Passive Income investing should be more than just high yield

In a recent survey conducted by Endowus with 902 respondents, 83% would like to have an income portfolio. It is surprising that while 75% of them want to preserve their capital through their income funds, more than half the respondents want a high yield of 5% and above.

In this article, we would like to share with you how Endowus selects best-in-class income funds, and how you can make use of the same principles and thought process when choosing your own funds — either through Endowus Fund Smart or even with ETFs such as Lion-Phillip S-REIT ETF.

What is an income fund?

An income fund is an investment vehicle (typically a unit trust or an ETF) with an investment mandate prioritising returns in the form of cash payments from its underlying investments. This will be in the form of coupons for fixed income funds or dividends from equities funds.

Each fund manager pools investors’ money to invest in a diversified basket of securities, and each fund is professionally managed by an investment management company, with its own investment objectives and strategy.

Types of income funds

Income funds can have different investment mandates, investing in different underlying assets or asset classes. The following type of funds may be considered as an income fund:

- Money Market Funds

- Fixed Income/Bond Funds

- REITs Funds

- Infrastructure/ Real Asset Funds

Appeal of income investing for passive income

As the payouts from the income funds are automated, passive investors just need to commit to an initial capital or investment, do an initial due diligence of choosing the appropriate income funds. The dividends earned from the funds later on will be a form of "passive income" as there is no active management or efforts put in.

Learn more about investing in REITs beyond SGX here

What are the fund selection criteria for income funds?

We have summarised the key criteria in 3 “C”s when selecting an income fund, and they are: Investment Capability, Payout Consistency and Cost.

Investment Capability of the Income Fund Managers

Investment capability is always the most important thing when selecting any actively managed funds. It provides investors the conviction that the fund is in good hands, and will run its course in line with stated objectives and deliver its expected returns and risk. Assessing a fund manager’s investment capability involves both quantitative and qualitative analysis.

For quantitative analysis, it starts with an understanding of the fund’s objective. In this case, one should be looking for funds that have clear income objectives. Usually, different funds target different levels of outperformance against different reference benchmarks given a set level of risk budget, so quantitatively investors should compare the fund’s historical performance and risk against the reference benchmark and see whether it has fulfilled what it set out to achieve. It is true that past performance is not an indicator of future performance, but for an actively-managed fund, if it is consistently unable to deliver its performance target, it casts doubt on the capability of the investment team.

But one should indeed look beyond just numbers and gain an understanding about the investment team and investment process of a fund. For qualitative analysis, the average tenure, turnover and size of the investment team shed light on how committed and well-resourced the team is to the fund. Characteristics of a good fund is that it has a deep bench of portfolio managers and analysts that are with the strategy for a reasonably long period of time, and that they have an effective pattern of idea-exchange and collaboration. Recent team shuffles and portfolio manager changes would be a red flag to inquire further on.

The investment process then helps us understand how investment decisions are made. Generally funds with a structured investment process would be preferred; examples of this include the use of a common research template amongst analysts, the use of quantitative scorecard and a disciplined downside risk management process. These defined steps usually greatly removes key man risk — meaning high decision-making dependency on one key person — and ensures that the investment process is repeatable and the investment philosophy can be coherently exercised by everyone in the team.

Consistency and source of payouts

An additional dimension of assessing income funds is its payout consistency, both historically and on a forward-looking basis. This is achieved by selecting funds that have been able to deliver a stable payout, and can sustain its payout going forward. Related to this, it is really important to make sure that one understands the payout structure of the fund.

In particular,

1. Does the fund pay out of capital?

2. Is the payout on a gross or net of fee basis?

3. What is the frequency of the payout?

4. Does the fund pay a fixed or variable percentage or amount?

The first question above is perhaps the most important one, while the remaining questions ensure that investors set the right expectations of where the fund-level cost is deducted (before or after distributions), when to receive the income stream, and the level of fluctuation of the income stream.

