no higher than unsecured creditors, which means that in the event of an insolvency, depositors may not get their full deposit back.

In Singapore, the Singapore Deposit Insurance Corporation (SDIC) insures up to a maximum of S$100,000 of deposits held with banks and finance companies that are part of the Deposit Insurance Scheme. While banks in Singapore are generally considered to be well-capitalised, those of you with a long memory may recall that there was a bank run on Chung Khiaw Bank in the 1970s.

Diversifying corporate cash solutions is tough in practice

While you may diversify accounts across multiple banks to mitigate such risks, this will be a time-consuming endeavour. There have been instances of banks taking more than 18 months to get a corporate account up and running.

In addition, even after onboarding the accounts, it is operationally tedious for finance departments to manage multiple bank account logins and signatories, as well as to compare interest rates across multiple providers.

Furthermore, splitting a business across multiple banks will mean that the corporate’s importance to any single banking entity is limited, which again can reduce the level of service offered by the bank.

Turn to Endowus Treasury Solutions for efficient corporate cash management

Endowus Treasury Solutions offer the following key benefits on a single, secure platform.

Invest in low-risk assets while enjoying flexibility in your corporate cash management

Money market funds (MMFs) invest in a diversified portfolio of short-term, low-risk securities such as Treasury bills (T-bills), commercial paper, and certificates of deposit. This diversification reduces the risk of loss and provides a buffer against fluctuations in any single investment.

Another key benefit is the stable net asset value (NAV) of a money market fund. As the assets are held until maturity and are of high credit quality, they are valued based on amortising cost — which means that the fund accrues daily interest at a steady rate without sudden drops or drawdowns, even if interest rates change.

