Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

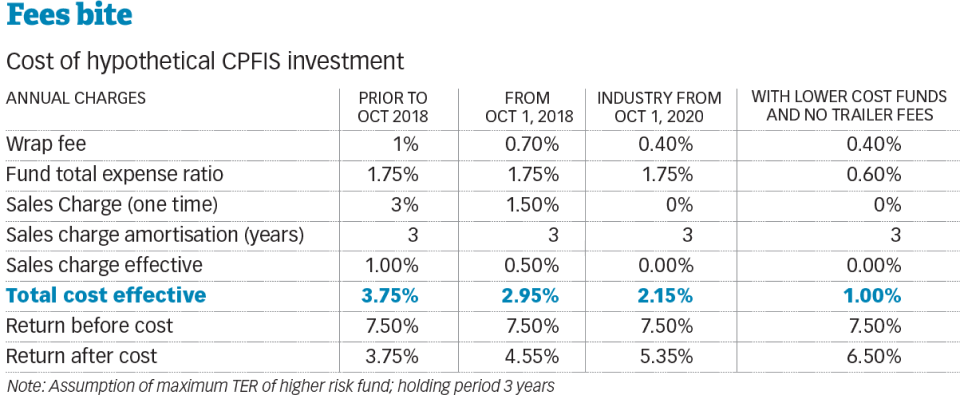

Since 1 Oct 2020, sales fees are cut to zero and wrap fees to 0.4%. Here are the implications for your CPF investments.

The original version of this article first appeared in The Business Times.

We all know that being diversified, patient, and fee-conscious can allow investors to harvest the power of markets and compounding over the long term.

But we also know that those who invest their Central Provident Fund (CPF) monies, who by default should be long-term investors, have had lacklustre investment performance. Only 60% of CPF Ordinary Account (OA) investors managed to beat the OA guaranteed rate of 2.5% per annum over a five-year period. This was according to the latest CPF Investment Scheme - Ordinary Account (CPFIS-OA) Profits/Losses Report as of Q3 2019, which does not include the market volatility induced by Covid-19.

Anything above the first S$20,000 in your OA is investible into professionally managed products, such as unit trusts. CPF member balances have grown significantly in recent years, but with these poor investor experiences it is not surprising that the total investment amount in CPFIS has gone from over S$27 billion in 2008 to under S$17 billion at the end of Q2 2020.

Fee caps should benefit the CPF member

Great steps have been taken to enhance the CPF investor experience. In March 2018, the Singapore Ministry of Manpower announced a stepped removal of sales charges and reduction of wrap fees. As of 1 Oct 2020, financial advisers, brokers, banks, and other distributors can no longer charge sales fees, and wrap fees have been further reduced from 0.7% to 0.4%.

This should make CPFIS investing more accessible and better for the end client. After all, reducing fees has a direct effect of higher returns, and CPF monies have everything to benefit as long-term money to be grown and utilised by members to and through retirement.

Lower fees mean significantly higher returns compounding over 10, 20, 30 years and beyond.

But there is an elephant in the room

Incentives make the world go round. While the reduction in wrap fee and removal of sales charges is a step in the right direction, there are valid concerns around whether distributors will act against the best interests of their clients or opt to maintain their own profit margins.

Many distributors will now make the bulk of their margins on trailer fees paid by fund managers to fund platforms, advisers and distributors for selling their products. Trailer fees are the portion of a fund's annual management fee that is paid to distributors. CPF members may be advised to invest in more expensive funds that distributors are systematically incentivised to sell because of a higher trailer fee.

Lower-cost funds may not be able to pay higher hidden trailer fees and therefore may not be recommended by distributors.

It is no surprise that the fund-level fees of the unit trusts listed on CPFIS remain very high despite CPF's efforts to reduce them. In January 2016, the CPF Board implemented the cap on total expense ratio for unit trusts.

Lower-cost funds do exist, but rarely have the support of distributors and advisers due to their relatively low or near zero trailer-fee incentives.

Actionable tips for the wealth conscious

Some players are making moves to further improve this landscape. Fee-only advisers cannot be paid by anyone but their clients. They therefore cannot collect trailer fees and are much more incentivised to serve their client's best interests.

You can search for diversified and lower cost funds included in the CPFIS list. For example, Vanguard-managed passive strategies such as the Infinity S&P 500 and the Global Stock Index Fund are currently available for investment by CPF-OA monies at a low cost, but are not widely distributed.

Ask about all associated fees with your investment, including trailer fees. We believe that greater transparency in trailer fees would be the next step forward to further improve CPFIS. While the Singapore fund distribution market may not be ready for eradication of trailer fee rebates, investors should at least be aware of where their CPF monies are going.

Find out more about Endowus' transparent fees here. Explore our Fin.Lit Academy to pick up tips on CPF and SRS, investing, wealth building, personal finance, and retirement planning. Take charge of your CPF investments with Endowus.

Endowus CPF Portfolios outperform average returns of CPF Investment Scheme (CPFIS)-included funds in 2020

5 Things to know before investing your CPF

Webinar: Starting your CPF Millionaire journey early

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)