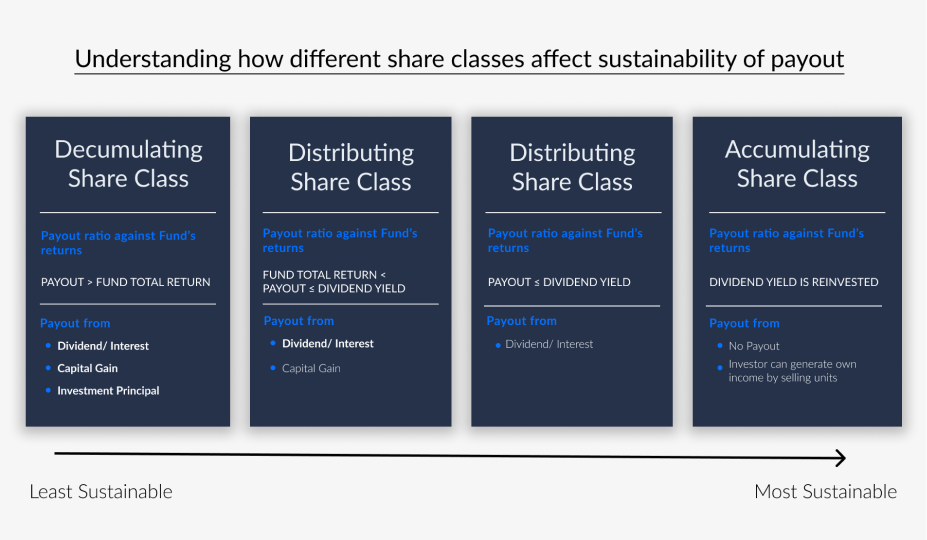

A fund can either just pay the dividend or coupon collected from the underlying investment, or supplement these with capital gains, or sometimes even the principal (the capital from investors). The rule of thumb when deciding what sources the fund is using to pay investors can be illustrated in 4 different scenarios:

Scenario 1:

If annual payout > annual total return, then the fund is paying out of dividend/coupon, capital gain and principal investment. This is a decumulating share class of an income fund.

Scenario 2:

If dividend/coupon yield < annual payout < annual total return, then the fund is paying out of yield and capital gain.

Scenario 3:

If annual payout <= dividend/coupon yield, then the fund is paying out of dividend/coupon only. For scenarios 2 and 3, the income funds are distributing share classes of income funds.

Scenario 4:

If the dividend/coupon yield is reinvested into the fund’s assets, then it is an accumulating share class of an income fund and there are no distributions unless an investor decides to redeem partial units as a form of payout.

It is generally fine if the fund is supplementing the payout with capital gains, but it would be worrying if the fund continuously supplements the payout using principal, because essentially the fund is paying the investors with their own money. One way to check this is to look at the historical NAV (net asset value) of the fund, and see whether it has been increasing (Scenario 3), stable (Scenario 2), or decreasing (Scenario 1), assuming no major drawdowns in the underlying assets.

Cost of fund — fund management fees and platform fees

Finally, a key, but often overlooked criteria when selecting funds is the cost of the fund. The cost of the fund comes in different forms, and depending on where you purchase the fund, it would include the upfront sales charge, the total expense ratio of the fund, and embedded in the total expense ratio: commissions that one pays to the distributor called trailer fees. One should always strive to build a low-cost portfolio as much as possible for the simple reason that costs eat into one’s return. An extra 1% of cost per year on an income fund means that one gets 1% less income annually, and this amounts to a significant amount over a period of time.

How can Endowus help?

Endowus was built around making investing easier for common investors like you and me, so that we can fulfill our financial needs and live better. We understand the pain points in investing as a retail investor, so we set out to solve them.

The biggest challenge when selecting funds is information asymmetry — retail investors have access to a lot less information compared to large institutions and the fund managers themselves. Usually the key reference materials for a retail investor are fund factsheets, Product Highlights Sheet and Prospectus.

Outside of these regulatory documents, and perhaps a few free but simplistic fund comparison websites, there is virtually no free resources left. How can one even come close to a conclusion as to the quality and suitability of the fund with such scarce information? We believe that investors should not make blind decisions based on limited information, so our investment office has taken on the role of an institutional investor on behalf of our clients to conduct holistic due diligence on fund managers and funds, equipped with multiple databases and direct access to fund managers.

Additionally, Endowus has pioneered in lowering the cost of investment to the best we can. There is no upfront sales charge, and we rebate 100% of the commissions for distributing funds (trailer fees) back to our clients, so that they can enjoy the lowest cost possible. Endowus also provides access to institutional share classes of funds — usually only institutional investors who can invest a large amount of assets (>$1mn) can enjoy such low-cost share classes, but Endowus has made it possible for retail investors to access the same share classes on its platform.

Endowus has recently approved and onboarded 11 new funds on its Fund Smart platform, including a number of income-focused funds, at the lowest cost possible.

You can learn more about these funds from our webinar and start investing now.

%20F1(2).webp)

%20(1).gif)

.webp)

.webp)