Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

Concerns over an “AI bubble” causing a pause in the markets

Global equity markets ended November with relatively muted performance, while global fixed income delivered moderately positive performance on a local currency basis. However, under the surface, anxiety surrounding equity valuations, particularly for the AI-driven tech sector was high.

Nasdaq peaked at the end of October (29 Oct) and subsequently corrected circa 9% until it troughed in 21 Nov and recovered much of its losses by end of the month. There were renewed concerns over an “AI bubble” forming particularly amid uncertainty around monetary policy amid a lack of economic data.

Strong Q3 earnings and softer labor data helped with a rally later in the month of November.

It is interesting to note that one of the worst performing asset classes for the month was Bitcoin, which was down 17% for the month (decoupling from Gold which rose 6% for the month).

The USD was relatively flat (-0.35%) for the month and has recently been exhibiting negative correlation to risk assets, particularly Nasdaq.

Global equity

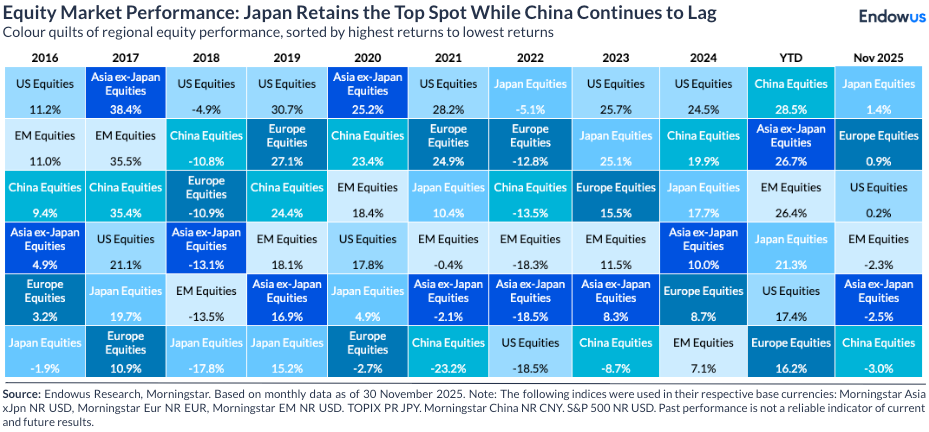

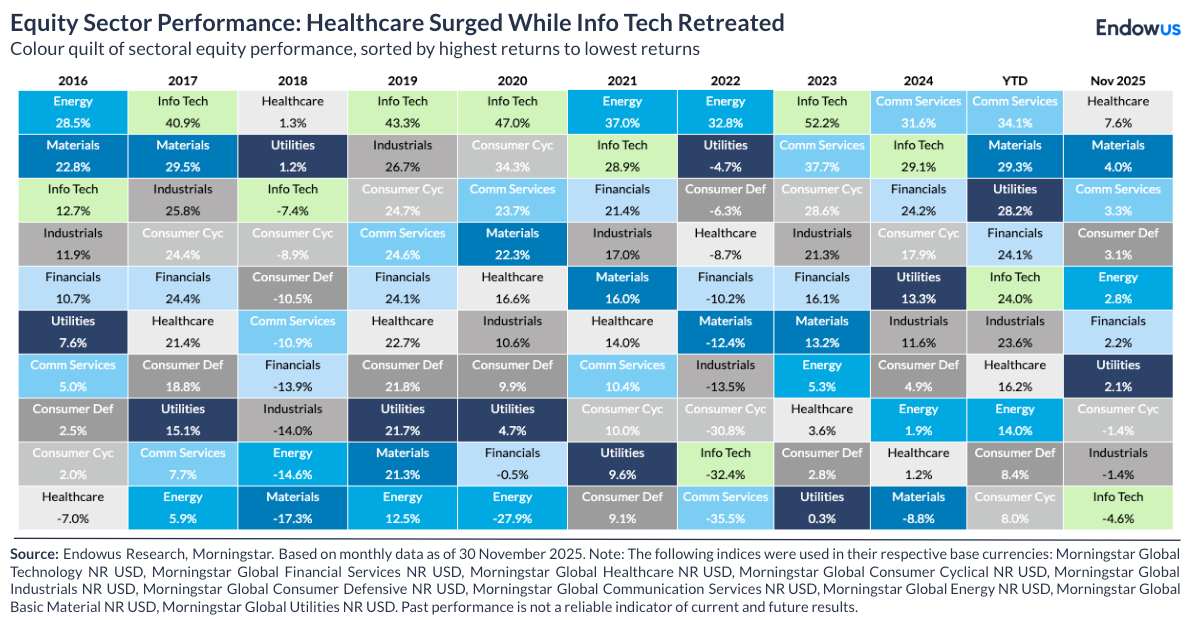

Global equities fell 0.3% on an SGD basis (flat on a USD basis) in November. The softness was mainly driven by the tech sector, which fell 4.6% for the month, while other laggard sectors like healthcare rose 7.6%.

On a regional basis, following its strong year-to-date performance that peaked in early October, China equities saw a pullback, down 3% in November. Similar to India and European equities, Japanese stocks fared well on a local currency basis, despite continued weakness of Japanese yen against SGD.

