Register for the event

Endowus invites you to our exclusive event with Macquarie Asset Management, as we discuss unlocking opportunities in Infrastructure- a $1.3tn asset class.

This event is reserved for Accredited Investors (AIs) only. To register for the event, please indicate one of the following:

- A core-satellite investment approach offers some stability to meet individuals’ essential goals, with flexibility to express conviction in themes that they believe will outperform the broader markets.

- Past winners had not always remained at the top—the technology rally has largely been driven by the Magnificent 7 stocks, hence investors should be cautious not to overconcentrate in these stocks across their core-satellite portfolios.

- Find out how the Endowus Satellite Technology Portfolio offers diversified, risk-managed exposure to the tech universe.

The US stock market has surged to new heights in recent years, but this rally hasn’t been a broad-based boom.

A handful of technology titans, dubbed as the Magnificent 7 companies, are the powerhouse behind the bull run. Notably, a Mag-Seven member and AI chipmaker Nvidia broke the US$4 trillion market capitalisation bar in July 2025, becoming the world’s most valuable company.

It's tempting to want a piece of the action, however, expressing a satellite view in technology beyond the core allocation may introduce a layer of risk, especially if it is done in a concentrated way.

Moreover, if you are already invested in the S&P 500, which represents the 500 largest companies in the US, these seven mega-tech stocks already make up 36% of that index (as of 26 Aug 2025).

And if we were to look even more broadly at the Morningstar Global Markets Index, which represents large-, mid- and small-cap stocks globally, technology already has a sectoral representation of 25% (as of 29 Aug 2025).

For investors, a more relevant question than “should I invest in tech stocks?” may be: "Should I overweight my allocation to technology beyond what the global market already provides?”

Here, we explore the technology universe at depth, and explain how to capture opportunities from its sheer breadth. Through a breakdown of our Satellite Technology Portfolio, understand how we provide better risk-adjusted returns and meaningful diversification for long-term investors.

Recap: What does it mean to have a satellite position in technology?

Clients may adopt a core-satellite approach, in line with our key investing principles: strategically passive, low-cost and global diversification. For starters, here’s a quick explanation of the core and satellite components:

Start with a core allocation

As the name suggests, a core allocation is the anchor of your portfolio. It typically is made up of low-cost, globally diversified index funds and primarily has a long-term focus, providing some level of stability to meet your essential financial goals, such as retirement.

Venture into satellite positions

Once you have laid the foundation with a core allocation, you may wish to go overweight on a specific market, sector or theme, such as technology. This is what we call “expressing a view,” which is a more narrow focus on a particular theme that you believe will outperform the broader market over your investment horizon.

Should you overweight tech stocks?

