Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

Note: This article was updated on 21 February 2022 to reflect the recent BRS changes announced in the latest Budget 2022.

With the announcement of the CPF (Amendment) Bill 2021 back in November 2021, several key changes were made to the CPF with the aim of helping all members better prepare for their retirement, even as the withdrawal age remains unchanged. As the CPF is an important part of financial planning, we should always stay updated with its changes. In this article, we take a look at what these changes are and what you need to know to better plan ahead.

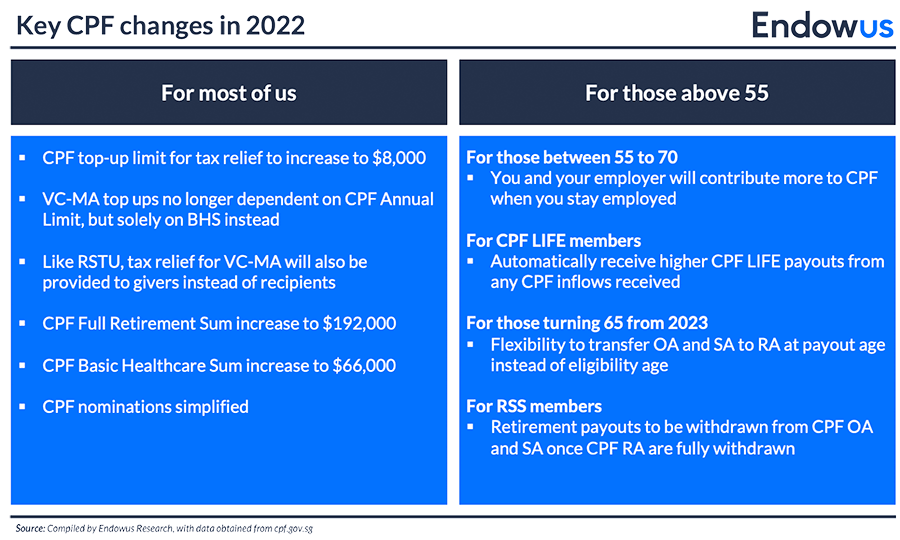

An overview of the key CPF changes in 2022

The table below provides a quick summary of these changes taking place from 2022. We will take a look at each of these in detail and also review other changes as well.

Making CPF top-ups easier from 2022

1. Tax relief cap for top-ups increased to $8,000

The cap for the total amount of annual tax relief has been raised to $8,000, up from $7,000 previously. Members that top-up their own CPF accounts can obtain an annual tax relief of $8,000 for self top-ups and also another $8,000 tax relief for top-ups for their loved ones. This cap of $8,000, however, is now shared between the Special Account (SA), Retirement Account (RA) and the MediSave Account (MA).

2. MediSave top-ups are simplified

Topping up MA is a popular option among CPF members for tax relief purposes. The computation of the amount eligible for top-up has been simplified.

Previously, the amount eligible for top-ups depends on two factors:

1) The difference between the CPF Annual Limit and the CPF contributions made for the calendar year, and also

2) The difference between the Basic Healthcare Sum (BHS) and current MA balance

From this year onwards, MediSave top-ups will only depend on the difference between the BHS and the current MA balance.

However, this also means that some Singaporeans, specifically those who have not hit the maximum $37,740 CPF Annual Contribution limit, will lose an avenue to use MediSave top-ups and RSTU for tax relief purposes. Here is a simplified example of how these changes can potentially affect you, depending on your current CPF situation.

Previously, someone earning $4,000 monthly, with no bonuses, can top-up and get tax relief of $26,980 ($7,000 into RSTU and $19,980 into CPF MA) for tax relief purposes, but now he can only get $8,000 for tax relief.

3. Tax relief for top-ups to MA is attributed to the giver

CPF members who top up their loved ones’ MediSave accounts will obtain tax relief benefits. Previously, tax relief was only provided to the recipients of these top-ups.

Simplifying your retirement payouts

1. Retirement payouts from RSS to be withdrawn from OA and SA once RA are fully withdrawn

From the first quarter of 2022, older CPF members on the RSS who have fully withdrawn the savings in their Retirement Account, will automatically receive payouts from their CPF OA and SA if they have funds in them.

Presently, recipients of payouts from the Retirement Sum Scheme will stop receiving any payouts once their RA has been depleted, even if there are still monies present in OA and SA.

