Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- Investing your red packet (hong bao or ang bao) money early allows it to multiply its original value with minimal effort

- Teaching our children about passive money is important. It ensures they take ownership of and are responsible with their money, and can build positive habits towards a strong financial foundation.

- Our children will thank us for investing their ang bao money on their behalf, so that it yields long-term compounding returns during their formative years.

This article was originally published in February 2021. We’ve updated it in February 2026.

Start inculcating the right financial values from young

Before the age of 15, I had a money diary that my mom would keep in her safe, of the money I received during Chinese New Year (CNY). At the end of every long day of house visits, I would run to her room, get my money diary, and stack bills and coins in piles, ready to count and put them in my ledger.

At some point, this ledger was finally replaced with a bank account. But it had not grown passively over almost two decades of accumulation — in fact, it didn't even grow at bank interest rates.

I remember setting up my first bank account and immediately being pushed to buy some "hot" funds of that period. Not knowing any better, I paid a sales charge and bought some products from the banker at our local branch, to put my capital in the markets.

Years went by. I’ve changed the funds a few times, but have not really used this bank account since — and it has not grown much at all, unsurprisingly.

Reflecting on this experience, I identified two points of failure:

- To my loving parents (who may chance upon this article), the act of saving was taught, but not the simple principles of inflation, interest, and compounding wealth.

- To me, I had the opportunity to reverse the fate of this money once I learnt how to invest, but turned a blind eye in my frustration and did not give it the care and attention it needed to be put on the right course.

What if you had invested your ang bao money earlier?

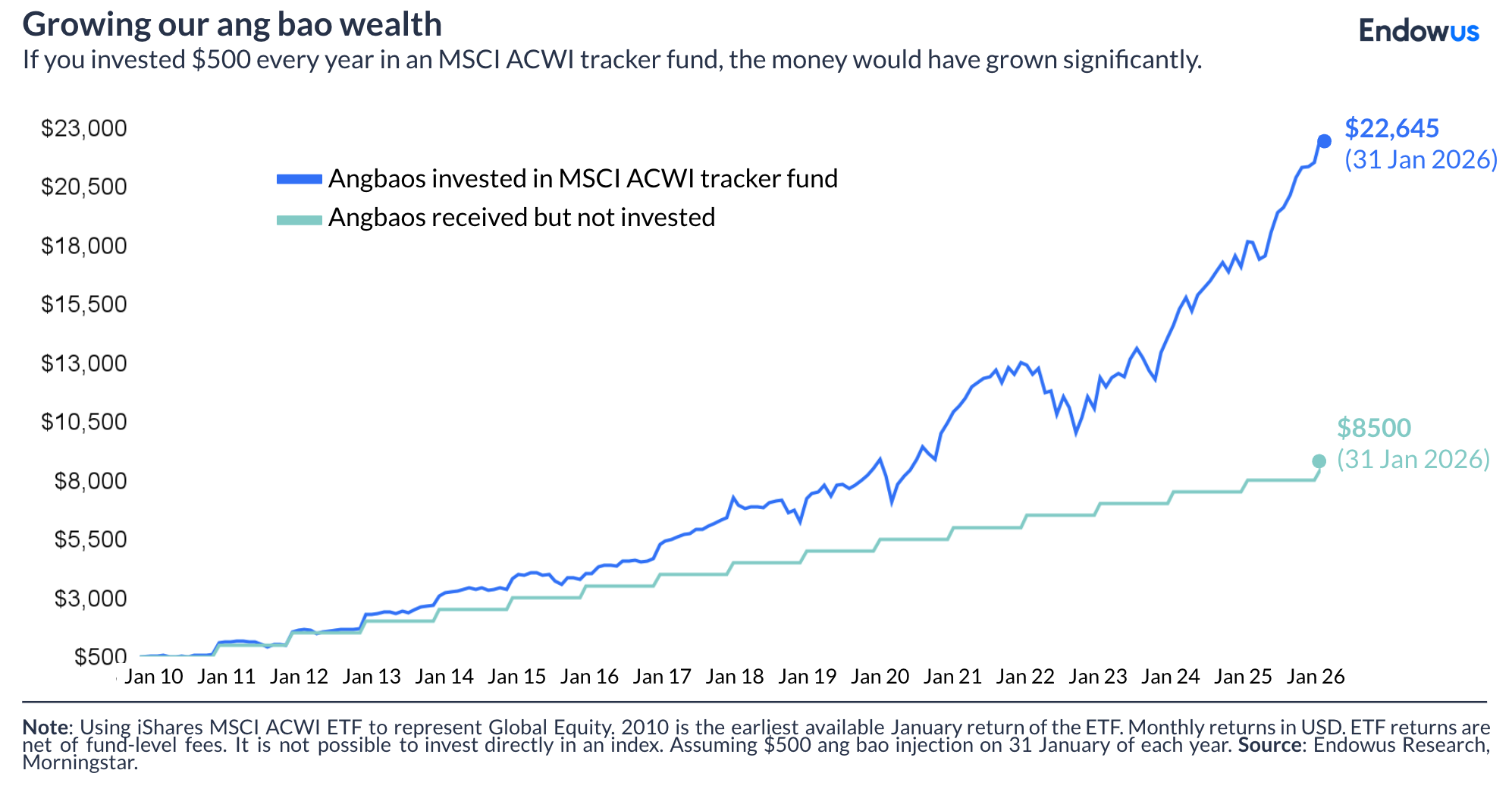

Doing some quick maths, someone who has invested their ang bao money in a MSCI All Country World Index (MSCI ACWI) tracker fund, which comprises large and mid-cap stocks across developed markets and emerging markets, from 2010 would have a portfolio value in Jan 2026 that is 2.7x of what it would have been if they were to merely save it.

Let's attach some numbers to this example to make it more tangible:

- Assume that they received S$500 in red packets every Lunar New Year from generous relatives and friends, from Jan 2010 to Jan 2026. That brings their total ang bao money collected to $8,500 to date.

- They diligently invested this money in a fund that tracks the MSCI ACWI tracker fund since 2010. To keep it simple, given that every CNY falls on different dates, let's assume that the $500 injection was made on 31 Jan of each year.

- If left untouched, their portfolio would have about $22,645 today.

Read more: Four investing myths to debunk for budding investors

Putting our children’s ang bao money to work

Fast forward to today — I now have three kids of my own.

The past CNY, my oldest child counted her money next to our bed in the morning and wrote down the total on a post-it. She handed it over with the cash and gave it to me for safekeeping.

We invest so much time, money, tears, joy, and love in our children. We should really help guide them through some of life's more uncomfortable realities, like money.

It got me seriously thinking about how I can empower her to be better with money so she can pursue her life ambitions in her control.

When she is of age, I will teach her some foundational principles about passive money, such as:

- The power of compounding interest

- What to expect in terms of volatility to achieve higher expected returns

- The benefits of diversification and keeping costs low

But for now, as she has entrusted me with her money, I have set up an investment goal for her hong baos so that her money can get to work, and these generous gifts from relatives and friends are utilised to empower a better future.

As we usher in the new year, make a commitment to invest in your future-you. Start early and let your wealth compound over time.

Investing doesn’t have to feel overwhelming. Endowus makes it simple to begin investing with as little as $1,000. Our guided setup walks you through a few questions about your goals and risk comfort, then recommends a suitable portfolio for you—invest with clarity today.

What to know about and do with CPF as a fresh graduate

.png)

Money Diaries — A "Money Optimiser" with a wedding to plan and a house to buy

Money Diaries — Everyday Singaporeans and their money

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)