Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- Singapore investors can easily invest in the S&P 500 through ETFs or unit trusts.

- Watch out for hidden costs like withholding taxes and estate duties on US-listed funds.

- We explore alternative low-cost funds that offer similar exposure and performance to the S&P 500, available on Endowus Fund Smart.

"Don’t look for the needle in the haystack. Just buy the haystack!"

— Jack Bogle, founder of Vanguard

You may have heard friends talking about buying a fund that tracks the S&P 500 index. But what does investing through this US index mean for an investor? Here’s a simple way to learn about the S&P 500, and whether buying exposure to this index is suitable for you.

What is the S&P 500 index?

Apple, Amazon, Google — these are famous American brands that we as consumers are all too familiar with. But as investors, our aspiration goes beyond being their customers. We want to participate and profit off their growth as leaders in their industries.

A country’s stock markets allow us to become an owner of the profits and future growth of various businesses in each respective country.

These businesses can be owned by the public, because they permit fractions of their business — known as a share — to be bought and sold through a marketplace by being listed. In this marketplace, the prices of each share of these businesses are determined by how actively traded these shares are, and the daily demand and supply for these shares.

Now the problem is, it’s tough on the pocket for most retail investors to buy the shares of all listed companies in a country. There are thousands of companies listed on two major US stock exchanges, NYSE and Nasdaq, alone.

Then came a sampling benchmark to show how well a country’s top listed businesses are collectively performing, based on their share prices. One such index is the S&P 500—it is built by combining the representative stock performance of the top 500 companies in the US. (S&P is short for the index constructor Standard and Poor’s.)

The S&P 500 index represents some US$53.7 trillion in market value of these 500 top firms, as of August 2025.

These are usually large, stable companies that are leaders in their industries, and have shares that are actively traded. They include well-known names such as Apple, Amazon, Alphabet (Google), Microsoft, and Tesla. The larger and more actively traded these companies are, the higher their represented portions would be in this market sample.

This scientific process of figuring how much a company’s share price should be reflected in a benchmark like the S&P 500 index is known as weighting; the weighting of the index, which has officially been around since 1957, is regularly reviewed so as to make sure that the S&P 500 index stays representative of the large companies listed in the US stock markets.

So by buying a fund that tracks the S&P 500 index, you are buying units of the index to be invested in a representative benchmark of big American brands — with these US corporate giants trading at a combined US$54-trillion valuation. Without this sample or benchmark, investors would have to buy the shares of hundreds of companies to get the same exposure — such trades would cost too much for the average individual investor.

The first S&P 500 fund was first available to individual investors in 1976 through fund house titan Vanguard. Jack Bogle, the founder of Vanguard, pioneered index investing using research showing that actively picking stocks does not consistently beat the market. It is better to just invest in the broad markets.

How does investing in the S&P 500 index work?

The easiest way for a retail investor to “buy the index” would be through an S&P 500 exchange-traded fund (ETF) or unit trust.

The fund manager takes investors’ money to buy and own the underlying stocks, such as Apple and Google, so as to mimic the index performance. Fund managers are institutional investors and have access to faster trading systems and much cheaper trading fees that retail investors do not, so they are able to buy these individual stocks efficiently.

Investors earn not just the capital gains — that is, the returns from higher share prices — but also from receiving dividends that these companies offer to their shareholders. Depending on how the fund is structured, the dividends earned can either be distributed to investors, or reinvested into the markets on behalf of investors.

How to invest in the S&P 500 from Singapore

Investing in S&P 500 ETFs or unit trusts comes with various fees and cost considerations. Let’s break them down.

How to invest in S&P 500 with cash

There are options for investing in the S&P 500 with cash that include US-listed ETFs, such as those with the ticker VOO, IVV and SPY. Their main draws are high liquidity, and low fees. Many low-cost brokerages also offer zero commissions for trades into the US markets.

But foreign investors investing in US-listed securities — such as US-listed ETFs — have to watch for estate taxes. Once your investment holdings exceed US$60,000, you will be charged up to 40% on most of your holdings.

To add, as a Singapore or Hong Kong-based investor with no US tax treaty, there is a dividend withholding tax of 30% levied at the fund level for US-listed ETFs.

On the other hand, investing in a SGD-denominated unit trust does not incur estate tax liability, does not require currency conversion, and can automatically reinvest the dividends from the underlying stocks into the unit trust.

With some of these funds, the headline fee may appear to be higher, but Endowus rebates distributor commissions known as trailer fees to our clients, so that brings the fees down. More importantly, it does not include the other forex and estate tax-related costs associated with investing in US-listed ETFs that may not be so obvious at first glance.

