Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

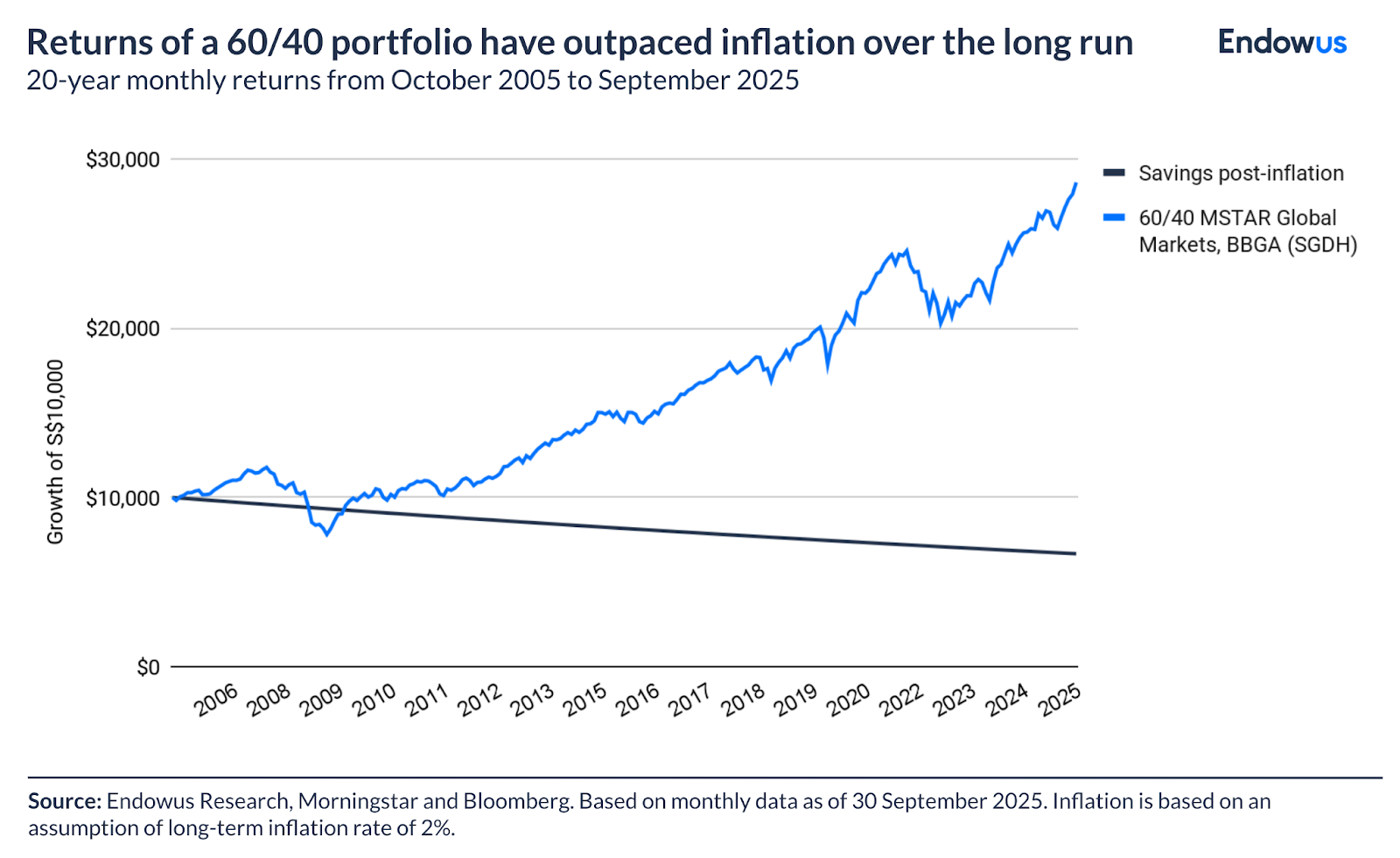

- Keeping your money in a savings account feels safe, but the real risk is inflation. Over time, it quietly erodes your purchasing power, making it harder to reach your long-term goals.