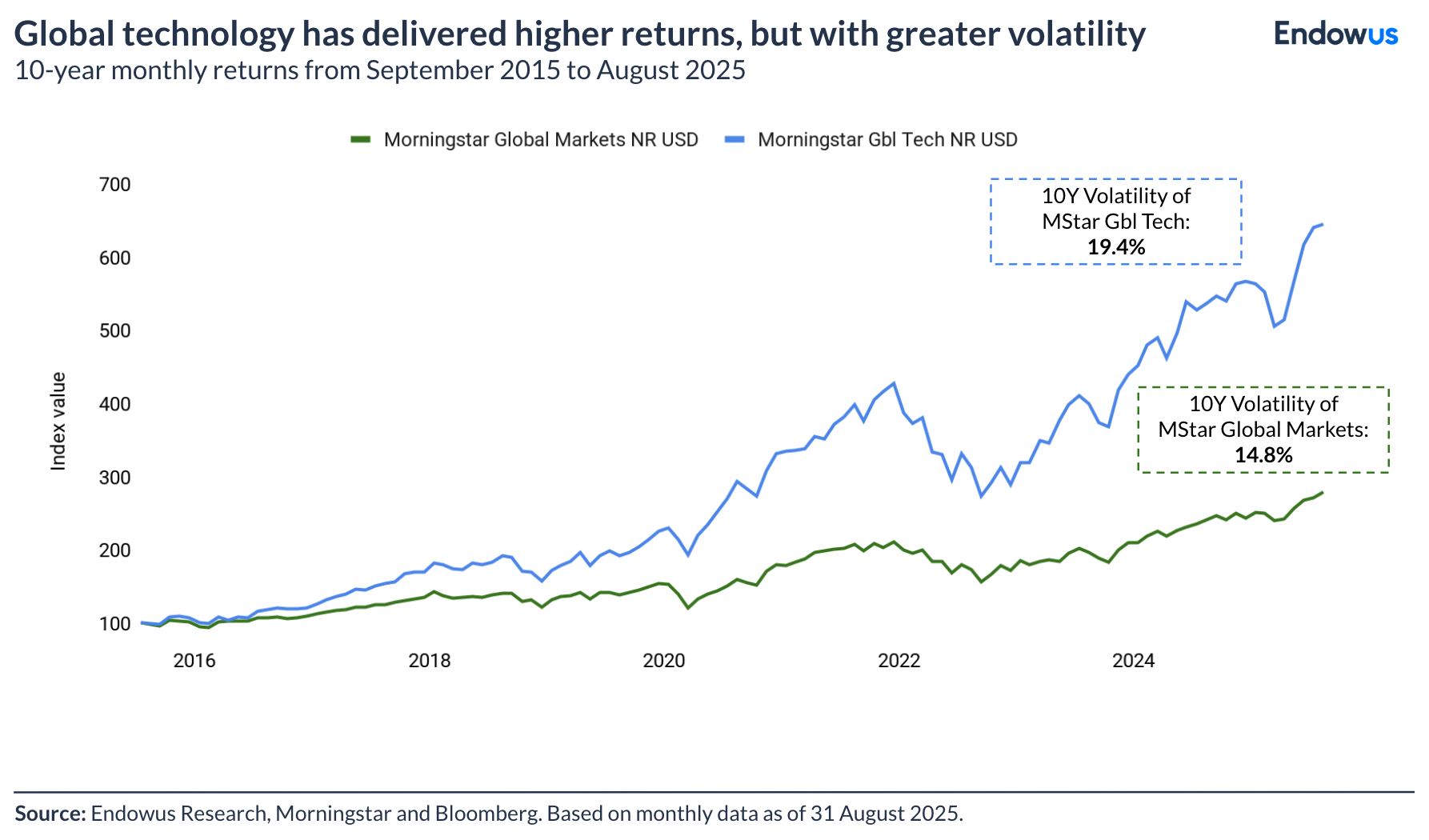

The big question here is whether or not an investor should take a greater position to fast-evolving secular trends like tech. Naturally, having a satellite position usually introduces more risk to your portfolio. In this case, an overweight position in technology means your portfolio is more sensitive to the sector's well-known volatility.

Whenever market fluctuations intensifies, investor convictions are often put to the test. The financial and psychological impact of downturns can be hard to stomach. Thus, before you add a satellite position to your portfolio, ensure that the conviction itself is based on thorough research and introspection, not just a reaction to short-term market hype.

A common core-satellite portfolio ratio is 80-20, but there is no golden ratio to follow. Your portfolio allocation should be tailored to your investment goals, time horizon and risk tolerance.