A low-cost SGD-denominated unit trust that tracks the S&P 500 index is part of the popular iShares range by BlackRock.

The iShares US Index Fund has a fund-level fee of only 0.08% — offering a cost-effective way to invest in top US stocks. The synthetic replication of this fund also means that it does not pay any US withholding tax, and is more efficient than UCITS ETFs in investing in the S&P 500 index. The iShares US Index Fund has been available on the Endowus Fund Smart platform since 2022.

Other options for investing in the index with cash include UCITs ETFs such as CSPX or VUAA. Domiciled in Ireland, these funds are not subjected to estate taxes, and reinvest dividends directly. However, they still have dividend-withholding taxes of 15%, reflecting the relatively favourable tax treaty between the US and Ireland.

Read more: Introducing BlackRock's lowest-cost passive index funds for retail investors in Singapore

A lower-cost alternative that tracks a US stock index

A little-known fact is that the S&P 500 is not the only index that can give you efficient exposure to major US equities. There are actually much lower-cost alternatives if you're open to considering other indices.

For example, the Solactive GBS US 1000 spans more than 1,000 companies in the US. Since January 2021, the correlation of returns between the S&P 500 and Solactive GBS US 1000 is 0.998, which indicates an almost perfect positive correlation. This is similar for the Amundi Prima USA Fund and Morningstar US Market Index, where the correlations to the S&P 500 are 0.998 and 0.997, respectively. This means that the returns of all three indices move together by almost the exact same percentage and direction.

The Amundi Prime USA Fund is an SGD-denominated unit trust that tracks this Solactive index, with a fund-level fee or total expense ratio of just 0.04%. You can invest in it using cash, CPF, or SRS. It has been exclusively made available first to Endowus for CPF investing.

With its 0.04% total expense ratio, this is the most affordable fund available in Singapore and on the CPF Investment Scheme. It is cheaper than SGX-listed ETFs and most UCITS ETFs. The Amundi Prime USA Fund's performance has very closely tracked the three aforementioned indices — the S&P 500, the Solactive GBS US 1000 Index, and the Morningstar US Market.

Correlation between Amundi Prime USA Fund and main US indices

High correlation with major US equity market indices

How to invest in S&P 500 with CPF

Endowus is the first and only digital advisor that allows investors to invest in the S&P 500 using their CPF savings. You can invest your CPF Ordinary Account (OA) money in unit trusts such as the Amundi Prime USA Fund.

The BlackRock iShares US Index Fund is not available for CPF investments, as of August 2025.

How to invest in S&P 500 with SRS

There are currently very limited investment options if you wish to use your Supplementary Retirement Scheme (SRS) savings to invest in the S&P 500.

A low-cost unit trust you may wish to consider for SRS investments is the iShares US Index Fund by BlackRock. It is denominated in SGD, and is also available for investments using cash. As mentioned above, the iShares fund does not pay any US withholding tax due to its synthetic structure, making it more efficient than UCITS ETFs and other passive index funds.

There is also an S&P 500 ETF listed on SGX. As this ETF is domiciled in the US and denominated in USD, it will have a similar investing cost as that of US ETFs.

Invest in US funds easily through Fund Smart

A simple way to invest your cash, CPF, or SRS in index funds is through Endowus Fund Smart platform — you can buy a single fund or customise your ideal portfolio with multiple funds in just a few minutes.

When you invest in a single fund, you will pay an all-in Endowus Fee of 0.3% per annum to Endowus, as well as the fund-level fee to the fund manager, after any Cashback on trailer fees. Find out more about our transparent pricing here.