On a sector basis, healthcare and biotech continued to perform well over the last few months as a 1H25 laggard and a compounding sector with more reasonable valuations.

Materials also performed well, thanks to the strength of Gold, Silver, and Copper which led the commodity index despite the weakness in Brent.

Global fixed income

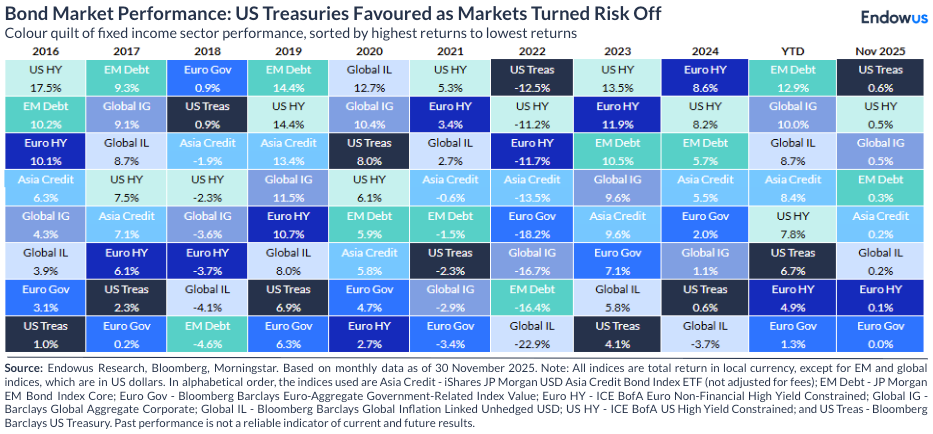

Fixed income delivered positive performance on a local currency basis, thanks to lower interest rates with 10-year treasury falling 6 basis points (bp) to 4.01% for the month and two-year treasury falling 8 bps to 3.49%.

After the US Federal Reserve cut rates by 25 bps at the end of October (following a 25 bp cut in Sep), there was a period of lull amid lack of recent data. Moreover, when the October Fed minutes came out in mid November, it showed more dissenters to the rate cut than before, which questioned another rate cut in December.

Subsequently, we saw a delayed release of the weak September unemployment numbers (4.4%) on 21 Nov, which provided a mini pivot in December rate cut probabilities as well as a recovery in equity markets.

US treasuries was the best performing sub-asset class in fixed income in November as spreads slightly widened. Treasuries outperformed investment grade bonds, and investment grade bonds outperformed high yield bonds.

Commodities

The commodities index rose 3.6% in November, thanks to the strength of Gold (+5.9%), Silver (+16.0%), and Copper (+2.8%) which are the three largest constituents of the commodities index. This was achieved despite the weakness in Brent (-2.9%) which is the 4th largest contributor to the index. The index rose 10 out of 11 months this year largely thanks to the strength of Gold and Silver.

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)