Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

Our thoughts:

Technology has changed the dating scene, as dating apps work through the hearts of consumers. But are these apps a match for users when it comes to ESG considerations? Consumers are looking at how these businesses prioritise data privacy, and align to a set of ethics for users’ safety and well-being.

In this article, we look at the subscription economy via the online dating industry, and the ESG considerations that it should prioritise soon — lest users "swipe left".

Dating: a multi-billion-dollar business

Like many human activities, social interactions have changed and evolved throughout time. The act of finding a pair has drastically changed, driven by the rise of technology, demographic changes as well as the ever-evolving consumer behaviour. Long gone are the times where the only means of meeting people had to be done physically. From the conventional offline way where one places an ad in the local newspaper, to the start of the Internet and online dating, mate-finding for humans has evolved.

Today the choice is wide, and the options are numerous — stored in our phones, we can find apps that meet that purpose in different shapes, colours and tastes. From the traditional, more formal, and elaborate courtship of the 19th century, today’s digital era has created a dating ritual fitting its time, and well, its technology — swipe, match, chat, meet, and then decide — whether to repeat the cycle or start one’s "happy ending".

And while there have been many success stories, swipe rights that led to marriage and families, there have been unhappy endings too. Cases of low self-esteem, addiction, despair, harassment, stalking and unsolicited content have been linked to the increasing use of dating apps.

For some, dating is a one-off process before finding eternity. For many others, a repeatable cycle as needed. And with it comes an opportunity. The dating industry has now become a multi-billion-dollar business. Several first movers have early on established a strong dominance and have been successful in capturing the demand, fulfilling user needs. With the accelerating digitalisation, dating apps are becoming the choice for pursuing relationships. And with this, many experts say the dating apps industry is just starting, with so much room to grow and opportunities to seize.

The single's market

Much like any market, relationships are all about supply and demand. As of today, there is abundant supply and demand. In today’s modern society, two main phenomenon have been feeding the dating market: the gradual increase in the number of singles coupled with an increased penetration of technology, and particularly apps.

The increase in the average marriage age is ultimately down to three factors:

- The empowerment of women who have gradually become more career-oriented leaving less opportunity for early commitment

- Younger generations see marriage as being obsolete — they usually opt for cohabitation rather than a legally binding marriage

- Divorce rates have skyrocketed over the last decades, further reducing the attractiveness of the sacred tradition

One might argue that relationships can be long-lasting without the tie of marriage. However, the latter has proven to increase the lifespan of a relationship, at least on paper. The result is an increasing pool of single people, that are mostly actively looking to find a partner whether it is for the short run or the long run. And where to look if not on a dating app? In fact, dating apps have rapidly become the go-to solution in matchmaking for as long as they have existed, replacing previously popular dating websites.

It all started in 1994 with the launch of Kiss.com followed by the notorious Match.com in 1995, and since then the ecosystem has never ceased to grow, amplified by the inevitable transition to mobile, increasing the applications’ reach drastically. The tech-savvy nature of younger generations played a big part in the digitalisation of love and many corporations have since rushed to capitalise on this rapidly growing market.

As of today, online dating has amassed more than 270 million subscribers growing at 12.7% CAGR over the past five years. Revenues also followed the same path, almost doubling over the same time span. According to business of apps, sales should grow further, reaching US$5.7 billion.

With these figures at hand, it is important to understand who the main actors are and what are the mechanisms through which these corporations are generating revenues.

Swipe, match, date, rinse, and repeat

Apps have transformed dating into a game — people swipe right if they like what they see, and left if they don’t. Matches are the fruit of both people swiping right to each other’s profile, and then the chatting game starts.

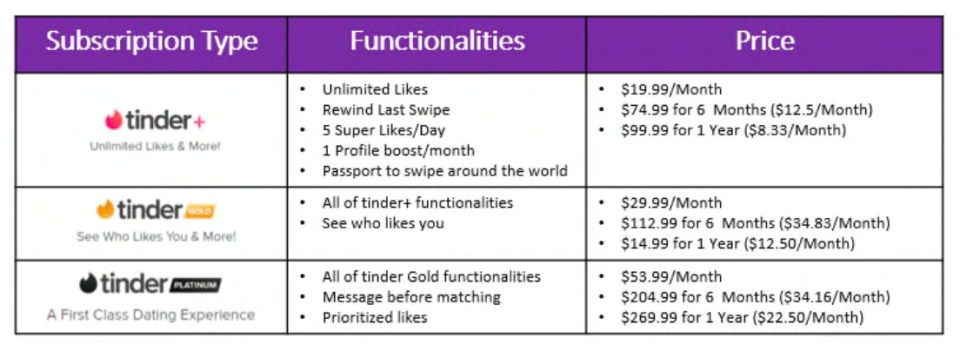

Tinder was a pioneer in that market and democratised this simple procedure. However, the dating giant found innovative ways to monetise its business mainly through subscriptions.