Final checklist

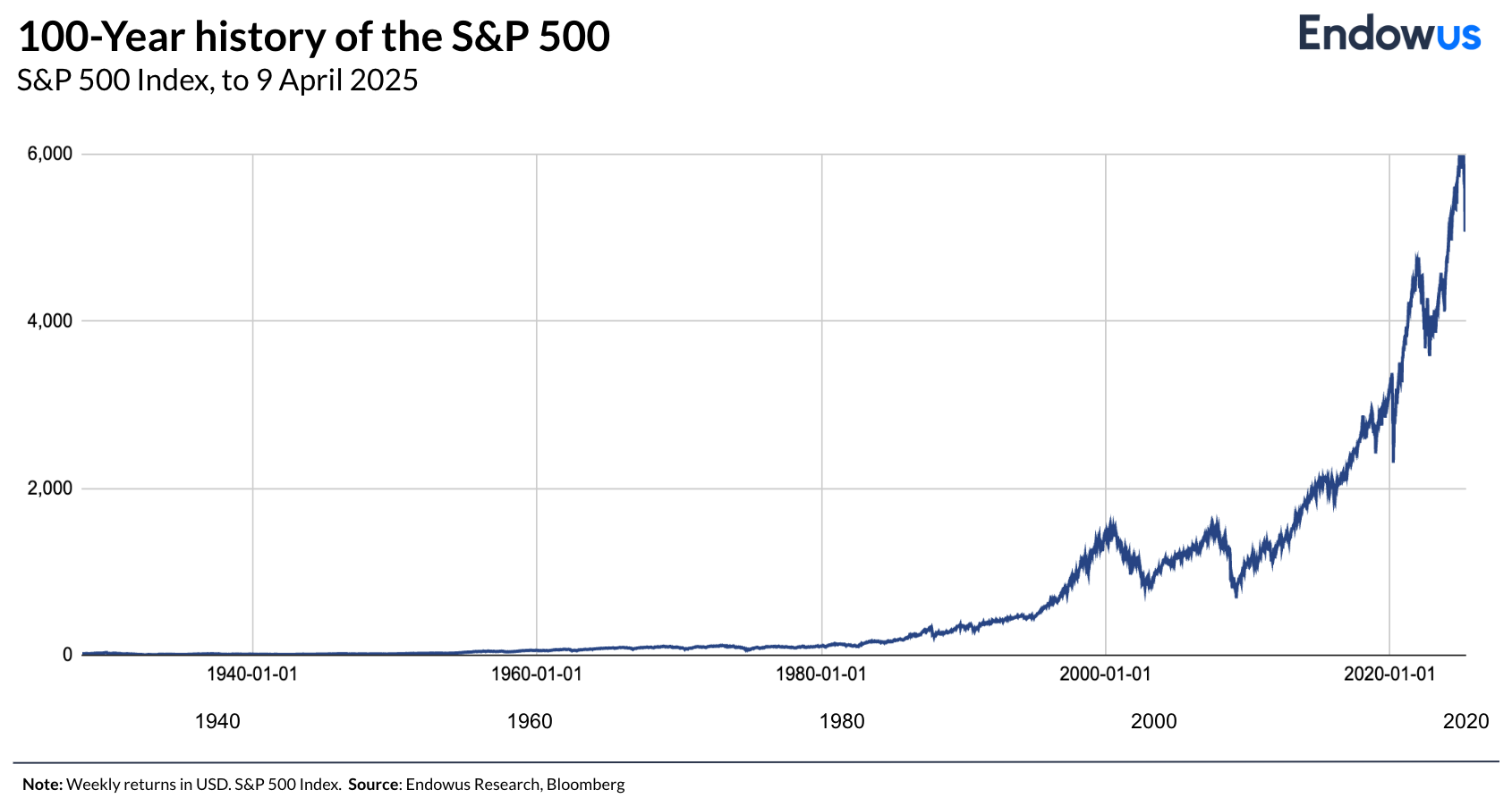

The S&P 500 has performed well historically, with an annualised return of 13.67% between August 2015 to July 2025.

That said, an S&P 500 fund is fully invested in equities and is only exposed to the top 500 US companies. How an index is reconstituted to take in new entrants can sometimes penalise passive index funds, as the Tesla case study showed.

To add, an investor needs to be comfortable with tolerating market volatility, including large fluctuations in a short time. Data showed that the worst historical 12-month return in recent history (from June 2004 to August 2025) is minus 43.07%. The worst drawdown assumed a starting investment in March 2008, during the Global Financial Crisis, through February 2009.

S&P 500 may also underperform more global portfolios over certain periods. Between 2000 and 2009, the S&P 500 total return was only minus 9.1%, compared to the MSCI EAFE ex-Japan index of 36.7%.

Investors with a lower risk appetite and shorter-term investment objective will need to look at a more risk-appropriate portfolio.

Investors can also consider investing in index funds that have a mandate to replicate all the developed markets or even the MSCI All Country World Index. Endowus uses Dimensional funds to construct our core Flagship Portfolios, giving our clients exposure to more than 10,000 companies.

Explore the Endowus Fin.Lit Academy for more tips on investing and personal finance.

Webinar: Investing in a better future: Through the lens of an equity investor

Why ESG investing should matter to Singaporeans

When you can’t see the forest for the trees: A holistic approach to asset allocation

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)