Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

Our Thoughts

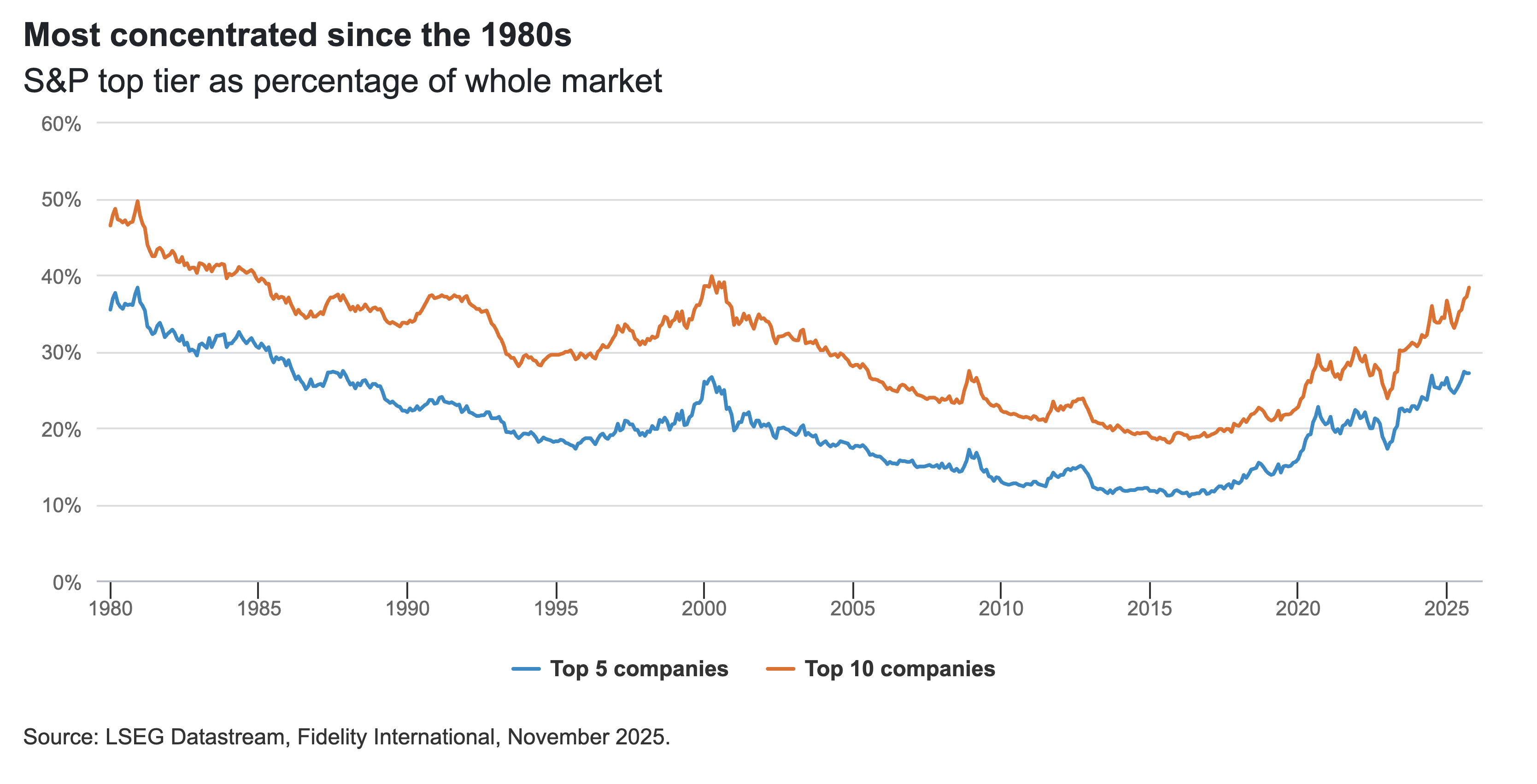

By late 2025, artificial intelligence (AI) has cemented itself as the defining force in global technology. The Magnificent 7 still dominates market performance — Nvidia even crossed US$5 trillion in value — but concentration risk is high with AI stocks, and monetisation of AI remains inconsistent. Crucially, new challengers like China’s DeepSeek are reshaping the landscape with efficient, open-source reasoning models, proving that leadership in AI is no longer confined to Silicon Valley.

