Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

The race for the US presidency and for control of the House and Senate staged many plot twists, with one of the most unexpected being US President Joe Biden’s withdrawal from seeking a second term in office.

In hopes of wrestling back control of the presidency, former President Trump has seen a boost in support, both nationally and in crucial swing states after a recent failed assassination attempt. The President in office faced mounting pressure from influential Democratic Party leaders and top donors who expressed scepticism about his ability to effectively govern for another four years post a lacklustre debate.

With Biden stepping aside, the Democratic Party now faces the task of selecting a new nominee at their upcoming convention in Chicago from 19-22 August. Vice President Kamala Harris is now a presumptive nominee with no contender for the nomination.

This development sets the stage for a highly anticipated and potentially transformative chapter in the US presidential race. The coming weeks will undoubtedly be filled with intense speculation and anticipation as the Democratic Party prepares to chart a new course for the future.

While voters and the media are searching for that answer for changes, we are taking a step back and taking stock of key constants in the financial markets that are going to be the same as ever. Together with commentaries from our fund manager partners, we list their observations on the coming elections.

<divider><divider>

One party control or not… What will it not change?

This is an excerpt taken from a commentary by Janus Henderson Investors published on 18 June, 2024.

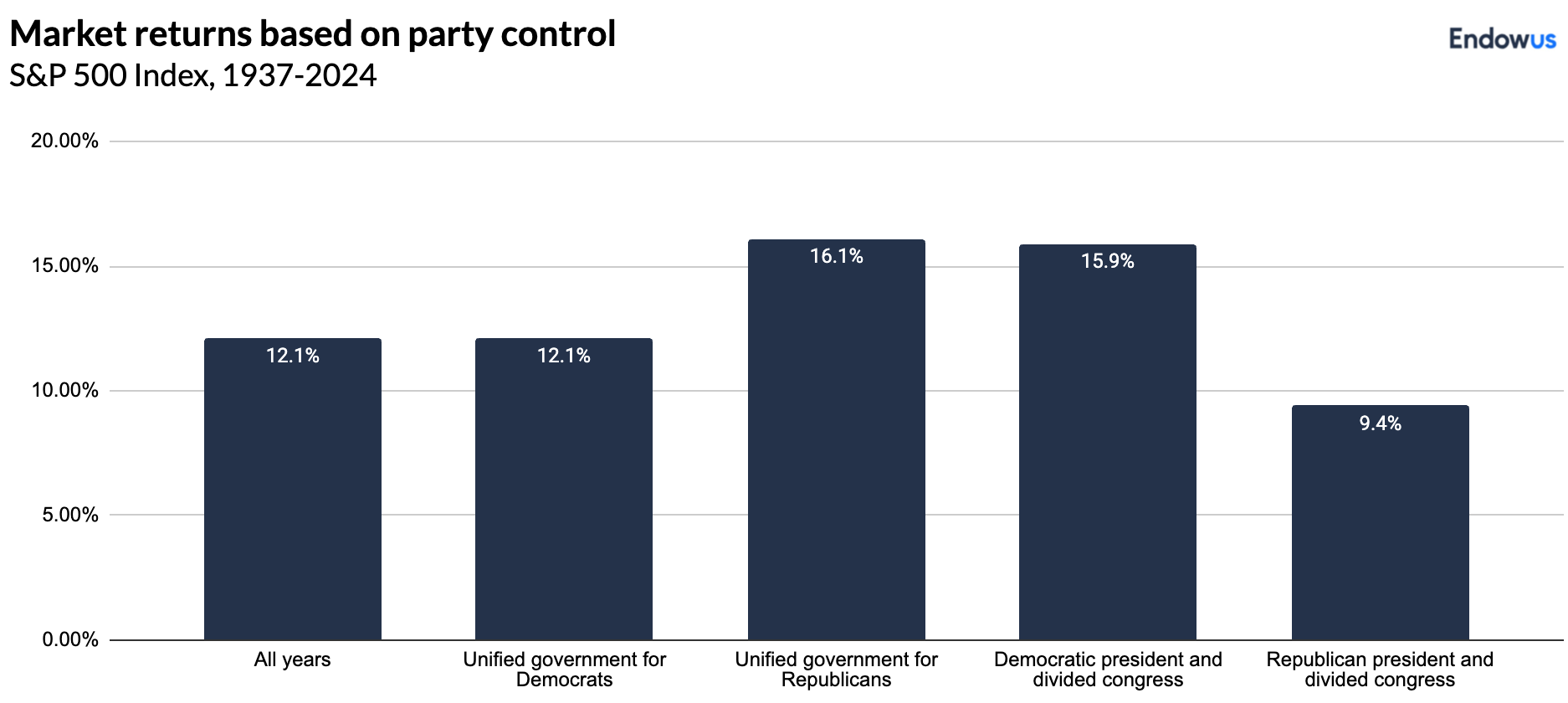

“While [different] sectors could see varying policy impacts, it does not appear that one party holds a clear advantage for the overall market. The market generally prefers congressional gridlock and a divided government, as it creates less disruption and fiscal policy uncertainty.

Yet, S&P 500 performance data shows varying results under different party control scenarios. This underscores that strong market performance hinges more on supportive economic fundamentals than political party dominance.

We expect the year’s biggest market drivers – including the trajectory of interest rates, economic growth, inflation, and corporate profits – to continue shaping the investment landscape over the next several months. Additionally, powerful secular trends like advancements in artificial intelligence (AI) and the burgeoning obesity drug market are poised to maintain momentum, irrespective of the White House occupant.

Those factors, rather than the political race itself, will likely play a larger role in guiding whether investors continue rotating into stocks or take a more defensive posture in the ensuing months.”

<divider><divider>

Incumbent president or not…

This is an excerpt taken from a commentary by Neuberger Berman published in July 2024.

The market impacts of the election may be more difficult to predict, given that economic and geopolitical issues can change the context in which the president must act.

