Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- To open a SRS account in Singapore as a foreigner, one must be 18 years old, not be an undischarged bankrupt and have earned income liable to income tax.

- The maximum SRS contribution limit for foreigners is capped at S$35,700 per year.

- Full SRS withdrawals are without penalty if made after the retirement age, or after 10 years from first SRS contribution

With soaring rental costs, high costs of ownership of cars and expensive private school fees, Singapore can be an expensive place for expats to live in. The Supplementary Retirement Scheme (SRS) can be one way for expats working in Singapore to defer taxes paid on income earned.

To make the best use of SRS though, expats will need to understand the rules specified for foreigners. That’s especially so when it comes to understanding:

- The penalty on early SRS withdrawal;

- Which tax rates will apply at the point of withdrawal;

- How withholding taxes are imposed on SRS withdrawals.

This article should not be treated as tax advice, and note that any SRS withdrawals you make may still be liable for taxes if you are a tax resident in other jurisdictions.

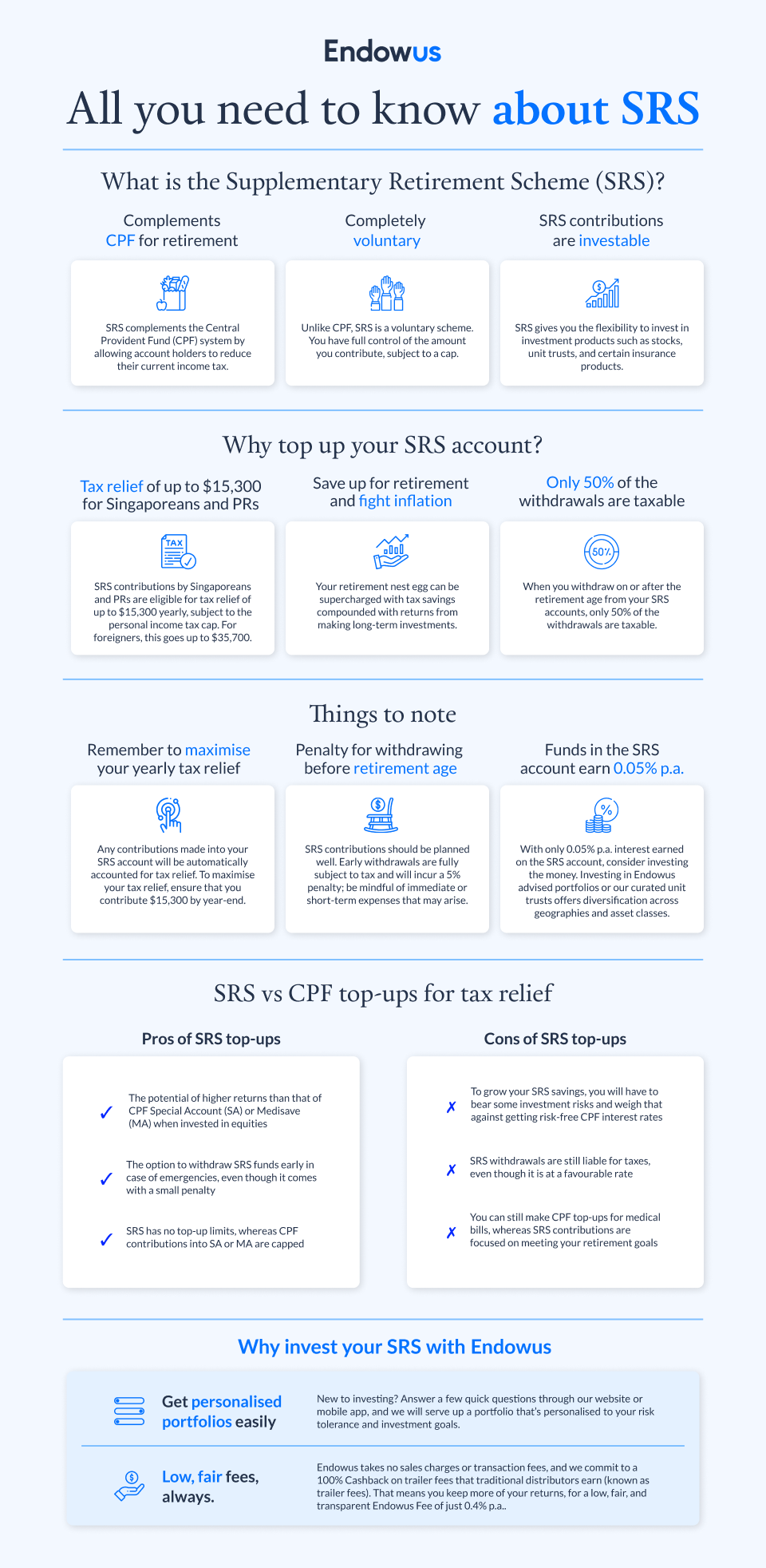

What is the Supplementary Retirement Scheme (SRS)?

SRS is part of the Singapore government’s scheme to help Singapore tax residents (including PRs and foreigners) save more for their old age.

There are two parts to the tax incentive from SRS. Firstly, the scheme allows you to postpone how much you should pay on your tax bill now. Secondly, it allows you to pay less tax later at the point of withdrawal and penalty-free — provided you meet certain conditions.

