Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- There must be clarity about the role of finance managers within charitable organisations and an understanding of the conflicting priorities of reserve management.

- Stakeholders should also establish an Investment Policy Statement, outlining the strategy and desired outcomes for effective reserves management.

- For most charities, it would be more sensible to outsource investment advisory services to an external advisor to utilise their expertise in investment products and performance reporting. Learn how Endowus fits into your needs.

Finance managers and committee members of charities and not-for-profit organisations (NPOs) have a fiduciary duty to manage the charity’s reserves in the best interest of its beneficiaries.

To effectively manage these funds, there must be clarity about the role of finance managers within charitable organisations and an understanding of the conflicting priorities of reserve management. Stakeholders should also establish an Investment Policy Statement, outlining the strategy and desired outcomes for effective reserves management.

In this article, we discuss how charities can approach the above and share insights into their thought processes.

How should charities’ finance managers manage their reserves?

Role of treasurers and finance directors

Beyond fulfilling the typical responsibility of financial operations and reporting, treasurers and finance directors must ensure compliance with the Charities Act and the Code of Governance for Charities and IPCs. Additional duties include maintaining donation records and making annual submissions to the Commissioner of Charities.

Unlike for-profit organisations, charities have the added responsibility of managing reserves. This can potentially introduce conflicting priorities and goals.

Priorities behind managing reserves

Liquid emergency cash

A 2021 report by the Commissioner of Charities revealed a decline in donations for certain charities during the pandemic. Despite a fall in donation income, operational costs such as rent and staffing, persisted. Charities with adequate liquid emergency funds would be better positioned to support their beneficiaries.

Inflation hedging

Inflation in 2023 remains high. NPOs are expected to absorb these rising costs as their services are usually provided for free. To maximise their funds, NPOs should proactively seek donations and consider investing spare reserves to counteract inflation.

Growing reserves for future needs

Many NPOs aim for self-sufficiency, desiring less reliance on donations.

NPOs might limit their reserves to a fixed amount, which is often three times their annual operational expenditure. Depending on their investment strategy for reserves and restricted funds, they might also explore higher-returning asset classes to future proof their services.

Financial stability and accountability

As stewards of charitable donations, financial managers should maintain strict adherence to sound financial management practices to maintain accountability to donors. Finance managers must prudently manage annual budgets and reserves, ensuring resources align with donors' intentions.

Getting started with Investment Policy Statements

Why establish an Investment Policy Statement

An Investment Policy Statement fosters alignment among charity stakeholders, including the executive committee, board of directors, finance and investment committee, and any external investment managers. A clear statement also helps when sourcing, comparing, and assessing external investment managers, as well as evaluating their performance.

Key components of an Investment Policy Statement

An Investment Policy Statement has several parts to it, typically including:

Roles and responsibilities: Defines the duties of the Investment Committee and the Executive Committee/Board of Directors.

Investment objectives, risk tolerance, and time horizon: Details investment goals, expected returns, return types, maximum drawdown limits, volatility, and holding periods.

Asset allocation and investment limits: Describes allowable asset classes, allocation limits, and acceptable investment instruments. It also includes risk management specifics.

Reporting and monitoring: Indicates the frequency and content of updates from the Investment Committee to the Executive Committee/Board of Directors. Significant drawdowns and their causes may also need investigation.

Socially responsible and ethical investment: Highlights any ESG investment approach, including industry exclusions or adherence to specific ESG frameworks like the Sustainable Finance Disclosure Regulation (SFDR) developed by the European Commission.