However, it may be instructive to note how the stock market has performed based on incumbent victory or defeat. As shown below, incumbent party victories have, on average, been followed by two years of strong S&P 500 Index performance relative to the two years after a challenging party victory. This is perhaps due to residual economic and earnings strength from stimulative election-year policies. The performance trend tends to reverse in years three and four, when the economy may fatigue after the “feast years” that helped to reelect the incumbent in the first place.

S&P 500 Index Presidential Year Performance (Median) After Incumbent Party Wins/Loses Presidential Race

S&P 500 Index earnings-per-share growth (average) after incumbent party wins/loses presidential race

<divider><divider>

Democratic or Republican presidency…

Haven rush, “Trump trades”, and all kinds of creative yet speculative calls abound, attempting to capitalise on the unfolding events and the final outcome of the US elections. Let’s take a step back and question whether short-term speculation is truly the most reliable approach to investing. Is there a better way to leverage the outcomes of the US elections?

When we examine historical data, it becomes evident that the party affiliation of the President has little impact on equity market returns. Since 1929, there has been no systematic correlation between the party of the President and equity market performance. Whether a president is a Democrat or a Republican, the almost hundred years of data show that the market tends to yield positive returns over time.

<divider><divider>

The year of the election or not…

What about investing in an election year versus a non-election year? Data suggests that the timing of your investments in relation to elections may not significantly impact your overall returns. While average returns in election years may be slightly higher, they also come with increased volatility compared to non-election years.

Ultimately, the average returns between the two are quite similar, indicating that attempting to time the market based on elections may not be worthwhile.

What truly matters is staying invested for the long term to improve your investment outcomes. The power of compounding, earned with your time in the market, will stay true as ever. Diversification is the only free lunch in investing – same as ever.

<divider><divider>

Mind the volatility, but do not force changes

While the US elections typically lead to short-term market fluctuations, the bottom line is that historical data suggests that market returns tend to skew upwards for the long haul, and thus long-term investing is the key to success.

Rather than getting caught up in short-term market movements, focus on a disciplined, long-term investment strategy that aligns with your financial goals. There are also long-term factors at play.

Watch our recent webinar, as Kyungju Hong and Yulin Liu from the Endowus Investment Office look at the current market environment and review Endowus portfolio performance.

Watch: Endowus H2 2024 Market Insights & Portfolio Performance

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)