Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

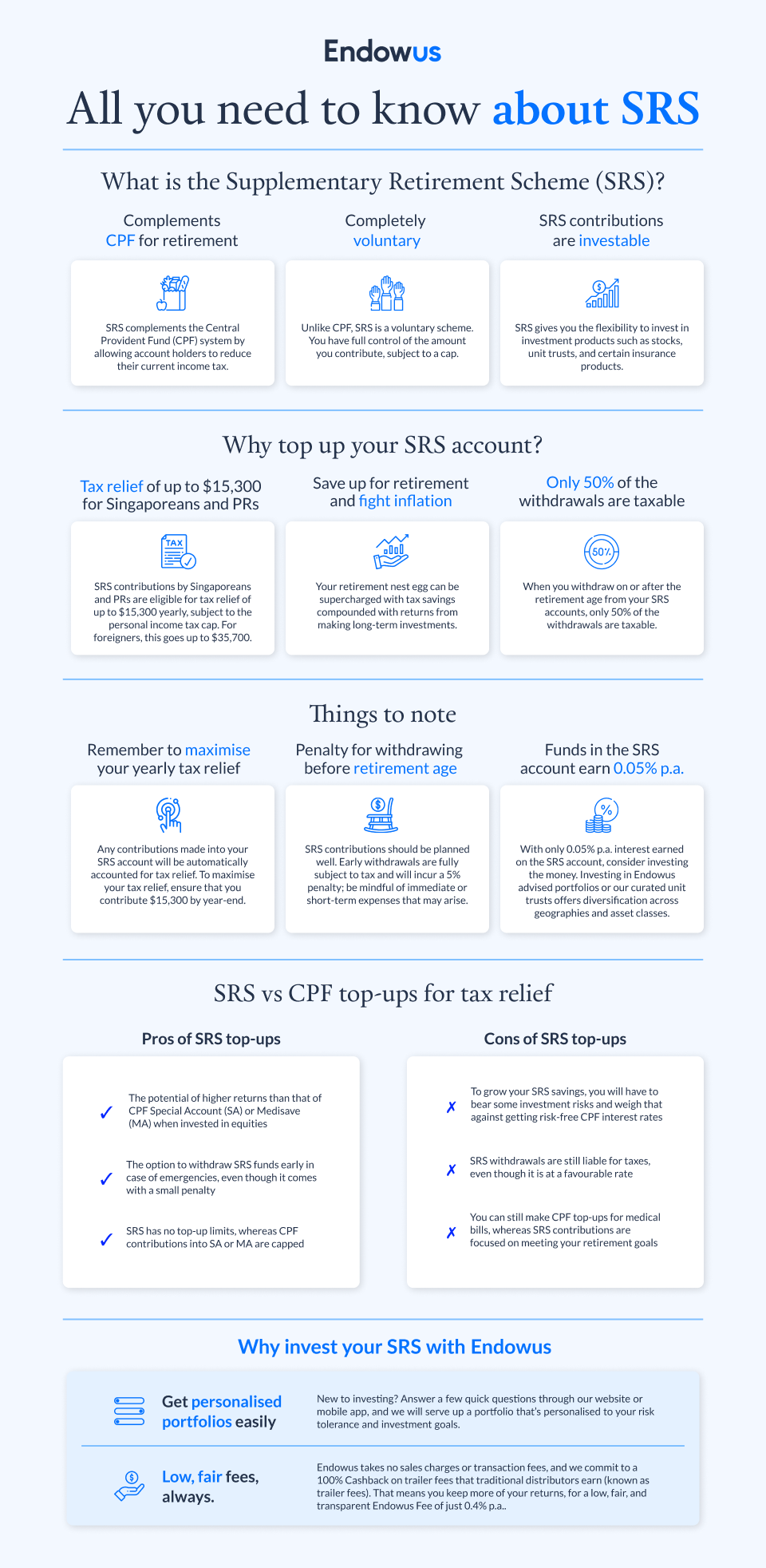

The Supplementary Retirement Scheme (SRS) is a personal income tax relief scheme that helps tax-paying Singapore residents and foreigners reduce their taxable income. The annual SRS tax relief quota resets after 31 December of each year — with just a few weeks left to the start of the new year, it's a good idea to try to use up your quota if possible.

Given the wide range of choices today, here are four reasons Endowus should be your preferred SRS investment platform, especially as the year-end approaches.

1. Endowus does not discriminate against the amount you have

Singapore’s tax system is progressive, meaning that the more income you earn, the higher the tax rate.

Take a look at what tax bracket you’re in, based on the income you’re earning. Let’s say your taxable income is $82,000 — that means you’ll have to pay taxes equivalent to 11.5% of your income. If you reduce your taxable income by $2,000 to $80,000, the applicable tax rate is reduced to 7%.

So, one way to save taxes is to transfer $2,000 to your SRS account, triggering a tax deduction. You can then invest that $2,000 now held in your SRS account. Note that SRS accounts only yield a fixed interest rate of 0.05% per annum, so investing the SRS savings can boost your long-term retirement savings.

Unlike brokerage platforms that have a fixed minimum transaction charge, or investing in listed securities that have a large minimum lot size, investing your SRS at Endowus starts as low as $100, with no minimum charges.

Use our SRS calculator to better understand your tax savings under the scheme.

2. You can get global, diversified exposure easily

You can invest in different advised portfolios on our platform simply through our mobile app or website.

These advised portfolios include:

- Our Flagship Portfolio is our most popular choice. You can get diversified access across more than 10,000 stocks and 6,500 bonds through a single portfolio.

- Our ESG Portfolio comprises top-rated ESG (environmental, social, and governance) funds screened using our robust SMART+ process. These portfolios aim to outperform the market and generate a positive impact.

- Our Factor Portfolios by Dimensional are designed to provide systematic exposure to long-term drivers of returns.

We also offer cash management solutions should you prefer to invest your SRS monies in very low-risk money market funds or short-duration bond funds.

You may also wish to build your own portfolio with a wide variety of funds that take in SRS savings, on our Fund Smart platform. Some of the exclusive, low-cost funds available on the platform include the Amundi Prime USA fund and the Dimensional Global Core Equity Fund.

3. There is no rebalancing cost, and no transaction costs

Many people invest their SRS in SGX-listed equities or real estate investment trusts (Reits) to maximise their investment returns.

But SRS brokerage fees, which often come with higher fixed minimums, make investing a smaller amount of money more expensive. Imagine paying a fixed $26.75 for a $500 investment — you'll lose 5% immediately on your investment before you even get started.

Ideally, we should not incur high fixed costs if we want to sell and buy our holdings to manage our risks. For SRS-advised portfolios, Endowus charges a flat access fee of 0.4% before GST. Find out more about our transparent pricing.

4. You won't incur any foreign exchange charges

Our standard funds are denominated in Singapore dollars, and the fund managers in our advised portfolios transact in Singapore dollars.

This means that when fund managers take our money on an aggregated basis, they will convert it into other currencies at the lowest possible rates to invest our money.

In summary

To learn about what an SRS account is and how to get one, you can refer to the Inland Revenue Authority of Singapore's (IRAS) website here.

Visit the Endowus Fin.Lit Academy to pick up tips to optimise your SRS savings and supercharge your retirement plan. For instance, learn about the different SRS investment options available, or read about how you can hack your taxes amid high inflation with SRS.

To start investing your SRS money in best-in-class funds with Endowus, follow this link. If you're new to Endowus, you can join us by creating an account here.

.webp)

%20(1).gif)

.webp)

.jpg)

%20F1(2).webp)

.webp)

.webp)