Expats may be familiar with similar schemes in other countries such as the 401(k) in the US, the Self-Invested Personal Pension (SIPP) in the UK, or Private Retirement Scheme in Malaysia.

In Singapore, SRS allows foreigners to contribute up to S$35,700 for tax relief. Any contribution will reduce your taxable income, up to the total cap on personal income tax relief of S$80,000.

How is an expat’s tax calculated in Singapore?

In Singapore, a foreigner holding a profession and who has stayed and worked in Singapore will be treated as a tax resident for the year of assessment if they have:

- Lived or worked here for at least 183 days in the previous calendar year;

- Lived or worked here continuously for 3 consecutive years (even if the period of stay in Singapore may be less than 183 days in the first year and/or third year); or

- Worked here for a continuous period straddling 2 calendar years and the total period of stay is at least 183 days.

An expat is therefore subject to paying taxes based on the progressive nature of Singapore’s income tax system — the more you earn, the higher your tax bracket. The Endowus SRS tax savings calculator can be used to find out how much you can save on income tax.

Taxes on SRS withdrawals for foreigners

With all that savings in your SRS accounts, the next natural question is when you can withdraw them. SRS is designed such that account holders will incur a 5% penalty if they withdraw the money out before their retirement age — this penalty applies to all, be they Singaporeans or foreigners.

Foreigners are allowed to withdraw penalty-free before their retirement age, but only if they withdraw their SRS savings ten years after they have started an active SRS account (i.e. so long as a dollar is held in the account). They must also withdraw their SRS savings in full. The tax discount — in the form of taxing just half of the SRS withdrawal sum — still applies.

Where there is also extra complication is how much expats will be taxed. This depends on whether you are a Singapore tax resident at the point of withdrawal. If so, you will be taxed based on the progressive tax rate followed by residents.

If not, you will be taxed differently, depending on how much you withdraw that year, and how much income you are earning at that point. The chart below sets out the flow and details:

Note while you might be charged a withholding tax for your SRS withdrawal, the withholding tax is not the final tax payable for you. Based on your tax residency status, you may be charged differently on your final income tax. You can file an income tax return form for your actual tax liability to be computed and unused tax credits to be refunded.

SRS and withholding tax

The only main difference to note is that withholding taxes are imposed on expats withdrawing their SRS sums. If a foreigner or Singapore Permanent Resident withdraws cash/investment from his or her SRS account — 50% or 100% of the withdrawn amount, depending on the type of the withdrawal — will be subject to a withholding tax.

The SRS bank operator will withhold an amount of tax at the prevailing non-resident tax rate of 24% at the point of withdrawal. This sum will be remitted to IRAS.

The withholding tax is not the final tax payable. Tax withheld on the SRS withdrawal is a tax credit that will be used to offset your actual tax liability. This means any unused tax credit will be refunded to you.

Should you use SRS for tax relief as a foreigner?

A sensitivity analysis may help to decide what is the right tax bracket and contribution amount for expats. Here are the key assumptions in our sensitivity analysis. We are comparing under what scenario will a foreigner have more wealth after 10 years: using SRS for tax relief and investment, or just investing money after income tax.

Before we dive into the sensitivity analysis, let’s illustrate how it works using an example.

Meet expat John, who is in the 11.5% tax bracket

Here’s a case study of John, who currently is earning $100,000 after all other tax relief (putting him in the 11.5% tax bracket). If he does not contribute $35,700 to SRS, he will only have $31,595 (post-tax monies) to invest.

He will manage to save and build up $480,013 without SRS contribution.

However, if he were to use SRS contributions, he would be able to invest a larger amount, although he will be liable for tax after 10 years.

If he manages to remain a Singapore tax resident, he will end up with $507,555 after taxes, a gain of $27,542.

However, if he becomes a non-SG tax resident, he would not be able to qualify for the concessionary withholding tax rate as he has a sizeable withdrawal amount of above $200,000. He would still end up with $482,725 after taxes, a gain of $2,712.

What is the SRS sweet spot for foreigners?

The coloured figures in the sensitivity table denote the losses or gains from SRS contributions for expats at the corresponding tax bracket and SRS contribution amount. The tables show how to identify John’s gains/losses from SRS contributions, at a 11.5% tax bracket, and with $35,700 annual SRS contributions.

Practically, unlike John, you may not work in Singapore for 10 years. You may only work for 5 years and hence contribute and invest your SRS for 5 years. To enjoy penalty-free withdrawal, you will only withdraw after another 5 years. This gives you the option to contribute more aggressively without exceeding the $200,000 threshold, which will lead to higher tax rates.

If you are at or above the 11.5% tax bracket, you should seriously consider contributing the full $35,700 into your SRS account, provided that you have no short-term cash needs. Your financial circumstances may change in the future, but later on, you can choose to reduce your SRS amount accordingly.

One important assumption in these analysis is that John has no other sources of income at the point of withdrawal, as the income taxes can be taxed at the progressive tax rates.

Learn more about SRS investment options next.

Should a new Singapore Permanent Resident make voluntary contributions to CPF accounts?

Understanding the different returns for CPF SA through a MCQ question

Webinar: Tax hacks: Pay less tax with CPF & SRS top-ups

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)