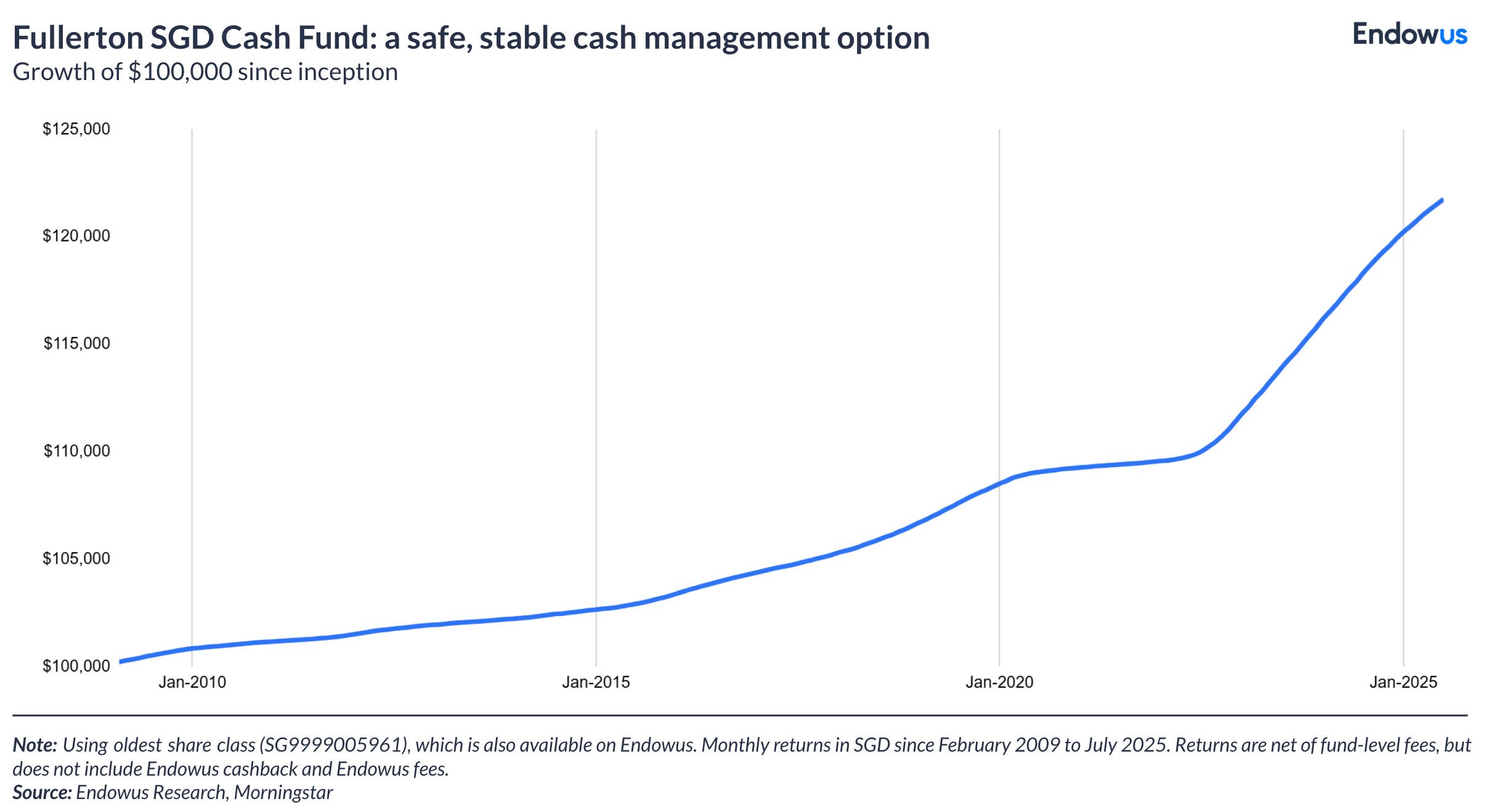

The chart above illustrates this with the Fullerton SGD Cash Fund as an example. As the underlying securities of the fund are largely valued based on the amortised cost method, the yield and NAV gain are spread evenly across the holding period of the underlying securities, instead of experiencing volatile mark-to-market drawdowns.

The Fullerton SGD Cash Fund, incepted in February 2009, has a strong track record. It has weathered multiple ups and downs in the markets over the years, including the Global Financial Crisis, the Covid-19 crash, and the ongoing rate hike cycle.

It’s worthwhile pointing out that the fund has demonstrated prudent risk management, with its maximum drawdown standing at just -0.03% — this loss was recovered by the next day. The fund’s drawdowns have averaged only -0.007%, or 7 cents for every $1,000 invested. All of the individual drawdowns so far were recovered within the following day. On a monthly basis, the Fullerton SGD Cash Fund has consistently delivered positive returns.

Attractive yields in corporate cash management with Endowus Treasury Solutions

Importantly, Endowus Treasury Solutions offer an attractive yield while providing flexibility. The funds can be sold at any time, with no lock-in or redemption fees. Typically, any investors would be able to get cash back within three to four business days, while earning any interest accrued during the period.

Access institutional investment advisory services through Endowus

In addition to money-market instruments, Endowus offers a curated range of fund products, including fixed-income funds and equity funds across a range of investment strategies. As of March 2023, the Endowus platform offers top-rated funds from over 50 leading global fund managers, across more than 200 unique investment strategies.

Most companies’ finance departments lack an investment advisory specialist to help them understand how to match their financial needs with the right investment products. The Endowus Investment Office constructs customised portfolios and explains to clients the portfolio traits such as:

- Historical performance: returns, maximum drawdown or MDD, and days to recovery

- Yield to maturity (YTM) vs credit rating, so you know you are taking credit risk that is compensated

- Yield to maturity (YTM) vs duration, so you know you are taking duration risk that is compensated

- Liquidity of the funds

- In the case of a portfolio constructed with short-duration bond funds — whether the underlying securities are held to maturity and how stable the total return of the fund has been historically

Furthermore, unlike typical retail fund platforms that operate as a “supermarket” of funds, the Endowus Investment Office only showcases best-in-class funds that are selected after rigorous qualitative and quantitative assessments of the investment firm, team, framework, process, and performance of the fund, as well as fee structures and business practices.

With Endowus, your assets are safe

Any cash and investments are held separately in your firm’s legal name with UOB Kay Hian, and are never commingled with Endowus or other entities. This is an important investor safeguard and also provides greater transparency and accountability.

Get a dedicated corporate relationship manager at Endowus

A dedicated advisor will work closely with you to understand your firm’s unique financial situation and provide bespoke solutions tailored specifically to your firm. Our team of advisors have decades of experience at leading global financial institutions including Morgan Stanley, UBS, Nomura, Saxo, DBS, and Citibank.

With Endowus, enjoy a multi-currency solution at competitive FX rates

In addition to SGD-denominated investments, Endowus also offers investment solutions in major currencies such as USD, GBP, EUR, and AUD. The platform offers very competitive all-in FX rates from our wholesale FX brokers, which we pass on to the end investor without adding a spread.

Work with Endowus to find your best treasury solution

The pursuit of higher yield for corporate cash savings is a complex endeavour that requires careful tradeoffs between factors such as risk, liquidity, and the effort required to manage the solutions.

As interest rates are expected to remain high, it is essential for CFOs and corporate treasurers to be proactive in seeking out alternative investment options to maximise their company's cash reserves.

Endowus Treasury Solutions offers a comprehensive and efficient platform to address these challenges, providing flexible, low-risk treasury management solutions, access to institutional investment advisory services, asset safety, and a dedicated relationship manager.

By leveraging the right tools and expertise, CFOs and corporate treasurers can make informed decisions and confidently navigate an evolving financial landscape to secure higher yields for their companies without sacrificing flexibility.

To find out more, please visit this link or contact us at institutional@endowus.com.

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)