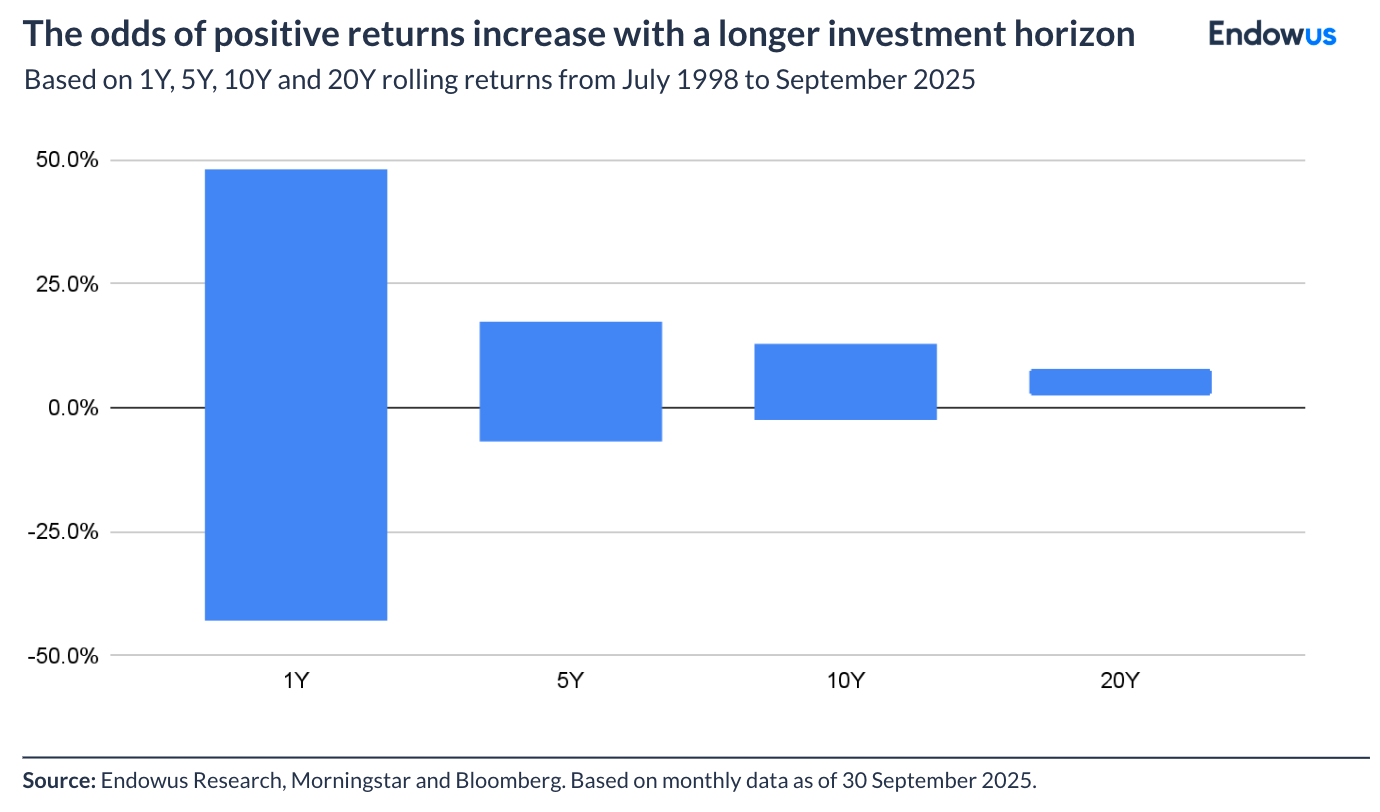

- While markets are volatile in the short term, historical data shows that the probability of loss decreases dramatically the longer you stay invested.