Tinder also monetises its services through "a la carte" features, where a user can pay for a single functionality, not through a subscription, but rather a pay for use approach. For example, a user can buy five Super Likes and spend them on the go.

One last monetisation vector, albeit a more traditional source and a much smaller stream of revenue for dating apps, is advertising. Their prevalence is much lower than with traditional app, in order to preserve user experience and keep the focus on the goal which is dating.

Tinder is probably the most renowned example when it comes to dating but the ecosystem goes far beyond the flame logo app. Match Group, Tinder’s owner, has the biggest portfolio as of today. With the rapidly growing Hinge, the Japanese oriented Pairs, Gen X-centric Match.com/Meetic, and even Hawaya (a dating app for single Muslims), Match Group supports more than 21 apps.

Other groups have recently emerged with their own solutions with the recently listed Bumble, an app destined to empower women on the dating scene, and the Chinese Tinder known as TanTan (to curb the ban on foreign apps). More recently, Facebook introduced a dating feature in a try to nibble some share of this multi-billion-dollar industry. Globally, many applications have emerged to serve either a particular country/region or a specific demographic — because of cultural differences, one model might work in one country but not in another.

The modern tool for fulfilment of some human needs?

Maslow, a highly influential psychologist of the 20th century, put in place the pyramid of human needs — a kind of a walkthrough to one’s happiness and fulfilment. At the third level of the pyramid, nested within psychological needs, lie two fundamental elements: intimate relationships and friends.

Indeed, social interactions are of utmost importance for the vast majority of human beings. A good way of understanding this would be to analyse the behaviour of humans during the Covid-19 pandemic. Intuitively, one might think that social interaction with strangers came to a halt during the sudden lockdowns. However, figures for traffic, downloads, and engagement tell a whole different story.

During that time, social interactions outside of one’s home were practically null. Usual meeting places such as colleges, restaurants, bars, offices even parks were closed, pushing people, particularly young adults, to find alternative ways to mingle. And what better tool than a dating app?

Indeed, applications adapted to this new normal as fast as society did, rolling out features such as video chats, quizzes and even increased the number of promotions on their products. Naturally, this translated into higher user engagement across the board.

Loneliness along with other mental issues were the second biggest health issues stemming from the pandemic. People in the UK reportedly felt lonelier as lockdowns progressed. Those aged between 18 and 44 were the hardest hit, likely due to the high proportion of singles among them.

This is why the likes of Match Group reported a significant increase in messaging, in swiping, and longer conversations on average — again showing that there is an undeniable positive impact on mental health and on one’s general wellbeing.

Match’s management were even surprised by the big uptick in women activity. Women went out of their ways and out of their comfort zone to fill their social needs. During this undeniably difficult phase, the positive externalities of apps was clear and helped greatly reduce the mental toll of spending time alone within four walls.

Friendships are also a part of the game

Both Match and Bumble have also added new features or apps to their ecosystem — but this time focused on friendships.

For Bumble BFF, the same principal is applied, swipe and match, but this time to find new friends close to you, chat, and eventually meet. This is particularly useful for people that move into new cities or countries as it helps them find people with the same interests. This new concept substitutes social media where content has been less and less personal but rather topical.

For Match, the Ablo app saw particularly strong traffic during lockdowns. Ablo enables users to connect randomly with people around the world and to communicate regardless of their preferred language. A person in France could speak French to a person in Turkey, who in turn would answer in Turkish — with Ablo taking care of the translation for both, to keep the conversation seamless.

ESG in the dating industry

Looking at the ESG ratings of listed companies in the dating industry, the most common material ESG issues that major sustainability rating agencies consider for companies within this activity are the data privacy and security, business ethics, and product governance.

Their solutions are also not considered as having any potential to contribute to any social objectives, for example the promotion of health and well-being in the UN Sustainable Development Goals. They are generally classified as Internet Software & Services alongside tech companies like Adobe or Microsoft. In this modern day of digital love and human relationship, are dating apps deserving of more recognition for their role in facilitating if not fulfilling evolutionary and social needs of humans?