2. CPF OA and SA transfer to start at payout start age instead

Previously, for CPF members turning 65 from 2023, savings from their OA and SA will be transferred to their Retirement Account, up to the Full Retirement Sum (FRS), which is when they are eligible to receive monthly payouts.

From January 2023 onwards, this transfer from OA and SA to RA will instead happen when the CPF member chooses to start receiving the payouts. This can happen anytime from 65 to 70 years old, depending on the member. This is to provide more flexibility for CPF members, as delaying the start of your payouts, should you not need them yet, will help compound your CPF monies further. Based on CPF’s calculation, every year of deferment from turning 65 can potentially increase your eventual payouts by up to 7% per year.

3. Automatic increase in CPF LIFE payouts when topping up RA

From 1 November 2021 onwards, CPF members will automatically receive higher CPF LIFE scheme payouts from any inflows received to their RA. Previously, any inflows to RA, such as through the Retirement Sum Topping-Up (RSTU) scheme or refunds from the sale of housing property, were paid separately as additional monthly payouts. This is now automatically applied to increase the CPF LIFE payouts and there will be no need for a separate application to combine them.

Other CPF changes to note for 2022

1. Increase in CPF contribution rates from 1 Jan 2022 for older employees

CPF contribution rates will be increased for employees aged 55 to 70 in order to better prepare for their retirement. You may also refer to the CPF contribution rate tables for a full breakdown of these changes by relevant age group.

These increases will also be allocated to the member’s CPF Special Account (SA) to maximise the interest earned. Currently, it has been stated that the interest rate of the SA will remain unchanged at 4% per annum.

Further, from January 2023, the employer and employee CPF contribution rates for employees aged above 55 to 70 will be raised by up to 1% each to support senior workers’ retirement adequacy.

2. Beneficiaries to receive CPF monies faster and easier

Making the appropriate CPF nominations is often an overlooked part of the scheme, and this eventually leads to a lot of hassle when it is time to distribute them. Currently, unnominated CPF savings will be transferred to the Public Trustee’s Office (PTO) to facilitate the disbursement. This is then followed by a lengthy process to verify each of the claims.

From 1 April 2022 however, this process will be simplified to allow a single beneficiary to represent all other relevant beneficiaries, with their consent, to receive these unnominated CPF monies, not exceeding $10,000. The process will remain unchanged for amounts exceeding $10,000.

In addition, from 1 April 2022, nominees of the Singtel discounted shares will also automatically receive the sale proceeds from the liquidated shares with no need to submit any application. The nominated shares will be automatically liquidated after the death of the member on the Special Discounted Shares scheme. Currently, this liquidation only takes place after seven years.

3. CPF Minimum Sum (BRS/FRS/ERS) increased to $96,000, $192,000 and $288,000

The CPF retirement sums need to be adjusted gradually on an annual basis in order to adjust for inflation, ensuring that payouts remain sufficient for their members. For the year of 2022, the amounts for the Basic Retirement Sum (BRS), Full Retirement Sum (FRS) and Enhanced Retirement Sum (ERS) have been updated to $96,000, $192,000 and $288,000 respectively.

As announced during the Budget 2022 speech, the Basic Retirement Sum (BRS) will rise by 3.5% for the next five cohorts turning 55 from 2023 to 2027. This means that the BRS will range from $99,400 in 2023 to $114,100 in 2027. Changes were made to help cope with rising living standards, as those who set aside the BRS when they turn 55 in 2027 will receive payouts of close to $1,000 every month once they turn 65.]

4. Basic Healthcare Sum (BHS) to be raised to $66,000 in 2022 (up from $63,000 in 2021)

Similarly, the Basic Healthcare Sum (BHS), which is the estimated savings required for basic healthcare needs, is also adjusted yearly to keep pace with the increases in healthcare costs. In 2022, this amount has been raised to $66,000, up from $63,000 in 2021.

Read more: Can CPF account interest rates change?

Conclusion

The CPF is a key pillar for retirement and it is important to always stay updated with its changes to maximise its benefits and better meet your retirement goals.Knowing a little goes a long way.

Stay up to date with the latest developments of the CPF and learn all about how these changes will affect you with Endowus Insights.

Next on the Endowus Fin.Lit Academy

Read the next article in the curriculum: What is SRS?

Retiring with a bucketing strategy

Webinar: Wealth — the wellness trend for women

Sparking joy: How to Marie Kondo your finances

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)