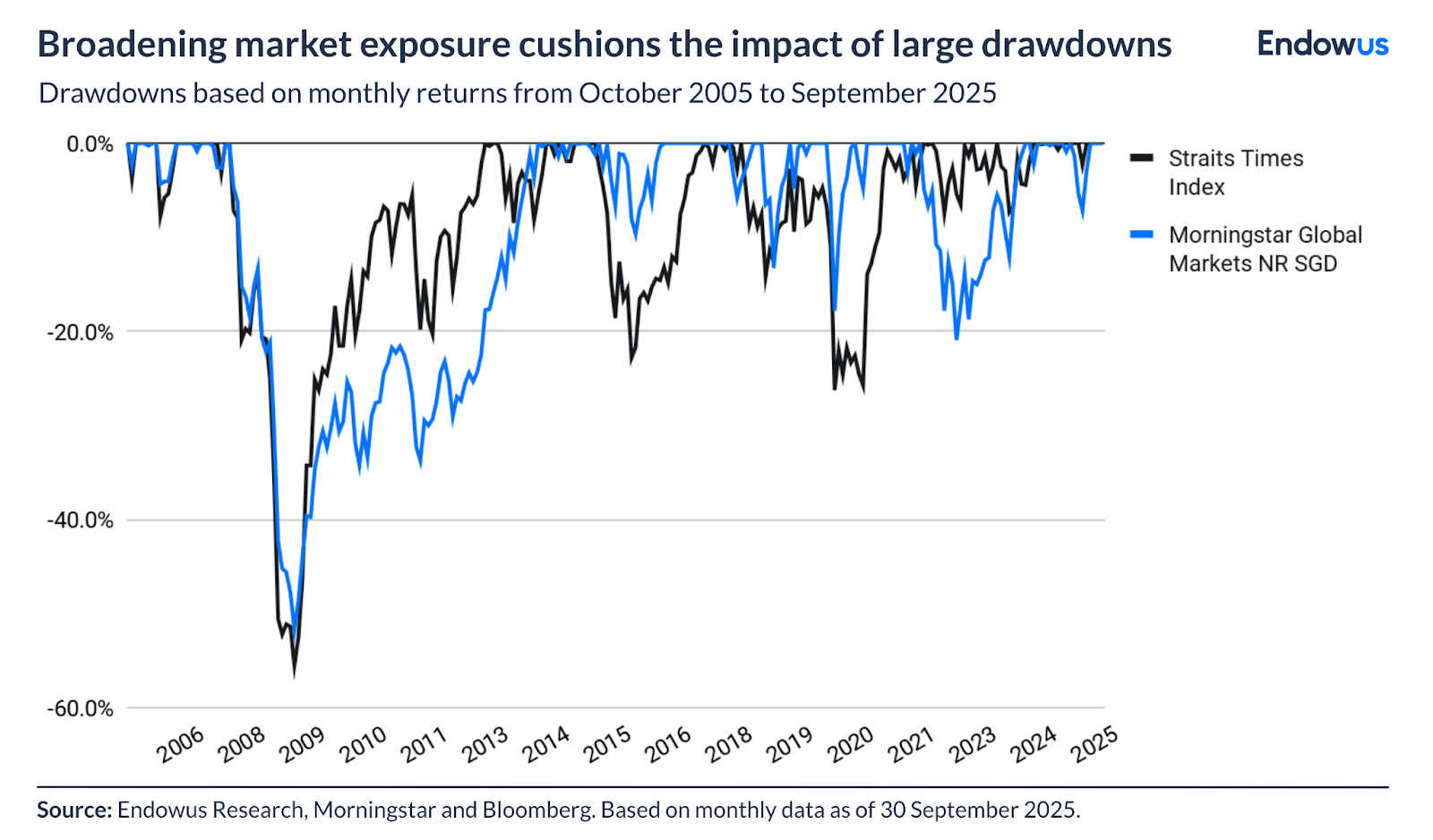

- Investing only in companies you know creates concentration risk, which is akin to betting your future on just a few outcomes. Global diversification is an effective tool to smooth out volatility.

- No one can predict or control the markets. Instead, focus on what you can control: constructing a resilient portfolio that can ride through volatility.

The sheer volume of information, the complex jargon, and the ups and downs of the stock market—investing feels way too complicated to be worth the risks, or is it?

Many of us did not learn about investing until adulthood. A lack of knowledge can propagate fear that repels us further away from the market. People who don’t invest may have avoided the pain of loss in the market, but it doesn’t come without costs: inflation erodes the value of your savings, and choosing not to let the market help you achieve your financial goals means that you have to put in more time and effort to compensate for this opportunity cost.

Of course, investment gains are not guaranteed, but the same can be said about losses. Empirical evidence has proven that extending your investment horizon can improve the odds of making positive returns, and that’s not the only evidence-based principle that has stood the test of time.

Let’s dive into the data to address some of the most common fears about investing.

“Why risk my money when I can keep it safely within reach?”