Positive impact?

In the current definition of ESG rating agencies, products or services with positive contributions are those that provide solutions to achieve the different targets of the UN Sustainable Development Goals.

The most common sustainable product categories used by rating agencies relating to health and well-being are Ensuring Health or Promotion of Good Health & Well-being. To qualify whether a solution is contributing to these themes, the definitions generally reference the World Health definition — a product can be considered having positive contribution to health and well-being if it helps in ensuring that every person can, to the best extent possible, be cured from disease or infirmity and achieve or maintain a state of complete physical, mental and social well-being.

Following the above definition, could dating apps be considered as contributing to achieving or maintaining mental and social well-being? Shouldn’t their utility in facilitating human fundamental needs for connection, love, and belongingness — factors that are essential parts of mental and emotional well-being — considered aligned with the current definition? The UN SDG Goal 3, Ensuring healthy lives and promote well-being for all at all ages, specifically set out and defined in one of its targets the promotion of mental health and well-being.

One of the stated proposition of one of the companies, Bumble, is to empower women by levelling the field. Looking at SDG Goal 5, focused on gender equality, one can argue that dating apps can also be linked to this sustainability theme.

By trying to remedy the unbalanced dating game, Bumble has been viewed as able to give a much-needed breath of fresh air to the industry. In the dating game of "pursuits", men have traditionally had the upper hand. Bumble’s mechanism has given women the power — to make the first move, to initiate, and to set the tone.

Bumble’s proposition is putting women at the centre of the app. Their thesis is that relationships are not equal for men and women, and rightly so. Men have too much pressure and must almost exclusively make the first move — the pressure is often synonymous with rejection and rejection, and can open the door to inappropriate behaviour. The main differentiating point of this platform is that the first move can be exclusively done by women, which means that only women can start a conversation with a match. In that case, women feel safer, men feel less pressure, and the experience is more enjoyable for both parties.

On top of that, Bumble invests a lot to curb the effect of impunity; inappropriate behaviour results in an automatic ban, which makes users think twice before acting.

Bumble is a textbook example of how to deal with a potential problem efficiently, and it has rapidly risen to the top of the dating app ladder, along with Tinder and Hinge (both owned by Match Group). Gradual rollouts of identity checks, artificial intelligence (AI) driven platform security, and background checks, are among other functionalities have drastically improved user experience. That being said, a lot remains to be done.

From a traditional lens, women empowerment and equality are largely viewed around issues such as equal pay, gender diversity, and equal access. Shouldn’t relationship also be an area where the empowerment of women can be promoted and enabled?

Some negative impact

As many say, technology is neutral. It enables, and the outcome is dependent on the objective of the user. And so as with any other technology, dating apps is also at risk of directly or indirectly causing harm.

Women have often complained of men’s behaviour on apps. They often report harassment, unsolicited explicit pictures as well as stalking. According to the PEW research centre:

- 53% of women in the US think dating sites or apps are an unsafe way to meet people

- 48% of women say matches continued to contact them despite their lack of interest

- 46% of women have received sexually explicit messages or images they didn’t ask for

- 33% of women have been called offensive names

- 11% of women have been threatened with physical harm

These proportions were high as we go down the age pyramid, with Gen Z and millennials reporting more incidents than older generations. Although men also reported the same behaviours from women, the proportion of positive respondents was 50% lower than for women.

Also, for men, the downside was more on the toll on self-esteem that dating apps can have — low matches and low responses to messages can make a person question himself. We could even think that this is exactly what dating apps are trying to capitalise on. Indeed, in an effort to increase their chances, people that are unsuccessful on these apps will splash more cash, spend more time on the app, tweak their profiles, and even sometimes lie or create fake accounts. Apart from the last two points, all of these reactions are beneficial to corporations that operate in the dating market.

While apps have been proven to alleviate loneliness, they can also be a source of other personal issues such as loss of self-confidence, fear of intimacy, as well as aggressive behaviour.

With regards to highly popular apps, other issues that have come under the spotlight include:

- Underage usage of the app, which in turn translates into potential child abuse

- Age discrimination: Tinder Platinum is more expensive the older you are — while this may be intended to preserve the popularity of the app among younger cohorts (18-25 years old), it can also be viewed as unethical and a rather discriminative decision

- Sex workers' use of the platform: This had a particularly negative effect in China, where the government enforced bans on dating apps until the situation came under control

Companies are aware of the potential threat to their reputation and have put a great deal of effort to limit whatever loophole one can find in their apps. Today, most apps require ID verification, to prevent either fake accounts or underage usage. It also increases accountability; a user that has committed a misdemeanour will be banned from using the app, preserving both safety and the quality of the app.

