Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

The global private credit market has grown to over US$3 trillion in assets, with projections reaching $5 trillion by 2029¹. Direct lending, the largest segment at approximately US$1.7 trillion, continues to deliver compelling yields of 8–10%—but the landscape has shifted meaningfully from the more favourable conditions of 2022–2023.

Private credit funds delivered solid performance through 2024–2025. The Cliffwater Direct Lending Index posted an annualised yield of approximately 9.8% as of Q3 2025, down 1.64% from 11.40% one year ago, largely due to five Fed rate cuts totalling 1.50%².

Spread compression is the defining trend of this cycle. First-lien transactions that commanded SOFR +600–700 basis points in 2022 now price at SOFR +475–550—a compression of 100–125 basis points³. The premium over broadly syndicated loans has narrowed to approximately 170 basis points from a historical average of 244 basis points⁴.

For investors who deployed capital during 2022-2023's market stress, hindsight confirms those were exceptional entry points. Spreads were wider, covenant protections stronger, and valuations more attractive. However, waiting for perfect conditions often means missing out on the opportunity entirely.

A common question we are hearing is whether to still invest in private credit despite yield conditions no longer being at the 2022-2023 peak. The answer, in our view, is yes—though with tempered expectations and careful manager selection.

Benchmarking private credit funds' performance: Setting realistic expectations

Investors entering private credit today should calibrate return expectations accordingly. Should base rates continue to decline as anticipated, floating-rate income will compress further. However, the case remains strong when compared to available alternatives:

- Versus investment grade corporates: Private credit offers a 400–600 basis point premium with senior secured positioning.

- Versus high yield bonds: Private credit provides 100–300 basis points additional yield with lower historical default rates.

- Versus leveraged loans: Private credit maintains a premium while offering better credit selection and downside protection.

Critically, these comparisons improve further on a risk-adjusted basis. Private credit's lower volatility, reduced correlation to public markets, and stronger recovery rates mean that investors are compensated more per unit of risk taken. Research suggests adding private credit strategies to diversified portfolios can improve Sharpe ratios—a benefit that persists even as absolute yields moderate5.

Read more: What role does private credit play in long-term portfolios?

Credit quality: The real story behind the numbers

Private credit funds are often praised for their safety, with reported default rates hovering around 1.8–2.7%, much lower than the 4–5% seen in similar bank loan markets6. However, the official default rate doesn't capture the full picture. Two key "hidden" risks are important to watch:

- "Shadow Defaults" (Payment-in-Kind): More borrowers are using "Payment-in-Kind" (PIK) to pay interest—meaning they pay with more debt instead of cash. Data shows over half of current PIK deals were not planned at the start.7 If we count these distress-driven changes as defaults, the "true" default rate may be closer to 6%.8

- Cash Flow Pressure: Roughly 37% of companies in these portfolios are essentially spending all their earnings just to pay interest, leaving little room for error.9

The bottom line is that not all loans are created equal. Smaller "middle market" loans (under US$350M) are generally safer because 97% of them have strict rules ("covenants") that force companies to fix problems early. Middle market loans retain meaningfully stronger protections.

Portfolio positioning: Why private credit investing still makes sense

For investors questioning whether they "missed the window," we would offer a different framing. The optimal entry point for any asset class is only knowable in hindsight. What matters for portfolio construction is whether the risk-adjusted return profile justifies allocation today.

Several factors support continued allocation to private credit:

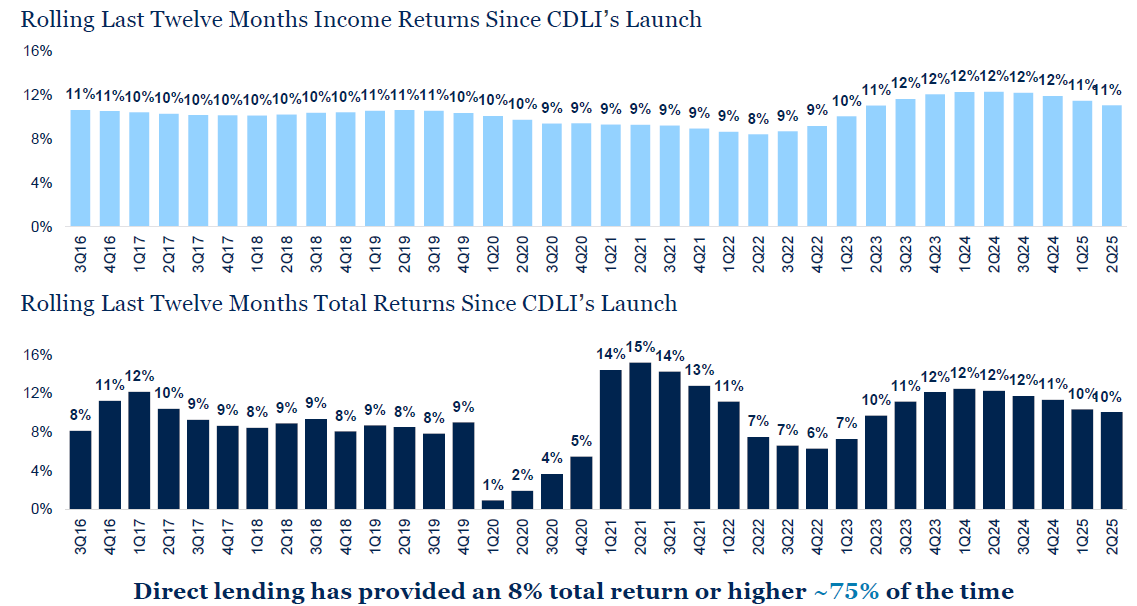

Absolute return levels remain attractive compared to public market. Net yields of 10-12% exceed historical averages and offer meaningful premiums over investment grade corporates (4-5%), high yield bonds (7-8%), and leveraged loans (8-9%).5 This "illiquidity premium" has remained remarkably stable despite the rise in private credit's popularity. Below are two bar charts showing the rolling last twelve months income and total returns of the direct lending benchmark index Cliffwater Direct Lending Index as of June 2025.

Diversification benefits persist. Private credit exhibits lower correlation to traditional equity and bond portfolios. Research suggests Sharpe ratio improvements of 15-25% from adding private credit to diversified portfolios.10

Income generation provides stability. Contractual cash flows and quarterly distributions offer predictable income streams less dependent on market sentiment than public fixed income.

Credit loss advantages are structural. Default rates one-third those of public alternatives and first-lien secured positioning provide genuine downside protection.

The key insight is recognising private credit's evolution from a yield play to a portfolio construction solution. Rather than chasing the highest possible returns at peak market stress, investors should evaluate private credit's role in generating consistent risk-adjusted income with defensive characteristics.

Invest with clarity: Access private credit solutions with Endowus Singapore

At Endowus Singapore, our investment philosophy is built on the pillars of transparency, conflict-free advice, and evidence-based wealth management. We believe that accredited investors deserve the same institutional-grade access and fair fee structures traditionally reserved for the ultra-wealthy.

Ready to enhance your portfolio's income potential? Schedule an appointment with us and verify yourself as an Accredited Investor (AI) to learn more about our Private Wealth Solutions, exclusive to AIs only.

<divider><divider>

Sources

- AIMA/Alternative Credit Council, "Financing the Economy 2024" ($3 trillion global private credit); Morgan Stanley, "Private Credit Outlook: Estimated $5 Trillion Market by 2029"; Preqin Global Report: Private Debt 2025 ($1.7 trillion direct lending)

- Cliffwater Direct Lending Index (CDLI)

- Lincoln International Private Market Index Reports 2024; KBRA Direct Lending Deals (DLD) Database

- Hamilton Lane, "Private Credit Viewpoints 2024"

- Cliffwater Direct Lending Index; Bloomberg indices for IG corporates, HY bonds, leveraged loans

- Proskauer Private Credit Default Index Q3 2025; Fitch Ratings US Leveraged Loan Default Index; S&P Global Ratings

- Lincoln International Q1 2025 data (56% of investments with PIK interest did not have PIK at underwriting)

- TCW, "The Big PIK-ture" (August 2025)

- Lincoln International, "Lincoln Private Market Index Q3 2024" (BusinessWire, November 2024)

- Hamilton Lane research on portfolio allocation benefits

.webp)

%20(1).gif)

%20(1).jpg)

.jpg)

.jpg)

%20F1(2).webp)

.webp)

.webp)