For investors, the path forward is clear: balance conviction in AI-led growth with diversification across geographies and market caps to capture upside while managing risk. At Endowus, we believe exposure to AI may be best expressed within broader, diversified technology funds that balance innovation with quality and risk control.

The recent surge in AI investment that dominated markets over the past year may continue to drive earnings higher, but profit outcomes are uncertain and risks are rising. Hence in the year ahead, Fidelity International is broadening the search for opportunities beyond predictable plays. Here, Fidelity’s team highlights four convictions to help guide investors in the Year of the Horse.

1. The AI-led surge will continue.

At US$21 trillion, the total market value of the US tech sector reflects how much of today’s market optimism rides on AI1.

Despite this over concentration, there are strong indications on the ground that the AI investment surge will continue and the growth outlook for tech is improving. A year ago, only 26% of Fidelity analysts expected AI to improve profitability in 2025. Since then, that proportion has doubled, with nearly half of the respondents now anticipating a positive profitability impact from AI. According to Fidelity’s analysts, the bigger debate isn’t “Is AI a bubble?” but rather, “Can AI leaders sustainably deliver future earnings to justify current valuations?”

2. AI winners extend beyond hyperscalers.

While hyperscalers command massive cashflows, opportunities abound across the vast ecosystem including businesses supplying the hardware, software, and infrastructure that make AI possible.

Software players that are embedding AI into their systems will be very well placed to benefit from enterprise adoption of AI. Semiconductor equipment manufacturers that have not benefitted strongly from the AI trade stand to gain as large chipmakers expand capacity. For instance, reports have shown that ASML stands to benefit as leading chipmakers increase capital expenditure to support AI-related capacity expansion. Meanwhile, China’s vast domestic market, policy tailwinds, and increasingly tech-savvy consumers will drive broader and faster AI adoption, supporting tech stocks in 2026 and beyond.

3. Earnings growth will likely pick up from AI investments.

According to Fidelity’s outlook, overall earnings growth is projected to accelerate – from mid‑to‑high single digits in 2025 to double‑digit gains across major regions in 2026. Within this, the IT sector stands out with anticipated profit growth of 25 per cent.

On balance, Fidelity analysts see fundamentals continuing to show real substance and optimism. But given ongoing geopolitical uncertainties, the diversification of risk remains essential into 2026.

4. 2026 is the year of diversification.

Outside the US, structural shifts across regions are opening compelling entry points for diversification – and creating rich ground for research‑driven, bottom‑up stock pickers to generate differentiated returns. Whether investors are targeting steady income or taking a contrarian view on tech, a global perspective is becoming essential to unlocking these opportunities.

Fidelity highlights three diversification themes:

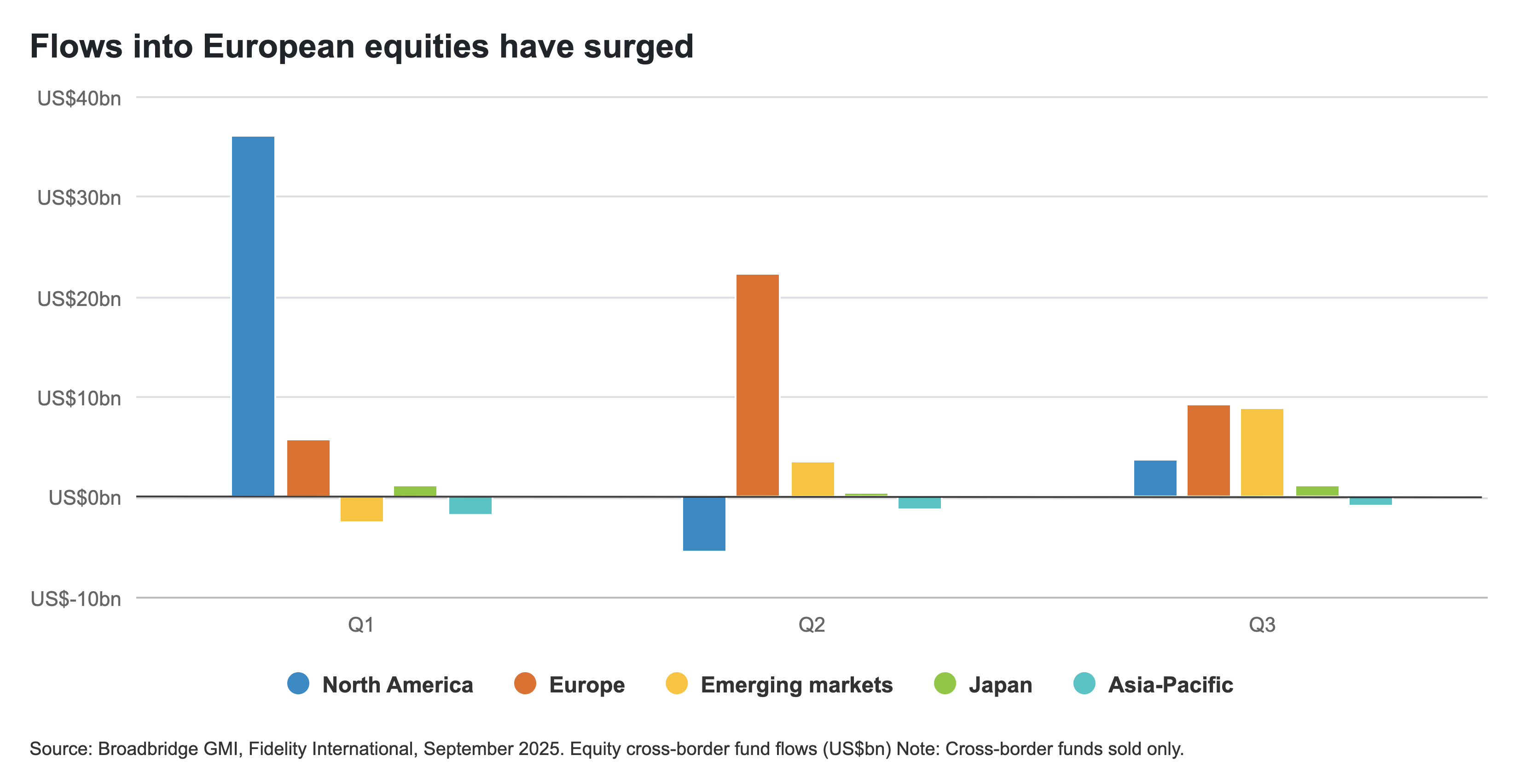

1. Europe: Strengthening case for global investors

Europe’s outlook has brightened meaningfully:

- Inflation is falling, and interest rates are easing

- Fiscal support is coming through

- Aerospace and defence sectors are benefiting from a re-arming Europe

European companies are global businesses (think large pharmaceuticals, food and beverage, chemicals, and luxury goods companies) with strong balance sheets — not just plays on the domestic economy.

2. China: Signs of a broader bull market

China is showing early signs of a more sustainable recovery:

- Innovation and tech progress are accelerating

- Valuations remain low

- Trade tensions with the US have de-escalated

- The government is supporting the market with fiscal spending

- Brutal price wars are being dialled back, helping earnings stabilise

Investor positioning is not crowded, creating potential upside if sentiment turns.

3. Japan and Korea: Reform-driven optimism

Japan remains a bright spot as reflation and reforms take root:

- Wages are rising and consumer spending power is improving

- Inflation is normalising

- Corporate governance reforms are bearing fruit

Korea is on a similar trajectory, as long‑standing low corporate valuations are being challenged by improving governance and stronger shareholder returns.

Key takeaway for investors: While risks remain, Fidelity sees multiple engines of strong returns in the year ahead. Greater divergence across regions and sectors is likely to define the next 12 months, reinforcing the case for a selective, bottom-up, and global portfolio approach.

[1] The total market capitalisation of the Mag 7 group of leading US tech companies, excluding Tesla Inc, was US$21.438 trillion on Nov. 17, 2025. These values vary with intraday market movements. Source: Refinitiv Workspace.

<divider><divider>

Fidelity International has been a global leader in investment solutions since its establishment in 1969, offering expertise across asset classes and retirement planning to institutions, individuals, and advisors worldwide.

On Endowus Fund Smart, you can access eight of their funds (20 share classes as of 31 December 2025), including strategies such as the Fidelity Global Dividend Fund and the Fidelity Asia Pacific Dividend Fund. These options provide a strong foundation for building resilient portfolios that balance growth and income.

Notably, the Fidelity Global Technology Fund is the largest position within the Technology Satellite Portfolio, a portfolio curated by the Endowus Investment Office to capture diversified opportunities in next-generation innovation.

This article is issued by Endowus. Views on funds available on Endowus Fund Smart or curated by Endowus Investment Office are entirely attributed to Endowus. Investment outlook and views expressed in this article are attributed entirely to Fidelity International.

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)