Investing into liquid, low-risk products

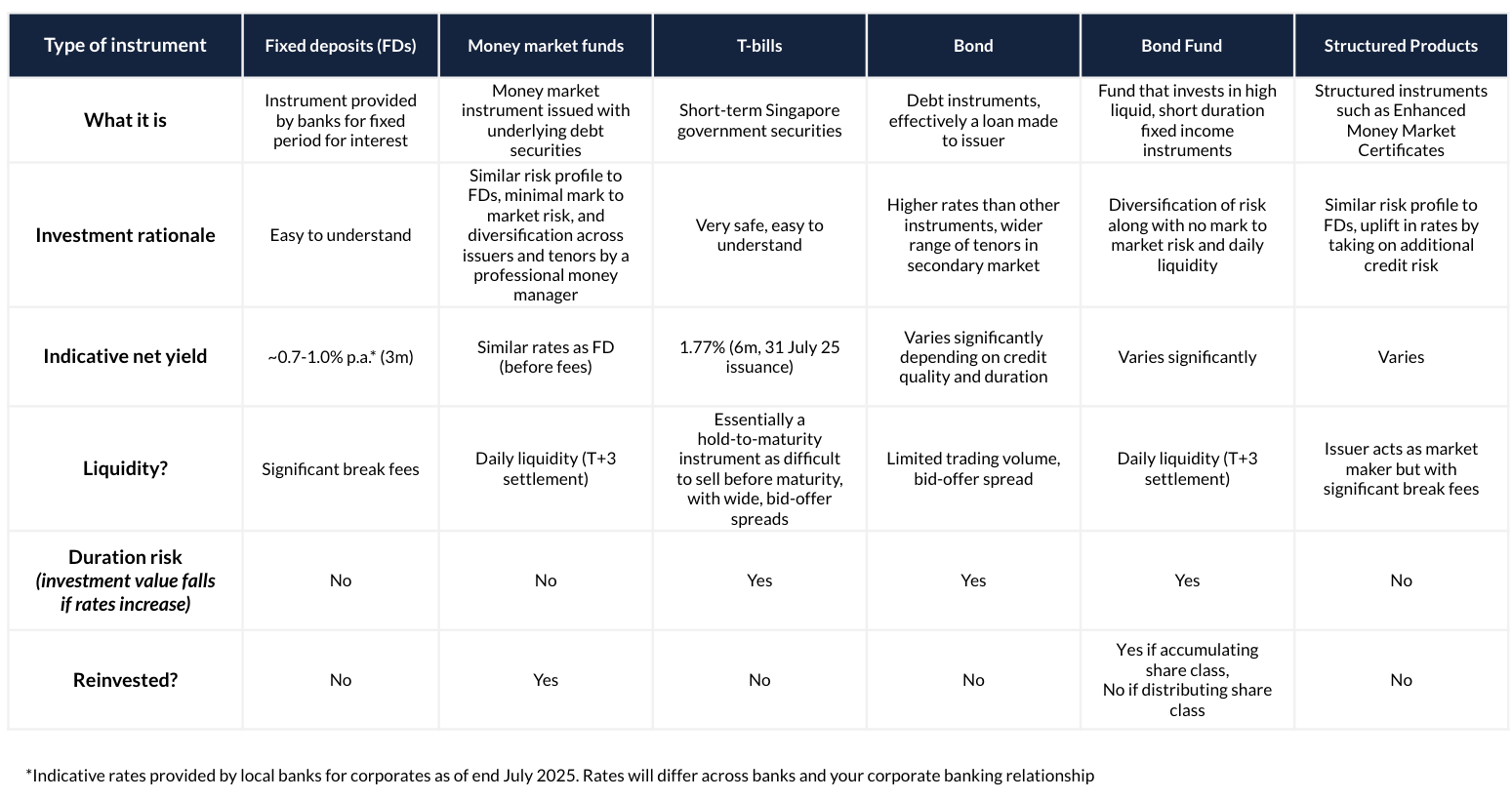

Beyond reviewing common products such as fixed deposits, finance managers have various low-risk alternatives to consider for reserve safeguarding. Trade-offs among yield, flexibility, and risk always exist.

Money market funds are particularly attractive as they invest in diverse low-risk assets such as banks' fixed deposits, and treasury bills.

Choosing Endowus as the right investment advisor for holistic advice

The responsibility of managing the charities’ budget, finance operations, and reporting can often take up a large part of the finance and treasury teams’ time and effort. For most charities, it would be more sensible to outsource investment advisory services to an external advisor to utilise their expertise in investment products and performance reporting.

Here are some factors to consider when choosing the right financial advisor for your charity:

Investment advisory services

To ensure that your charities’ financial needs, risk tolerance, and return expectations are carefully taken into consideration, you would need an experienced team that has managed investments for charities before. Preferably, there would be a client advisor and an investment advisor working together to distil your goals into a coherent investment strategy.

Safety of assets

Ensuring that your charities’ assets are safely held and properly accounted for is also important for a finance manager. It is more secure to have your charities’ assets held or custodised in your own entity’s name, minimising the risk of them being misused or misappropriated by any financial intermediary. This also makes it easier to verify your actual account investment holding details with the custodial bank.

Competitive, transparent all-in fees

Charities should also receive unbiased financial advice from an advisor that has no conflict of interest. Unfortunately, a study from Morningstar showed that the majority of fund products in Singapore are embedded with trailer fees.

An appropriate remuneration model would be for the advisor to charge on a fee-only basis, through which the advisors can only be paid by the client.

Engage Endowus to find out the best approach to managing your reserves

Managing a charity’s reserves is a multi-faceted, complex responsibility that requires careful stakeholder management, risk and returns monitoring, and working with new financial products and partners.

To maintain the value of your reserves in a high inflation environment, it is essential for charities' CFOs and corporate treasurers to be more proactive in exploring new advisory solutions.

Endowus Treasury Solutions offers a comprehensive and efficient platform to address these challenges, with dedicated relationship managers and institutional advisory services to guide your charity in taking a deliberate, informed approach to investing your reserves.

To find out more, please contact us at institutional@endowus.com.

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)