Endowus Cash Smart Portfolios

.webp)

Making my money work even when I’m at rest, that’s why I use Endowus.

Martin

and endowus client

The smart and flexible way to earn more on your cash

Unlimited transfers

returns

No transaction fees,

100% Cashback on trailer fees

Make your cash work smarter for you

Endowus Cash Smart helps you access the best cash, money market, and short duration bond funds in the industry, at the lowest cost achievable. You will be provided with an advised portfolio suitable for your goals so your money never goes a day without working

When you should be Cash Smart

If you have cash set aside for an upcoming expense, earn higher returns on it instead of letting it sit in your current or savings account. When you park your cash and salary with Cash Smart, your money never sits idle.

Three choices for your cash

Enjoy the flexibility of choice, with three optimised portfolios that can cater to all your cash and short term liquidity management needs, at varying risk. Managed by Singapore's biggest money managers, our portfolios give you projected yields that are significantly higher. Your cash in your control, on your terms, meeting your needs.

Safely held in your name at UOB Kay Hian

When you create an Endowus account, we will create a trust account in your own name at UOB Kay Hian, Singapore's largest broker. Your assets are safely held in the trust account and UOB Kay Hian will process all the transactions you make on the Endowus platform.

High yield. Low fees.

Choose from three portfolios designed to cater to your risk tolerance and unique cash management needs, based on factors like your expected investment time horizon, or when you might require cash for your next big expense.

Secure combines a cash fund that invests in institutional fixed deposits with one of Singapore’s best-performing money market funds.

- 50% Fullerton SGD Cash Fund

- 50% LionGlobal SGD Enhanced Liquidity

Suitable for immediate and near-term cash needs. Key focus is capital preservation with good yield.

Absolute fall in value (drawdowns) are highly unlikely, with any negative returns expected to be minimal.

How is this calculated?

p.a. after all fees

Enhanced combines a short duration fund with two cash and money market funds to target a higher yield than Secure.

- 50% UOB United SGD Fund

- 30% LionGlobal SGD Enhanced Liquidity

- 20% Fullerton SGD Cash Fund

Suitable for both near-term and mid-term cash needs. Balanced portfolio with higher yield than Secure with a slight increase in risk.

Drawdowns can occur more frequently and for longer periods than Secure, although the negative returns are expected to be minimal compared to Ultra.

How is this calculated?

p.a. after all fees

Ultra aims to provide the highest yield among the three Cash Smart portfolios over time by having a diversified allocation across some short duration bond and money market funds.

- 10% Fullerton Short Term Interest Rate Fund

- 10% LionGlobal Short Duration Fund

- 10% PIMCO Low Duration Income Fund

- 15% Fullerton SGD Cash Fund

- 20% LionGlobal SGD Enhanced Liquidity Fund

- 35% UOB United SGD Fund

Suitable for mid-term cash needs and may result in the need to hold on for longer during periods of volatility to achieve higher yield.

Drawdowns can be sharper with a prolonged recovery period compared to Enhanced, although the maximum negative returns are expected to be in the low single digits. Negative months can occur when fixed income markets fall.

How is this calculated?

p.a. after all fees

Secure combines a cash fund that invests in institutional fixed deposits with one of Singapore’s best-performing money market funds.

- 50% Fullerton SGD Cash Fund

- 50% LionGlobal SGD Enhanced Liquidity

Suitable for immediate and near-term cash needs. Key focus is capital preservation with good yield.

Absolute fall in value (drawdowns) are highly unlikely, with any negative returns expected to be minimal.

How is this calculated?

Enhanced combines a short duration fund with two cash and money market funds to target a higher yield than Secure.

- 50% UOB United SGD Fund

- 30% LionGlobal SGD Enhanced Liquidity

- 20% Fullerton SGD Cash Fund

Suitable for both near-term and mid-term cash needs. Balanced portfolio with higher yield than Secure with a slight increase in risk.

Drawdowns can occur more frequently and for longer periods than Secure, although the negative returns are expected to be minimal compared to Ultra.

How is this calculated?

Ultra aims to provide the highest yield among the three Cash Smart portfolios over time by having a diversified allocation across some short duration bond and money market funds.

- 10% Fullerton Short Term Interest Rate Fund

- 10% LionGlobal Short Duration Fund

- 10% PIMCO Low Duration Income Fund

- 15% Fullerton SGD Cash Fund

- 20% LionGlobal SGD Enhanced Liquidity Fund

- 35% UOB United SGD Fund

Suitable for mid-term cash needs and may result in the need to hold on for longer during periods of volatility to achieve higher yield.

Drawdowns can be sharper with a prolonged recovery period compared to Enhanced, although the maximum negative returns are expected to be in the low single digits. Negative months can occur when fixed income markets fall.

How is this calculated?

Years to earn.

Read more

Want to know more?

Endowus Cash Smart is available for Cash and SRS investment.

Because the portfolio holds different types of funds, we use different industry standards to calculate the yield for each component:

Yield for money market funds:

- This is the 7-Day Yield. It is calculated as the change in value (NAV plus reinvested distributions) over the trailing 7 days, annualized on a compound basis.

- It's a quick, short-term measure that shows what the fund has earned recently, annualized to give you a percentage return for the year.

Yield for short duration fixed income funds:

- This is the Yield to Maturity (YTM).

- It is an estimate of the total annual return one would earn if one held all the bonds in the fund until their maturity dates.

The yield shown for your entire Cash Smart Portfolio (Secure, Enhanced, or Ultra) is a Weighted Average of the yields of all the underlying funds.

The difference between Gross and Net yield is essentially the impact of fees and rebates on your return.

Net yield is after deducting fund-level fees, and adding back rebates. Gross yield is before deducting any fees.

Cash Smart Portfolios, which consist of money market and/or short-duration fixed income funds (unit trusts), are designed to deliver relatively stable returns compared to other fixed income portfolios of longer durations.

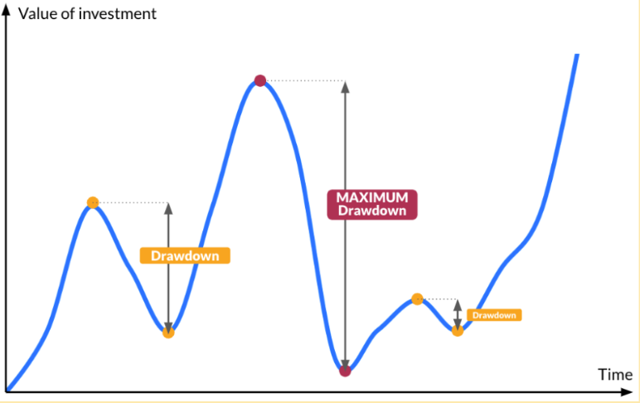

Nonetheless, there is risk in investing in the Cash Smart Portfolios, and they are not capital-guaranteed. Understanding the historical maximum loss of the respective portfolio can be a good way to assess whether the portfolio is suitable for your risk appetite.

Historical maximum loss(“drawdown”) is the fall from the peak (the highest point) to trough (the lowest point) in investment value, based on historical performance.

Investors may use the historical maximum drawdown as an indication of the maximum loss they may have experienced by investing in the specific portfolio over a period of time.

Please note that the drawdown figure is based on historical performance, which may not be indicative of future performance. There is always the risk that the latest maximum drawdown will be overtaken by a new maximum drawdown in the future. Investors should therefore view the historical maximum drawdown as a reference point and not a guarantee of future maximum loss.

%20F1.avif)