Holding cash in a savings account feels safe. It’s tangible, predictable, and free from the market’s daily swings, but it can also give a false sense of security.

Due to inflation, the $10,000 you have today will not buy $10,000 worth of goods in 10 or 20 years. To build wealth, or even just to preserve it, your money needs to grow at a rate that outpaces inflation.

Investing also can potentially generate higher returns on top of providing protection against inflation.

On the other hand, what you should probably fear more is that not investing carries the near-certain risk of failing to meet your financial goals or adequacy, especially for a multi-decade goal like retirement. While markets are volatile in the short term, the volatility smooths out over time.

What you can do:

Start small by investing an amount you are comfortable with. If risk is something difficult to wrap your head around, you may consider lower risk assets, like money market funds or short-term bond funds, to overcome the inertia and get acquainted with investing.

Ultimately, it is important to understand what you are investing in, including the risks involved. For beginners, we have a library of resources to help you learn more about investing on Endowus Insights.

“What if I lose all my money?”

The idea of a market crash wiping out your hard-earned savings can be petrifying. This fear is often driven by focusing on worst-case scenarios and short-term noise. When we look at the long-term data, a very different picture emerges.

Markets are volatile in the short term. But over time, the range of outcomes narrows significantly.

The data shows that while losses are possible (and even common) in any given year, the probability of experiencing a loss diminishes dramatically the longer you stay invested. Given a long enough time horizon, the market's trajectory has historically been upward.

Even during severe downturns, markets have recovered. The key is patience. A paper loss during a market dip only becomes a permanent, realised loss if you sell in a panic.

What you can do: Match risk to the time horizon of your goals

Generally, higher risk investment instruments tend to give higher returns, though not always. For short-term goals, which are usually expenses that are due within a year or two, it might be more suitable to invest in low-risk instruments like money market funds.

This is where creating “buckets” of investments that are goal-based comes in useful. Each bucket is a group of investments that match the risk tolerance and time horizon you have for each goal. Here’s a sample of how you can do so:

“Isn’t it too risky to invest in companies that I’m not familiar with?”

When it comes to investing, we tend to gravitate towards companies that we are familiar with, whether it is a company that produces the smartphones we use, or big names that everybody keeps talking about.

The dangers of familiarity bias is that we tend to ignore negative information that counters what we want to believe to be true about the companies we invest in. Additionally, doing so introduces concentration risk to our investment portfolios, which is essentially betting our wealth on a few companies, a certain sector or geography’s future growth, if any.

As seen above, the Straits Times Index (STI) that tracks the performance of the top 30 companies listed on SGX, experienced more large drawdowns than Morningstar Global Markets.

What you can do: Invest in a low-cost, globally diversified portfolio

Diversification helps to spread out the risks and smooth out the volatility. It doesn't eliminate risk, but it makes drawdowns more tolerable, which helps you stay the course.

Take note of your investment fees too. A mere 1% difference in fees of a $100,000 investment capital can wipe out a quarter of its potential returns. Passive index funds that track major stock market indices at low cost are a good place to start.

“I think I’m ready. Where should I begin?”

The investing world is full of noise. You will hear endless predictions about which stock will be “the next big thing” or when the “perfect time” to invest is.

Instead of trying to outsmart the market, focus on what you can control.

The best place to start is simple: create a financial plan based on your goals. Define them, work out how much money you need for each goal, and how much time you have to achieve them.

This plan will be your map to start investing and guide the way you bucket your investments, matching each goal with a portfolio of appropriate risk. It will also be the anchor that holds you steady when markets get choppy.

Doing the right thing doesn’t have to be complicated

We believe in an evidence-based approach towards investing. The data continues to support time-tested principles espoused by successful investors including Warren Buffett, John C. Bogle and Franklin Templeton: diversify your portfolio, keep investing costs low, and stay invested over the long term.

We provide access to institutional-quality portfolios that are globally diversified and low-cost, removing the guesswork for you. Our Investment Office conducts regular monitoring of our advised portfolios and funds, so you can stay focused on your goals.

If you need guidance on your wealth journey, feel free to reach out to our team of MAS-licensed client advisors.

How to start managing and investing your money (#adulting)

.png)

Are gambling and investing similar?

.png)

Goal-based investing and why it matters

.webp)

%20(1).gif)

.jpg)

%20F1(2).webp)

.webp)

.webp)