Heavy investment in AI also aid to filter unacceptable content and ensure that users comply by the application’s guidelines. This is key to the company’s ESG profile, as it greatly limits the risks associated to its core business. And in turn it should translate into better ESG ratings.

Online dating is a double-edged sword

The current ESG risk-opportunity assessment of dating app companies appears to be tilted towards zoning in on the risks while unrecognising, if not disregarding, the opportunities.

It is our view that the "S" or social factor in ESG can be improved or redefined to account for new areas or activities, as well as evolving human behaviour and consumption patterns as they move with time and technology.

Online dating is a double-edged sword. On one hand, it can be perceived as a modern-day digital cupid, and on the other, it may be seen as a threat. One thing for sure is that the industry is going in the right direction. Investment in research and development has been rising, improve the user experience. Subscription-based models are the perfect motivation to constantly improve the ecosystem, listen to paying users’ needs, and ultimately be at the forefront of societal interaction and matching.

This article was originally published by Thematics Asset Management in July 2021.

Thematics Asset Management is a dedicated equity investor in innovative thematic strategies, which include Water, Safety, Artificial Intelligence & Robotics, the Subscription Economy and Wellness. It invests in a collection of markets that have the potential to grow at a rate superior to that of the broader global economy due to the long-term secular growth drivers that underpin them, and integrates ESG principles in its portfolio construction process. Thematics Asset Management is an investment affiliate of Natixis Investment Managers.

Endowus has three funds from Thematics AM (as of 17 Feb 2022), namely the Thematics AM Subscription Economy Fund, Thematics AM Safety Fund, and the Thematics AM Meta Fund.

Get started building your own portfolio with funds like these on Endowus Fund Smart.

<divider><divider>

Natixis disclaimer

Portfolio holdings are subject to change. References to specific securities, sectors, or markets does not constitute investment advice, or a recommendation or an offer to buy or to sell.

In Singapore: This document is provided by Natixis Investment Managers Singapore Limited (company registration no. 199801044D) for informational purposes only.

Investment involves risk. The information contained herein does not constitute an offer to sell or deal in any securities or financial products. The content herein may contain unsolicited, general information without regard to an investor’s individual needs, objectives, risk parameters or financial condition. Therefore, please refer to the relevant offering documents for details including the risk factors and seek your own legal counsel, accountants or other professional advisors as to the financial, legal and tax issues concerning such investments if necessary, before making investment decisions in any fund mentioned in this document.

Past performance information presented is not indicative of future performance. Certain information included in this document is based on information obtained from other sources considered reliable. However, Natixis Investment Managers Singapore Limited does not guarantee the accuracy of such information.

Natixis Investment Managers Singapore Limited is a business development unit of Natixis Investment Managers, the holding company of a diverse line-up of specialised investment management and distribution entities worldwide. The investment management subsidiaries of Natixis Investment Managers conduct any regulated activities only in and from the jurisdictions in which they are licensed or authorised. Their services and the products they manage are not available to all investors in all jurisdictions. It is the responsibility of each investment service provider to ensure that the offering or sale of fund shares or third party investment services to its clients complies with the relevant national law.

<divider><divider>

Endowus disclaimer

This article is for information purposes only and should not be considered as an offer, solicitation or advice for the purchase or sale of any investment products. It is recommended that you seek financial advice as to the suitability of any investment. Whilst Endowus Singapore Pte. Ltd. (“Endowus”) has tried to provide accurate and timely information, there may be inadvertent delays, omissions, technical or factual inaccuracies or typographical errors.

Any opinion or estimate above is made on a general basis and none of Endowus, nor any of its affiliates, representatives or agents have given any consideration to nor have made any investigation of the objective, financial situation or particular need of any user, reader, any specific person or group of persons. Opinions expressed herein are subject to change without notice.

Investment involves risk. The value of investments and the income from them can go down as well as up, and you may not get the full amount you invested. Past performance is not an indicator nor a guarantee of future performance.

Please note that the above information does not purport to be all-inclusive or to contain all the information that you may need in order to make an informed decision. The information contained herein is not intended, and should not be construed, as legal, tax, regulatory, accounting or financial advice.

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)