Why you should invest beyond the Magnificent 7

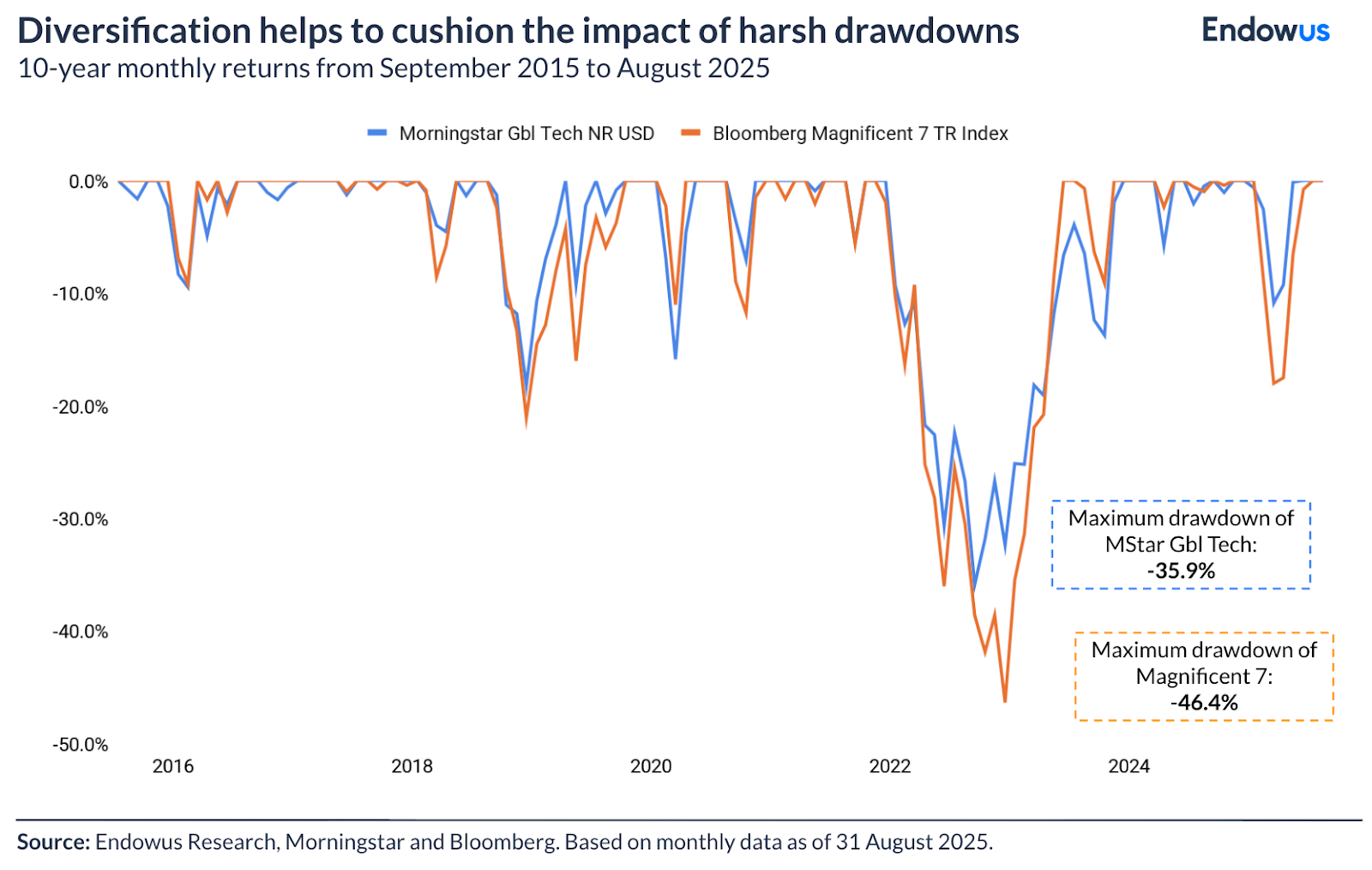

When people think of tech stocks, their minds tend to jump to the Magnificent Seven. Focusing only on these giants creates concentration risk, tying your wealth to a handful of companies within the same sector and geography.

We also learn from history that winners don’t always stay on top. In the past three decades, only Microsoft still secured its spot in the list of top 10 largest companies by scale.

Putting all your eggs in one basket is hardly ever a good idea in investing. This is also given that the technology universe is not homogenous, but vast and varied. Diversification is important to spread risks across your core and satellite allocations.

Capture opportunities while staying diversified: Endowus Satellite Technology Portfolio

For investors seeking to invest in tech stocks, the primary challenge is managing concentration risk while capturing the upside. The Endowus Satellite Technology Portfolio is constructed to address this by providing diversified exposure across the technology universe.

A benchmark-aware approach

Since the 2022 pullback, the market has observed a shift in winners from high-performing, smaller cap companies to the Magnificent 7 and high-quality companies with strong balance sheets and cash flow.

The key takeaway is that performance of individual companies will vary across different periods—not only should we avoid investing in just a few tech stocks, but also periodically review if our investments continue to meet their objectives.

As part of the due diligence process, the Endowus Investment Office regularly monitors advised portfolios and makes Recommended Portfolio Changes (RPC) with optimising the risk-return profiles and lowering costs as the goal. These are believed to help our clients navigate changes effortlessly.

In the latest RPC for the Satellite Technology Portfolio, enhancements were made to reflect the change in tides. Following its benchmark, Xtrackers MSCI World IT ETF 1C, more closely in terms of size and geographical allocation, allocations have been increased in: 1) mega- and large-cap companies, 2) core and value companies, and 3) US companies.

Exploring opportunities outside of the Magnificent 7

So, if you are invested in a global equities or an S&P 500 index fund, you would already have considerable exposure to the Magnificent 7. Taking a broader core-satellite view, the Satellite Technology Portfolio can provide meaningful diversification from what is already in our Core Flagship Portfolios.

This approach allows our clients to express conviction in the tech sector in a more diversified and risk-managed way, especially suitable for those looking to invest long-term.

Invest in technology funds by reputable global fund managers

High valuations of the Magnificent 7 have proven challenging to generate returns above benchmarks, which is why fund manager selection is a key part of portfolio construction.

The funds within the Satellite Technology Portfolio are managed by fund managers with proven track record, such as BlackRock, Janus Henderson, JP Morgan Asset Management, Fidelity, and Franklin Templeton. All portfolio funds have undergone a rigorous due diligence process by the Endowus Investment Office.

To learn more about the Satellite Technology Portfolio, read more here, or start investing with Endowus in 4 simple steps.

Webinar: Investing in a better future: Through the lens of an equity investor

Why ESG investing should matter to Singaporeans

When you can’t see the forest for the trees: A holistic approach to asset allocation

.webp)

%20(1).gif)

%20F1(2).webp)

.webp)

.webp)